ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

See attachment. This is not a writing assignment. I need to understand the mathematical steps to calculate the continuous rate of wine consumption, and also the number of wine bottles being consumed in the 30th year.

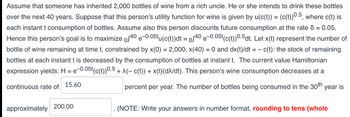

Transcribed Image Text:Assume that someone has inherited 2,000 bottles of wine from a rich uncle. He or she intends to drink these bottles

over the next 40 years. Suppose that this person's utility function for wine is given by u(c(t)) = (c(t))0.5, where c(t) is

each instant t consumption of bottles. Assume also this person discounts future consumption at the rate d = 0.05.

Hence this person's goal is to maximize of40 e-0.05tu(c(t))dt = of40e-0.05t(c(t))0.5dt. Let x(t) represent the number of

bottle of wine remaining at time t, constrained by x(0) = 2,000, x(40) = 0 and dx(t)/dt = c(t): the stock of remaining

bottles at each instant t is decreased by the consumption of bottles at instant t. The current value Hamiltonian

expression yields: H = e-0.05t(c(t))0.5 + λ(− c(t)) + x(t) (dλ/dt). This person's wine consumption decreases at a

continuous rate of 15.60

percent per year. The number of bottles being consumed in the 30th year is

approximately

200.00

(NOTE: Write your answers in number format, rounding to tens (whole

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Name Owner File size Location 5. In December 2023, the CPI-U for all items was 306.746. Five years earlier, in December 2018, the CPI-U was 251.233. What was the percentage increase in the CPI-U during those five years?arrow_forward21arrow_forwardQuestion 5 > Recall the fact that 1 feet = 12 inches. Conversion factors are fractions of value 1 that we use to convert units from one measurement to another. 1 feet = 12 inches gives rise to two conversion factors, 1 feet 12 inches and 12 inches 1 feet Use a conversion factor to convert feet to inches. Enter your answer as an integer or a reduced fraction. 1 feet inchesarrow_forward

- Ten years ago, Ginny inherited $50,000 from her grandmother. She decided to invest all of this money in GE stock. Suppose she decides to sell the stock today so she can purchase her first home. The sale price of the stock is $64,500. Suppose that at the beginning of the ten year period the Consumer Price Index (CPI) was 125 and today the CPI is 215. Use this information to determine the difference between the initial investment in today's dollars and the sale price.arrow_forwardGive an example of a good or service that has increased in price since the time when you were young. Describe the good or service and tell us what price the good cost when you were young compared to today. Calculate the percentage change in price (the inflation rate for the good in question) over the time period you are describing.arrow_forwardHanna, who is a 5-year-old girl, eats nothing but pasta, yogurt, and lemonade. Each month her parents buy 32 pounds of pasta, 79 packages of yogurt, and 22 bottles of lemonade. Hanna's parents have recorded the prices per unit of pasta, yogurt, and lemonade for the last four months, as shown in the table below. Hanna's Meals Month Pasta (dollars per pound) Yogurt (dollars per package) Lemonade (dollars per bottle) January $1.83 $1.14 $2.58 February 1.90 1.04 2.35 March 2.07 0.95 2.54 April 2.26 1.04 2.77 Instructions: Round your answers to two decimal places. a. Compute the total monthly cost of Hanna's meals and indicate whether inflation, deflation (negative inflation), or no inflation occurred during these months. In January, the total monthly cost was $. In February, the total monthly cost was $ and (Click to select). In March, the total monthly cost was $ and (Click to select). In April, the total monthly cost was $ and (Click to select). b. If Hanna's parents want to buy the same…arrow_forward

- Give an analysis of Elephant Chart by Branko Milanovic.arrow_forwardSearch for the “World Economic Outlook Database” on the internet and locate the most recent version. Use this database to select inflation data (units of percentage change) for Germany, Japan, and the United States for the period 1990 to 2010. Construct a table of annual inflation rates for these countries. Now construct a graph using annual inflation rates on the vertical axis and the year on the horizontal axis. Plot the annual inflation rates from your table in three separate lines on the same graph. How would you compare the experiences of these three countries based on your graph?arrow_forwardThe nominal interest rate is equal to the real interest rate plusarrow_forward

- Problem: Imagine you have two competing athletes who have the option to use an illegal and dangerous drug to enhance their performance (i.e., dope). If neither athlete dopes, then neither gain an advantage. If only one dopes, then that athlete gains a massive advantage over their competitor, reduced by the medical and legal risks of doping (the athletes believe the advantage over their competitor outweighs the risks from doping ). However, if both athletes dope, the advantages cancel out, and only the risks remain, putting them both in a worse position than if neither had been doping. What outcome do we expect from these two athletes? Please use ideas like concepts of monopolies, Oligopolies and Game Theory and Factor markets for this scenario.arrow_forward8arrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education