International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

am. 122.

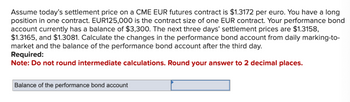

Transcribed Image Text:Assume today's settlement price on a CME EUR futures contract is $1.3172 per euro. You have a long

position in one contract. EUR125,000 is the contract size of one EUR contract. Your performance bond

account currently has a balance of $3,300. The next three days' settlement prices are $1.3158,

$1.3165, and $1.3081. Calculate the changes in the performance bond account from daily marking-to-

market and the balance of the performance bond account after the third day.

Required:

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Balance of the performance bond account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume today's settlement price on a CME EUR futures contract [with EUR 125,000 per contract] is $1.1500/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $2,500. The next three days' settlement prices are $1.1450/EUR, $1.1400/EUR, and $1.1600/EUR. Calculate the changes in the performance bond account for each day (show the value each day) from daily marking-to-market and the balance of the performance bond account at the end of the third day. (fill in each box below with the dollar amount in the margin account after settlement each day, use whole dollars, no decimals, no $ symbol) Performance bond/margin-Day1 Performance bond/margin-Day2 Performance bond/margin-Day3arrow_forwardAssume today's settlement price on a CME EUR futures contract is $1.1140/EUR. You have a short position in one contract with a standard contract size of 125,000€. Your performance bond account currently has a balance of $2,000. The next three days' settlement prices are $1.1126, $1.1133, and $1.1050. Calculate the balance of the performance bond account after the third day.arrow_forwardAssume today's settlement price on a CME EUR futures contract is $1.3160/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $1,800. The next three days' settlement prices are $1.3130, S1.3140, and $1.3100. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day.arrow_forward

- Assume today's settlement price on a CME EUR futures contract is $1.3160/EUR. You have a long position in one contract. Your performance bond account currently has a balance of $2,700. The next three days' settlement prices are $1.3146, $1.3153, and $1.3069. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.) > Answer is complete but not entirely correct. Balance of the performance bond account $ 3,837.50 xarrow_forwardAssume today's settlement price on a CME EUR futures contract is $1.3166/EUR. You have a long position in one contract. Your performance bond account currently has a balance of $3,000. The next three days' settlement prices are $1.3152, $1.3159, and $1.3075. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Changes in the performance bond accountarrow_forwardAssume today’s settlement price on a CME EUR futures contract is $1.3140/EUR. You have a long position in one contract. Your performance bond account currently has a balance of $1,700. The next three days’ settlement prices are $1.3126, $1.3133, and $1.3049. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- Assume today's settlement price on a CME EUR futures contract is $1.3174/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $3,400. The next three days' settlement prices are $1.3160, $1.3167, and $1.3083. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.) What's is balance of the performance bond account?arrow_forwardAssume today's settlement price on a CME EUR fütures contract is $1.3176/EUR. You have a short position in one contract. Your performance bond account currently has a balance of $3,500. The next three days settlement prices are $1.3162, $1.3169, and $1.3085. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Balance of the performance bond accountarrow_forwardAssume today's settlement price on a CME GBP futures contract is $1.4948/£. You have a short position in one contract (with the standardized contract size of £62,500). Your initial performance bond account currently has a balance of $4,000 and the maintenance level is $2,500. The next three days' settlement prices are $1.4908, $1.5088, and $1.5208. Fill out the following table by calculating the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day. Day Settlement price ($/£) Daily Gain/Loss (5) Account balance (5) 0 1.4948 1 1.4908 2 1.5088 3 1.5208 $4,000 Daily account balance (please fill out ONLY the account balance, not daily profit/loss): Day 1: $4250 Day 2: $ 3.125 Day 3: $750 Total profit/loss: Day 3: $ 750 Total profit/loss: $ -1.625 . (Use negative sign in front of the number for loss) Are you going to have a margin call during the three-day trading period? Answer: Yes (yes/no). If your answer…arrow_forward

- Yesterday, you entered into a futures contract to sell €75,000 at $1.79 per €. Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted? $1.6676 per €. $1.1840 per €. $1.2084 per €. $1.7767 per €.arrow_forwardYesterday, you entered into a futures contract to buy €62,500 at $1.50 per €. Your initial performance bond is $1,500 and your maintenance level is $500. At what settle price will you get a demand for additional funds to be posted? ANSWER D IS CORRECT BUT WHAT IS THE PROCEDURE BUT HOW DO I GET THERE? a) $1.5160 per €. b)$1.208 per €. c)$1.1920 per €. d)$1.4840 per €. Correctarrow_forwardThis morning (Day 0) you take a short position in a pound futures contract that matures in 3 days (Day 3). The future price is $1.9750 today. The contract size is £62,500 and its initial performance bond and maintenance bond are $2,430 and $1,830, respectively. a. (b) Assuming that the daily settlement prices are indicated below, how would the daily change in settlement future prices affect your account? Show the daily gain/loss and account balance. Day 0 1 2 3 Settlement 1.9750 1.9700 1.9815 1.9907 Total Gain/Loss Account Balance b. During this period, did you receive a margin call? If you did, on what day? c. At the end of Day 3, how much in total did you make/lose on this futures contract?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you