FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

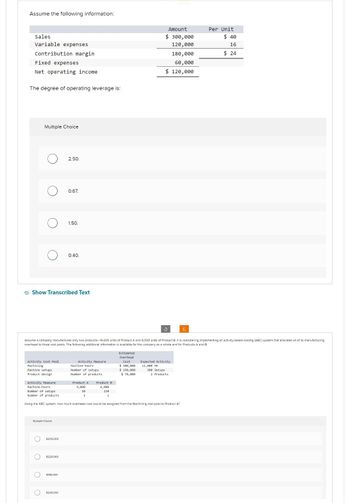

Transcribed Image Text:Assume the following information:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income.

The degree of operating leverage is:

Multiple Choice

O

O

Activity Cost Pool

Machining

Machine setups

Product design

OOOO

Show Transcribed Text

Multiple Choice

$205.000

2.50.

$225,000

0.67.

$198.000

1.50.

$249.000

0.40.

Assume a company manufactures only two products-14,000 units of Product A and 6,000 units of Product 8. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing

overhead to three cost pools. The following additional Information is available for the company as a whole and for Products A and B

Activity Measure

Machine-hours

Number of setups

Number of products

Product A Product B

9,000

se

1

Estimated

Overhead

Cost

Activity Measure

Machine-hours

Number of setups

Number of products.

Using the ABC system, how much overhead cost would be assigned from the Machining cost pool to Product A?

6,000

150

1

$ 300,000

$ 150,000

$78,000

Amount

$ 300,000

120,000

180,000

60,000

$ 120,000

3

200 Setups

Expected Activity

12,000 MH

2 Products

C

Per Unit

$40

16

$24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardNonearrow_forwardCost Volume Profit (CVP) Relationships (Algo) You are provided with the following data. Unit sales Selling price per unit Variable expenses per unit Fixed expenses Target Profit 80,000 units $70 per unit $ 28 per unit $ 2,688,000 $ 1,610,000 Required: Compute the CM ratio and variable expense ratio. Compute the break-even. Compute the target profit. Compute the margin of safety with the original data. Compute the degree of operating leverage with the original data. Use the Degree of Operating Leverage to determine the new Net Operating Income if sales increase by: 16% 1. Use the Open Excel in New Tab button to launch this question. 2. When finished in Excel, use the Save and Return to Assignment button in the lower right to return to Connect.arrow_forward

- don't give answer in image formatarrow_forwardQUESTION 6 You have information about 4 different companies below in the table. The variable and fixed costs are expressed as the percentage of revenue based on the current sales. The companies are otherwise very similar. Which of these companies is probably have the highest degree of operating leverage? A B с D Variable cost (%) 35% 27% 50% 80% 50% 60% 30% 5% Fixed cost O Project A O Project D O Project C O Project Barrow_forwardCalculate the Operating Leverage for a business given the following data: Sales = $300,000.00 Variable Costs = 75% of Sales Operating Income = $40,000.00 Group of answer choices a. 0 b. 7.500 c. 1.875 d. 1.333arrow_forward

- Determine the missing amounts. Unit Selling Price 1. 2. 3. $ $500 $250 (e) LA $ LA Unit Variable Costs $200 (c) +A $ Unit Contribution Margin $65 (f) $560 (a) Cc Marrow_forwardGiven the following information, what is the contribution margin ratio? Sales Variable expenses Fixed Expenses Net Income 44% 33% 23% 56% $828000 364320 276000 $187680arrow_forwardasap pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education