Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

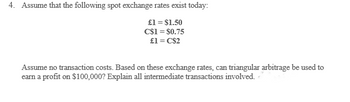

Transcribed Image Text:4. Assume that the following spot exchange rates exist today:

£1 = $1.50

C$1 = $0.75

£1 = C$2

Assume no transaction costs. Based on these exchange rates, can triangular arbitrage be used to

earn a profit on $100,000? Explain all intermediate transactions involved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose the Japanese yen exchange rate is ¥116/$ and the British pond exchange rate is $1.27/£. a) What is the yen to pound cross-rate? b) Suppose that a bank gives you a quote of ¥156/£. Is there an arbitrage opportunity here? If so, explain how to take advantage of the mispricing.arrow_forwardD3)arrow_forwardUse the following exchange rates to calculate the cross rates: EURUSD = 1.0500 GBPUSD = 1.2505 AUDUSD = 0.7050 USDJPY = 134.75 USDMXN = 19.2585 USDCAD = 1.2565 A: EURJPY B: CADMXN C: EURGBP D: AUDJPY E: CADJPYarrow_forward

- Suppose the Japanese yen exchange rate is ¥122 = $1 and the British pound exchange rate is £1 = $1.53. Suppose the cross-rate is ¥140 = £1. If there is, what would be the profit of the mispricing?arrow_forwardGanado Europe (B). Using facts in the chapter for Ganado Europe, assume as in Problem 11.1 that the exchange rate on January 2, 2020, in Exhibit 11.5 dropped from $1.2000 = €1.00 to $0.9000 = €1.00 (Rather than to $1.000/€). Recalculate Ganado Europe’s translated balance sheet for January 2, 2020, with the new exchange rate using the temporal rate method. What is the amount of translation gain or loss? Where should it appear in the financial statements? Why does the translation loss or gain under the temporal method differ from the loss or gain under the current rate method?arrow_forwardAssume that you are a retail customer. Use the information below to answer the following question. Exchange Rate - Bid Exchange Rate - Ask Interest Rate APR S0($/€) $ 1.42 = € 1.00 $ 1.45 = € 1.00 i$ 4 % F360($/€) $ 1.48 = € 1.00 $ 1.50 = € 1.00 i€ 3 % If you had borrowed $1,000,000, traded them for euros at the spot rate, and invested those euros in Europe, how many euros do you receive in one year?arrow_forward

- If the real exchange rates between the USD and CAD, AUD, and BRL respectively are 1.20, 0.90, and 1.40 respectively with the percentage of trade between the US and Canada, US and Australia, and US and Brazil are 50%, 20%, and 30% respectively (assuming these are only countries on the planet!), what is the effective real exchange rate for the USD? Question options: a)0.9 b)1.4 c)1.2 d)1.0arrow_forwardSuppose that in the Moscow interbank market one ruble corresponds to 0.0135 euros and 1.5 yen, while in the Tokyo interbank market 100 yen equals 0.8 euros. Consider whether there is a possibility of Triangular Arbitrage.arrow_forwardSuppose the current USD/EUR spot exchange rate is 1.20$/ €. At the same the euro interest rate amount to 10% per year while the dollar interest rate is 0% per year. a. What is the no-arbitrage one-year USD/EUR forward exchange? b. Suppose the one-year USD/EUR forward exchange was 1.25$/ €. How could you make money from this situation? 4arrow_forward

- Consider the following table. There are two countries and two goods. Assume both countries have the same price table: Time t t+1 P1 $8 $10 P2 $4 $5 a. Assume commodity price parity. What is the foreign currency price of the two goods at the two points in time? What is the domestic inflation rate? What is the foreign inflation rate. b. Suppose PPP is known to hold as is covered interest parity between two countries. What determines any differences between the expected real returns on risk free interest bearing assets in the two countries?arrow_forwardSuppose quotes for the dollar–euro exchange rate E$/€ are as follows: in New York $1.05 per euro, and in Tokyo $1.15 per euro. Describe how investors use arbitrage to take advantage of the difference in exchange rates. Explain how this process will affect the dollar price of the euro in New York and Tokyo.arrow_forwardUse the following exchange rates to calculate the cross rates: EURUSD = 1.0500 GBPUSD = 1.2505 AUDUSD = 0.7050 USDJPY = 134.75 USDMXN = 19.2585 USDCAD = 1.2565 EURJPY = CADMXN = EURGPB = AUDJPY = CADJPY =arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education