ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

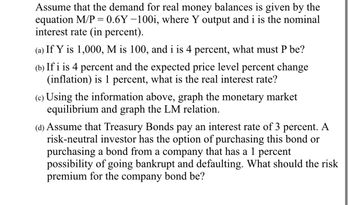

Transcribed Image Text:Assume that the demand for real money balances is given by the

equation M/P = 0.6Y -100i, where Y output and i is the nominal

interest rate (in percent).

(a) If Y is 1,000, M is 100, and i is 4 percent, what must P be?

(b) If i is 4 percent and the expected price level percent change

(inflation) is 1 percent, what is the real interest rate?

(c) Using the information above, graph the monetary market

equilibrium and graph the LM relation.

(d) Assume that Treasury Bonds pay an interest rate of 3 percent. A

risk-neutral investor has the option of purchasing this bond or

purchasing a bond from a company that has a 1 percent

possibility of going bankrupt and defaulting. What should the risk

premium for the company bond be?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (a) Suppose real GDP per person falls during a devastating recession, which in turn causes consumption to fall by 5%. Suppose there are no taxes in this economy. Would giving everyone 5% more income during the recession cause consumption to go up 5%? (b) An individual gets a salary increase from £50,000 to £75,000 per year. The individual saved £10,000 a year before the salary increase and £20,000 a year after the salary increase. Assume there are no taxes, the individual does not borrow, and the individual does not withdraw their savings. Calculate the individual's marginal propensity to consume.arrow_forward4. land after 3 years for $160,000. Assume that your capital gains tax is 15%. What is the average inflation rate over this time period if your after-tax, inflation adjusted rate of return on this investment is 4%? You bought some land for $100,000 for investment purposes. You sold thearrow_forward13) The aggregate demand curve shows a(n). relationship between the A) positive; interest rate and planned investment B) negative; interest rate and planned investment C) negative; interest rate and money demand D) inverse; price level and aggregate outputarrow_forward

- The options are: a) raise / reduce / maintain b) increase / reduce / maintain c) more / less / the same amount of d) more / less / just as e) shift to the right / shift to the left / no shift at all f) shift to the right / shift to the left / no shift at all g) an appreciation / a depreciation / no change in the valuearrow_forward2arrow_forwardQuestion 8 Dr. John buys stock in a foreign company that has a yield of 28% but the inflation rate is 6%. The effective rate of return is most nearly: Oa 24% Ob.21% O<.18% Od 20%arrow_forward

- Suppose the production function takes the form F(K, L) = The capital share is equal to: ⒸĀK 13 L L+K ĀK K+L ĀKL K+Larrow_forward(a) ASP100) P Q 125 100 75 (D) AS(P125) $560 500 440 P Q P (C) AS(PS) 125 $500 120 100 440 100 75 300 75 500 Suppose the full employment level of real output (Q) for a hypothetical economy is $500, the price level (P) initially is 100, and prices and wages are flexible both upward and downward. Refer to the accompanying short-run aggregate supply schedules. In the long run, an increase in the price level from 100 to 125 will O increase real output from $500 to $560 O $620 O change the aggregate supply schedule from (a) to (c) and result in an equilibrium level of real output of $560 O decrease real output from $500 to $440 O change the aggregate supply schedule from (a) to (b) and result in an equilibrium level of real output of $500arrow_forwardThe lower the interest rate: the greater the level of inflation the smaller the present value of a future amount the greater the present value of a future amount None of the statements associated with this question are correct.arrow_forward

- (a) In this case, Cunneen thinks that the RBA wants to [maintain] the value of the Australian dollar. (b) If the RBA wanted to reduce the value of the Australian dollar, it would need to [reduce] Australian interest rates. (c) If the RBA’s strategy was to increase the value of the Australian dollar, it would have taken steps to cause [less] capital to flow into Australian financial markets. (d) A strategy of reducing the value of the Australian dollar via conventional monetary policy would be [more, less, just as] difficult, if interest rates overseas were to rise. (e) Were the RBA to want the value of the Australian dollar to be higher, they would need the demand curve for the Australian dollar in the FX market to [shift to the right, shift to the left, not shift at all] . (f) Were the RBA to want the value of the Australian dollar to be lower, they would need the supply curve for the Australian dollar in the FX market to [shift to the right,…arrow_forwardWhy do the selling prices of depreciable assets increase with the general inflation rate?arrow_forward14.46. Well-managed companies set aside money to pay for emergencies that inevitably arise in the course of doing business. A commercial solid-waste recycling and disposal company in Mexico City puts 0.10% of its income after-tax income into such an account. (a) How much will the company have after 7 years if after-tax income averages $16.4 million per year and inflation and market interest rates are 4% per year and 9% per year, respectively? (b) What will be the buying power of that amount in today's dollars if the inflation rate is 4% per year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education