Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

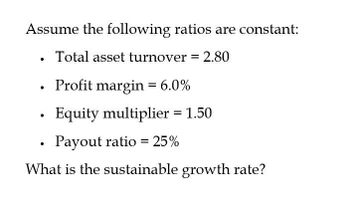

Transcribed Image Text:Assume the following ratios are constant:

•

Total asset turnover = 2.80

Profit margin = 6.0%

Equity multiplier

=

1.50

Payout ratio = 25%

What is the sustainable growth rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the sustainable growth rate ?? General accountingarrow_forwardNonearrow_forwardAssume the following ratios are constant. Total asset turnover Profit margin Equity multiplier Payout ratio = || || || || Sustainable growth rate = = 2.27 5.5% 1.74 What is the sustainable growth rate? Note: Do not round intermediate calculations and enter your answer as a percent 38% %arrow_forward

- Assuming the following ratios are constant, what is the sustainable growth rate? PLEASE INCLUDE EXCEL FUNCTIONS. Thank you! Assuming the following ratios are constant, what is the sustainable growth rate? Total asset turnover Profit margin Equity multiplier Payout ratio Plowback ratio 3.40 5.2% Complete the following analysis. Do not hard code values in your calculations. Return on equity 22.98% Sustainable growth rate 1.30 35%arrow_forwardAssume the following ratios areconstant: Total asset turnover 2.8Profit margin 6.8 % Equitymultiplier 2 Payout ratio 30 %What is the sustainable growthrate? (Do not round intermediate Training calcarrow_forwardWhat is the sustainable rate of growtharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT