FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

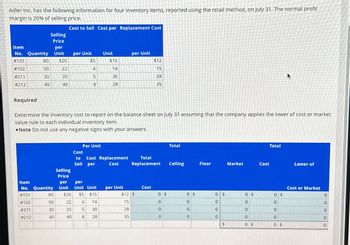

Transcribed Image Text:Adler Inc. has the following information for four inventory items, reported using the retail method, on July 31. The normal profit

margin is 20% of selling price.

Cost to Sell Cost per Replacement Cost

Item

Selling

Price

per

No. Quantity Unit

per Unit

Unit

per Unit

#101

80

$20

$5

$15

$12

#102

50

22

4

14

15

#211

30

35

5

30

28

#212

40

40

8

28

35

Required

Determine the inventory cost to report on the balance sheet on July 31 assuming that the company applies the lower of cost or market

value rule to each individual inventory item.

Note Do not use any negative signs with your answers.

Per Unit

Total

Total

Cost

Cost

to Cost Replacement Total

Sell per

Replacement

Ceiling

Floor

Market

Cost

Lower of

Selling

Price

Item

per per

No. Quantity

Unit Unit Unit

per Unit

Cost

#101

80

$20 $5 $15

$12 $

0 $

#102

50

22

#211

30

35

45

14

15

0

30

28

0

#212

40

40

8

28

35

0

000 O

0

ос

00

Cost or Market

0 $

0 $

0 $

0 $

0

0

0

0

0

0

0

0

0

0

$

0 $

0 $

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume Shopping.com began July with 10 units of inventory that cost a total of $180. During July, Shopping.com purchased and sold goods as follows: View the purchases and sales. Suppose Shopping.com used the LIFO inventory costing method and the periodic inventory system. Using the information above, determine Shopping.com's cost of goods sold at the end of the month. A. $1,065 B. $1,080 C. $105 ○ D. $90 Purchases and sales Jul. 8 Purchase 30 units @ $19 Jul. 14 Sale 25 units @ $38 Jul. 22 Purchase Jul. 27 Sale 20 units @ $21 30 units @ $38 - ☑arrow_forwardAkira Company had the following transactions for the month. Numberof Units TotalCost Beginning inventory 130 $1,300 Purchased Mar. 31 190 2,280 Purchased Oct. 15 160 2,400 Total goods available for sale 480 5,980 Ending inventory 70 ? Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $29 each. Round your intermediate calculations to 2 decimal places and final answers to the nearest dollar amount. Gross Margin A. First-in, First-out (FIFO) $fill in the blank 1 B. Last-in, First-out (LIFO) $fill in the blank 2 C. Weighted Average (AVG) $fill in the blank 3arrow_forwardFollowing is the information of Radhe company. Calculate the cost of closing inventory using Weighted Average method and prepare an Income statement if the operating expense for the month is $150. Cost Unit in S Item Opening Inventory Purchase Purchase Date Quantity 01-Dec 31 12-Dec 44 18-Dec 32 25-Dec Purchase 37 23 28-Dec Purchase 34 20 Radhe company sold 155 units in the month of December @ $23 22 21 25 per Total 682 924 800 851 680arrow_forward

- The Sonny Company sells blankets for P30 each. The following was take from the inventory records during July. Date Product T Units Cost July 3 July 10 July 17 July 20 July 23 July 30 500 P15 Purchase Sale Purchase Sale 300 1,000 600 300 P17 Sale Purchase 1,000 P20 Required: Determine the cost of sales and cost of ending inventory under each of the following independent assumptions: 1. First-in-first-out (FIFO) Method 2. Weighted-Average Method (Periodic) 3. Weighted-Average (Moving Average)arrow_forwardLaker Company reported the following January purchases and sales data for its only product. The Company uses a perpetual inventory system. Required: 2. Determine the cost assigned to ending inventory and to cost of goods sold using weighted average. Date Activities Units Acquired at Cost Units Cost per unit Total cost Units Units Sold at Retail Selling price per Total Sales January 01 Beginning inventory 205 $13.00 $2,665.00 January 10 January 20 January 25 Sales Purchase Sales 165 $22 $3,630.00 140 $12.00 $1,680.00 145 $22 $3,190.00 January 30 310 $11.50 655 Purchase Totals Notice that cost of goods sold, $3,917.22, plus ending inventory, $3,992.78, equals cost of goods available for sale, $7,910.00. Weighted Average Cost of Goods Sold $3,565.00 $7,910.00 310 $6,820.00 Inventory Balance Units Date Activities Cost per unit Cost of goods sold Units Cost per Total Cost January 01 Beginning inventory 205 unit $13.00 $2,665.00 January 10 Sales 165 $13.000 $2,145.00 40 $13.00 $520.00…arrow_forwardBridgeport Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. Inventory, May 1 $ 165,300 Purchases (gross) 619,800 Freight-in 30,100 Sales revenue 940,100 Sales returns 68,700 Purchase discounts 11,600 Compute the estimated inventory at May 31, assuming that the gross profit is 25% of net sales. The estimated inventory at May 31 2$4 %24arrow_forward

- A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 330 units. Ending inventory at January 31 totals 140 units. Units Unit Cost Beginning inventory on January 1 300 $ 2.80 Purchase on January 9 70 3.00 Purchase on January 25 100 3.14 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method.arrow_forwardThe following information was available from the inventory records of Jun Company for January: Unit Cost Total Cost $9.77 $87,930 Units Balance at January 19,000 Purchases: Sales: January 6 January 26 6,000 8,100 January 7 January 31 10.30 10.71 61,800 86,751 (7,500) (11,100) Balance at January 31 4,500 Assuming that Jun maintains perpetual inventory records, what should be the cost of goods sold during January, using the average inventory method, rounded to the nearest dollar? Group of answer choices $192,516. $190,413. $189,861. $188,286.arrow_forwardCoronado Company uses a periodic inventory system. For April, when the company sold 450 units, the following information is available. Units Unit Cost Total Cost April 1 inventory 330 $22 $ 7,260 April 15 purchase 380 26 9,880 April 23 purchase 290 29 8,410 1,000 $25,550 Compute the April 30 inventory and the April cost of goods sold using the FIFO method. Ending inventory Cost of goods sold %24 %24arrow_forward

- Givens Company uses a periodic inventory system.Its records show the following for the month of december 2019,in which 68 units were sold at$100 per unit. Units Units Cost Total Cost December 1 Beginning inventory 30 $9 $270 15 Purchase 25 $11 $275 24 Purchase 35 $12 $420 Totals 90 $965 Required: (show all calculate the Cost of Goods Sold on December 31,2019 for Given Company using the following cost flow assumptions: a.Calculate the Cost of Goods Sold on December 31,2019 for Given Company using the following cost flow assumptions: i)Weighted Average Cost method and ii) First-In-First-Out(FIFO) method. b.calculate the Gross Profit for the month ended December 31,2019 for Given Company using the following cost flow assumptions: i)Weighted Average Cost method and ii) First-In-First-Out(FIFO) method.arrow_forwardAztec Corporation uses a periodic inventory system and the retail inventory method to estimate ending inventory and cost of goods sold. The following data are available for the month of September: Cost Retail Beginning inventory $ 29,000 $ 46,000 Net purchases 14,500 ? question mark Net markups 10,700 Net markdowns 2,700 Net sales ? question mark The company used the average cost flow method and estimated inventory at the end of September to be $24,998.00. If the company had used the LIFO cost flow method, the cost-to- retail percentage would have been 50%. Required: Compute net purchases at retail and net sales for the month of September using the information provided.arrow_forwardFrom the following, calculate the cost of ending inventory and cost of goods sold for the FIFO method, ending inventory is 54 units. Note: Round your answers to the nearest cent. Beginning inventory and purchases January 1 April 10 May 15 July 22 August 19 September 30 November 10 December 15 Cost of ending inventory Cost of goods sold Units 4 11 11 16 EX 17 21 31 17 Unit cost $ 2.50 3.00 3.50 3.75 4.50 4.70 4.90 5.30arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education