Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

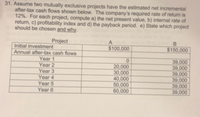

Transcribed Image Text:31. Assume two mutually exclusive projects have the estimated net incremental

after-tax cash flows shown below. The company's required rate of return is

12%. For each project, compute a) the net present value, b) intenal rate of

return, c) profitability index and d) the payback period. e) State which project

should be chosen and why.

Project

Initial investment

Annual after-tax cash flows

Year 1

Year 2

Year 3

$100,000

$150,000

20,000

30,000

40,000

50,000

60,000

39,000

39,000

39,000

39,000

39,000

39,000

Year 4

Year 5

Year 6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- You are given the following cash flows for a project. Assuming a cost of capital of 12.84 percent. determine the profitability index for this project. Year 0 1 2 3 4 5 O 14981 O 1.68/7 O1.7508 1.6245 1.5613 Cash Flow -$1,115.00 $554.00 $622.00 $648 00 $426.00 $216.00arrow_forward4. Consider the investment projects given in the following table. n 0 1 2 Project 1 - $1,500 $700 $2,500 Net Cash Flow Project 2 - $5,000 $7,500 $600 Project 3 -$2,200 $1,600 $2,000 Assume that MARR=15% and a financing rate of 12%. a. Compute the IRR for each project. b. On the basis of the IRR criterion, if the three projects are mutually exclusive investments, which project should be selected?arrow_forwardCompute the rate of return for a project that has an initial cost of $40,000 and would provide positive cash flows of $6,000 the first year, $7,000 the second year, $8,000 the third year, $9,000 the fourth year, $10,000 the fifth year, and $11,000 the sixth year.arrow_forward

- Financial Manager of Timmy Company is considering two projects (project A and project H), which have cash flows as follows: Year Cash Flow of Project A (in $) Cash Flow of Project H (in $) 0 -100 -100 1 10 70 2 60 50 3 80 20 Timmy Company’s cost of capital is 10 percent. Calculate payback, NPV, IRR, and MIRR for both projects. (Please have a step by step format to your answer with explainations. Thanks (=)arrow_forwardThe following table contains the estimated cash flows of a project. Assume the appropriate discount rate (hurdle rate) is 14%. Year Operating Cash Flow 0 -$20,000 1 $7,000 2 $8,000 3 $9,000 4 $4,000 a. What is the payback period of project 1?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education