FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

https://thevoiceslu.com/2020/10/massy-waterfront-gutted-by-fire/?fbclid=IwAR1BoNgDi0OJmqeG5Po8Mo8xYwV9DFVc42OPhtn5HRY2gRK6nB8HIAwwufw

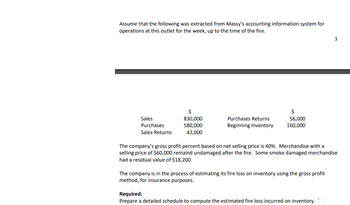

Transcribed Image Text:Assume that the following was extracted from Massy's accounting information system for

operations at this outlet for the week, up to the time of the fire.

Sales

Purchases

Sales Returns

$

830,000

580,000

42,000

Purchases Returns

Beginning Inventory

$

56,000

160,000

The company's gross profit percent based on net selling price is 40%. Merchandise with a

selling price of $60,000 remaind undamaged after the fire. Some smoke damaged merchandise

had a residual value of $18,200.

The company is in the process of estimating its fire loss on inventory using the gross profit

method, for insurance purposes.

3

Required:

Prepare a detailed schedule to compute the estimated fire loss incurred on inventory.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CengageNOWv2| Online teachin X m/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator=&inprogress=false ☆ 国。 Paused Calculator EPrint Item Alfredo Company purchased a new 3-0 printer for $960,000. Although this printer is expected to last for ten years, Alfredo knows the technology will become old quickly, and so they plan to replace this printer in three years. At that point, Alfredo believes it will be able to sell the printer for $10,000. Calculate yearly depreciation using the double-declining-balance method. Round final answers to nearest whole dollar amount. Year 1 Year 2 Year 3 Y Check My Work The double-declining balance uses 'double' the straight-line rate for depreciation. The 'base' that is used to apply that rate is the book value of the asset (determined by subtracting the balance in the accumulated depreciation account from the original cost of the asset). *** Previous Next Check My Work Save and Exit Submit Assignment for Grading All work saved.…arrow_forwardeducation.wiley.com/was/ui/v2/assessment-player/index.html?launchid=63b6bdc2-60b0-49f0-8567-aeb590318d19#/question/0 PO → bofa workjam (ulta) school b bartleby b bartleby we wiley 4 Homework Question 1 of 12 X Your answer is incorrect. Prepaid Insurance Equipment Accumulated Depreciation 1. The trial balance of Cullumber Fitness shows the following balances for selected accounts on November 30, 2022: 2. 3. 4. connect BARE MYOCC h 5. 87,552 14,976 zoom $12,800 Unearned Fitness Revenue $29,184 Note Payable Rent Receivable 40,800 quizletE google docs 640 Using the additional information given below, prepare the appropriate monthly adjusting entries at November 30. (Use Fitness Revenue instead of Service Revenue.) (List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) google slides 0/1 instagram Revenue earned for fitness center fees, but not yet billed, totaled $3,456 on November 30. The note payable…arrow_forwardCengageNOWv2| Online teachir x b d21 mnsu - Bing -2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSes.. On January 1, a company sold a machine for $5,000 that it had used for several years. The machine cost $11,000, and had accumulated depreciation of $4,500 at the time of sale. What gain or loss will be reported on the income statement for the sale of the machine for the year ended December 317 Oa. gain of $5,000 Ob. loss of $6,500 Oc. gain of $1,500 Od. loss of $1,500 11:05 AM 4/6/2021 aarrow_forward

- ezto.mheducation.com/ext/map/index.html?_con%3Dcon&external_browser%30&launchUrl=https%253A%252F%252Fblackboard.american.edu%2.. Quiz i Saved Help Save & Exit Sub California Inc., through no fault of Its own, lost an entire plant due to an earthquake on May 1, 2021. In preparing its insurance claim on the inventory loss, the company developed the following data: Inventory January 1, 2021, $430,000; sales and purchases from January 1, 2021, to May 1, 2021, $1,220,000 and $905,000, respectively. California consistently reports a 40% gross profit. The estimated inventory on May 1, 2021, is: Multiple Choice 14:39 $568,000. $604,200. $603,000. $663,000. Prev 5 of 5 Nex Profile.pdf Profile (1).pdf HY ndfarrow_forwardCengageNOWv2 |Online teachin X * CengageNOWv2 | Online teachin x+ ow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator=&inprogre... * еВook Show Me How Staley Inc. reported the following data: Net income $406,700 Depreciation expense 60,700 Loss on disposal of equipment 39,500 Increase in accounts receivable 26,800 Increase in accounts payable 11,100 Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use t out flows, cash payments, decreases in cash, or any negative adjustments. Staley Inc. Statement of Cash Flows (partial) Cash flows from operating activities: Net income 406,700 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation 60,700 Loss on disposal of equipment 39,500 Changes in current operating assets and liabilities: Increase in accounts receivable 26,800 x Increase in accounts payable 11,100 Net cash flow from operating activities 491,200…arrow_forwardOnline teachin x n/takeAssignment/takeAssignmentMain.do?invoker3&takeAssignmentSessionLocator=&inprogress%3false еВook Discussion Question 13-6 (LO. 4) On July 16, 2020, Logan acquires land and a building for $500,000 to use in his sole proprietorship. Of the purchase price, $400,000 is allocated to the building, and $100,000 is allocated to the land. Cost recovery of $4,708 is deducted in 2020 for the building (nonresidential real estate). a. What is the adjusted basis for the land and the building at the acquisition date? Land Building b. What is the adjusted basis for the land and the building at the end of 2020? Land Building $ 40 Previous Next Check My Work 10:57 PM 28°F Clear 2/14/2022arrow_forward

- * My Home x : CengageNOWv2 | Online teachin x b Home | bartleby x + A v2.cengagenow.com/iln/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false M Gmail YouTube Maps Blackboard HW #10 - Chpt 22 1 eBook E Print Item Schedule of Cash Payments for a Service Company Oakwood Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $124,500 April 115,800 Мay 105,400 Depreciation, insurance, and property taxes represent $26,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 60% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. Oakwood Financial Inc.…arrow_forwardus.wvu.edu/webapps/assessment/take/launch.jsp?course_assessment_id=_349525_1&course_id=_172235_1&content_id= 91004 Musketeers worldhiston H Blackboard M WVU Gmail a Discord Complete History... m HBO Max N Netflix A ALEKS- Musketeers Excel Email am and sieges v Question Completion Status: Florist Grump, Inc., had beginning retained earnings of $137,000. During the year, Florist Grump had net income of $63,000 and declared and paid dividends of $18,000. What will be shown for ending retained earnings on Florist Grump's year-end balance sheet? QUESTION 9 For the year ended December 31, Year 2 For the year ended December 31, Year 1 Revenues $ 7,500 $ 500 Expenses 1,500 Net Income December 31, Year 2 December 31, Year 1 Assets $ 16,500 $ 1,000 500 Liabilities Stock 300 300 Retained Earnings 1.$ 200 Assume Year1 is the company's first year of business and there were $100 dividends in Year 1 and $100 dividends in Year 2. After determining the missing amounts ($ Earnings 1.$ in the above…arrow_forwardmheducation.com/ext/map/index.html?_con=con&external_browser3D0&launchUrl=https%253A%252F%252Frccc.blackboard.com%252Fweba Maps Login BStart Here - OST-13.. Saved mework Assignment Haymitch Global Industries is a world leading producer of loudspeakers and other electronics products, which are sold under brar names like JRH, Excelsior, and Haymitch/Krug. The company reported the following amounts in its financial statements (in millions) 2016 2015 Net Sales Cost of Goods Sold Beginning Inventory Ending Inventory $5,300 4,200 $5,360 4,050 510 440 610 510 Required: 1 Determine the inventory turnover ratio and average days to sell inventory for 2016 and 2015. (Use 365 days in a year. Round your intermediate and final answers to 1 decimal place.) 2016 2015 Inventory Turnover Ratio times per year times per year Days to Sel! days days Prey 3 of 5 Nextarrow_forward

- Il Ter x G wileyplus - Google Search ww Ch10 Homework F21: Margrette x O NWP Assessment Player UI App x on.wiley.com/was/ui/v2/assessment-player/index.html?launchld3697735de-d478-43cf-9a0f-57f95a21595e#/question/10 -k F21 Question 11 of 20 0/ View Policies Show Attempt History Current Attempt in Progress X Your answer is incorrect. A truck was purchased for $184000 and it was estimated to have a $36000 salvage value at the end of its useful life. Monthly depreciation expense of $3700 was recorded using the straight-line method. The annual depreciation rate is O 3%. O 10%. O 30%. O 24%. eTextbook and Media Save for Later Attempts: 1 of 2 used Submit Answer & 7arrow_forwardPractice need help with stepsarrow_forwardInbox (74) - flyingparul008@gma X Chegg Expert Registration: Finan X 3o Zoho Creator - Chegg Expert Hir X g.cheggindia.com/#Form:Subject test?privateLink=bF53Pq3tqOdXDb6qq0PKbXBKnU6s212F4b2fdONuXXgZX2DīmgJz56EF3A. Subject Test Note: - You are attempting question 10 out of 1: The $1.000 face value 7% coupon bond pays interest semi-annually. The bond will mature in 5-years. Find the Modified duration of the bond if it sells for $1,025.30. (A) 4.54-years (B) 4.18-years (C) 4.40-years (D) 5.00-years Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education