Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

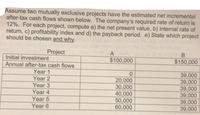

Transcribed Image Text:Assume two mutually exclusive projects have the estimated net incremental

after-tax cash flows shown below. The company's required rate of retum is

12%. For each project, compute a) the net present value, b) intemal rate of

return, c) profitability index and d) the payback period. e) State which project

should be chosen and why.

Project

Initial investment

Annual after-tax cash flows

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

A

B

$100,000

$150,000

20,000

30,000

40,000

50,000

60,000

39,000

39,000

39,000

39,000

39,000

39,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Given the following cash flows for project X and project Y, Year Project X Project Y 0 -55000 -100000 1 20000 15000 2 13500 17000 3 11000 19000 4 10000 25000 5 9000 30000 6 7500 35000 Calculate the NPV, IRR, MIRR and traditional payback period for each project, assuming a required rate of return of 7 percent If the projects are independent, which project(s) should be selected? If they are mutually exclusive, which project should be selected? (Answer in word form please)arrow_forwardA company has two projects that are under evaluation. The project investment costs, annual projected cash flows, and required rates of return are shown below: Project 1 Project 2 Rate of Return: 0.065 0.065 Project Cost: -$1,397,654 -$1,619,835 Year 1 $245,367 $267,345 Year 2 $302,542 $343,563 Year 3 $316,543 $367,834 Year 4 $367,843 $432,098 Year 5 $450,425 $589,435 Compute the NPV for each project using Microsoft Excel NPV's function. Be sure to show your work. Which project should be pursued? Why?arrow_forwardA company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Project A $ 11,226 (10,000) Project B $ 10,568 (10,000) a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will it accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the net present value of each project. Potential Projects Project A Project B Project C Present value of net cash flows Initial investment Net present value $ $ $arrow_forward

- The management of NUBD Co. is considering three investment projects-W, X, and Y. Project W would require an investment of P21,000, Project X of P66,000, and Project Y of P95,000. The present value of the cash inflows would be P22,470 for Project W, P73,920 for Project X, and P98,800 for Project Y. Rank the projects according to the profitability index, from most profitable to least profitable. *arrow_forwardconsider the following two investments with the cashfow as shown. given the project are mutually exclusive, use Incremental-Investement Analysis to determine which of the two projects you should select. Given that the MARR required by management is 12%.arrow_forwardFind internal rate of return of a project with an initial cost of $43,000, expected net cash inflows of $9,550 per year for 8 years, and a cost of capital of 9.35%. Round your answer to two decimal places. For example, if your answer is $345.667 round as 345.67 and if your answer is .05718 or 5.718% round as 5.72. A. 15.64% B. 14.90% C. 13.70% D. 14.75% E. 11.17%arrow_forward

- Refer to two projects with the following cash flows: Year Project A Project B 0 -$110 -$110 1 45 55 2 45 55 3 45 55 4 45 If the opportunity cost of capital is 11%, what is the profitability index for each project?arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (X) Cash Flow (Y) 0 1 2 3 -$20,000 8,850 9,100 8,800 2 Instruction: Sketch the NPV profiles for X and Y over a range of discount rates from 0% to 25%. What is the crossover rate for these two projects (when both projects have the same NPV)? Show your steps. -$20,000 10,100 7,800 8,700 A▾ B I = 18 1arrow_forwardAccounting Draw the cash flow diagram for the given project below and then calculate the project net profit. The following table shows the activities description, dependency, duration, and cost elements. Assume the followings: Project overhead 8%. Tax 3%. Bond 1.25%. Profit 6%. Interest rate 9% per year. Down payment 10% with a guarantee letter, which costs 0.25% per month paid to the bank at the project start date. A performance guarantee letter of 10% will be submitted from contractor at the project begin. Invoices are submitted every month and will be paid a month later. Retention 10% and will be paid at the last invoice. Subcontractors: retention 10% will be paid at the last invoice, down payment 20%. Labor: labor expenses to be paid bi-weekly. Equipment: equipment expensesarrow_forward

- You are given the following cash flows for a project. Assuming a cost of capital of 12.84 percent. determine the profitability index for this project. Year 0 1 2 3 4 5 O 14981 O 1.68/7 O1.7508 1.6245 1.5613 Cash Flow -$1,115.00 $554.00 $622.00 $648 00 $426.00 $216.00arrow_forwardUse the following information to answer questions 11-15:A firm evaluates a project with the following cash flows. The firm has a 2 year payback period criteria and a required return of 11 percent.Year0 1 2 3 4 5Cash flow (OMR) -24,000 17,000 12,000 9,000 -8,000 11,0001-Whatis the net present value for the project?2-Whatis the payback period for the project?3-what is the discounted payback period for the project? 4-What is the profitability index for the project?5-Given your analysis, should the firm accept or reject the project?arrow_forwardCompute the discounted payback statistic for Project y and recommend whether the firm should accept or reject the project with the cash flows shown as followsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education