FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

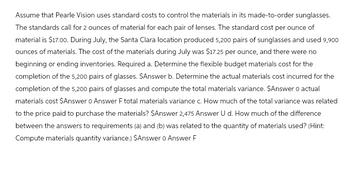

Transcribed Image Text:Assume that Pearle Vision uses standard costs to control the materials in its made-to-order sunglasses.

The standards call for 2 ounces of material for each pair of lenses. The standard cost per ounce of

material is $17.00. During July, the Santa Clara location produced 5,200 pairs of sunglasses and used 9,900

ounces of materials. The cost of the materials during July was $17.25 per ounce, and there were no

beginning or ending inventories. Required a. Determine the flexible budget materials cost for the

completion of the 5,200 pairs of glasses. $Answer b. Determine the actual materials cost incurred for the

completion of the 5,200 pairs of glasses and compute the total materials variance. $Answer 0 actual

materials cost $Answer 0 Answer F total materials variance c. How much of the total variance was related

to the price paid to purchase the materials? $Answer 2,475 Answer U d. How much of the difference

between the answers to requirements (a) and (b) was related to the quantity of materials used? (Hint:

Compute materials quantity variance.) $Answer o Answer F

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Genuine Spice Inc. began operations on January 1 of the current year. The company produces eight- ounce bottles of hand and body lotion called Eternal Beauty. The lotion is sold wholesale in 12-bottle cases for $100 per case. There is a selling commission of $20 per case. The January direct materials, direct labor, and factory overhead costs are as follows:arrow_forwardawson Toys, Limited, produces a toy called the Maze. The company has recently created a standard cost system to help control costs and has established the following standards for the Maze toy: Direct materials: 7 microns per toy at $0.35 per micron Direct labor: 1.1 hours per toy at $7.00 per hour During July, the company produced 5,400 Maze toys. The toy's production data for the month are as follows: Direct materials: 73,000 microns were purchased at a cost of $0.33 per micron. 25,750 of these microns were still in inventory at the end of the month. Direct labor: 6,340 direct labor-hours were worked at a cost of $48,818. Required: 1. Compute the following variances for July: (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount.) a. The materials price and…arrow_forwardDalton Quilting Company makes blankets that it markets through a variety of department stores. It makes the blankets in batches of 1,400 units. Dalton made 24,000 blankets during the prior accounting period. The cost of producing the blankets is summarized here. Materials cost ($10 per unit x 24,000) Labor cost ($9 per unit x 24,000) Manufacturing supplies ($1.50 × 24,000) Batch-level costs (20 batches at $4,200 per batch) Product-level costs. Facility-level costs Total costs Cost per unit = $846,000 ÷ 24,000 = $35.25 $ 240,000 216,000 36,000 84,000 96,000 174,000 $ 846,000 Required a. Sunny Motels has offered to buy a batch of 700 blankets for $25 each. Dalton's normal selling price is $46 per unit. Calculate the relevant cost per unit for the special order. Based on the preceding quantitative data, should Dalton accept the special order? a. Cost per unit a. Should Dalton accept the special order? b. Cost per unit b. Should Dalton accept the special order? b. Sunny offered to buy a…arrow_forward

- Erie Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows: Standard Hours 27 minutes Standard Rate per Hour $6.00 During August, 9,540 hours of direct labor time were needed to make 19,600 units of the Jogging Mate. The direct labor cost totaled $56,286 for the month. Required: 1. What is the standard labor-hours allowed (SH) to makes 19,600 Jogging Mates? 2. What is the standard labor cost allowed (SH x SR) to make 19,600 Jogging Mates? 3. What is the labor spending variance? Standard Cost $2.70 4. What is the labor rate variance and the labor efficiency variance? 5. The budgeted variable manufacturing overhead rate is $4.50 per direct labor-hour. During August, the company incurred $47,700 in variable manufacturing overhead cost. Compute the variable overhead rate and efficiency variances for the month. (For requirements 3 through 5, indicate…arrow_forwardSifton Electronics Corporation manufactures and assembles electronic motor drives for video cameras. The company assembles the motor drives for several accounts. The process consists of a lean cell for each customer. The following information relates to only one customer's lean cell for the coming year. For the year, projected labor and overhead was $5,627,900 and materials costs were $32 per unit. Planned production included 5,344 hours to produce 16,700 motor drives. Actual production for August was 1,500 units, and motor drives shipped amounted to 1,480 units. Conversion costs are applied based on units of production From the foregoing information, determine the amount of the conversion costs charged to Raw and In Process Inventory during August. O $606,600 Ob $608,432 O $247,163 Od $107,840arrow_forwardGlobal GPS industries assembles its GPS systems with the following costs. Each or requires one computer system and 4 batteries. Computer systems cost $140 each, and Batteries are $2.50 each. Global is able to reliably obtain computers as needed and does not maintain them in inventory. However, batteries are stocked in inventory sufficient to produce 20% of the following month's expected production. Planned production is as follows: January February March April 24,000 systems 39,750 systems 23,850 systems 25,000 systems BB batter Compute No end/No Required: Prepare a direct material purchasing plan for January, February, and March based on the above facts.arrow_forward

- Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,200 helmets, using 2,048 kilograms of plastic. The plastic cost the company $13,517. According to the standard cost card, each helmet should require 0.58 kilograms of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,200 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,200 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forwardBandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,800 helmets, using 2,812 kilograms of plastic. The plastic cost the company $21,371. According to the standard cost card, each helmet should require 0.66 kilogram of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,800 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,800 helmets? 3. What is the materials spending variance? 4. What are the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forwardDawson Toys, Limited, produces a toy called the Maze with the following standards: Direct materials: 7 microns per toy at $0.35 per micron Direct labor: 1.5 hours per toy at $6.80 per hour During July, the company produced 5,100 Maze toys. The toy's production data for the month are as follows: Direct materials: 76,000 microns were purchased at a cost of $0.32 per micron. 31,375 of these microns were still in inventory at the end of the month. Direct labor. 8,050 direct labor-hours were worked at a cost of $58,765. Required: 1. Compute the following variances for July: Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount. a. The materials price and quantity variances. b. The labor rate and efficiency variances.arrow_forward

- Vishnuarrow_forwardGarden Yeti manufactures garden sculptures. Each sculpture requires 8 pounds of direct materials at a cost of $3 per pound and 0.4 direct labor hour at a rate of $16 per hour. Variable overhead is budgeted at a rate of $2 per direct labor hour. Budgeted fixed overhead is $4,000 per month. The company's policy is to maintain direct materials inventory equal to 40% of the next month's direct materials requirement. At the end of February the company had 9,600 pounds of direct materials in inventory. The company's production budget reports the following. Production Budget Units to produce (1) Prepare direct materials budgets for March and April. (2) Prepare direct labor budgets for March and April. (3) Prepare factory overhead budgets for March and April. Complete this question by entering your answers in the tabs below. Required 1 March April May 3,000 4,300 4,500 Units to produce Required 2 Required 3 Prepare direct materials budgets for March and April. GARDEN YETI Direct Materials…arrow_forwardDawson Toys, Limited, produces a toy called the Maze. The company has recently created a standard cost system to help control costs and has established the following standards for the Maze toy: Direct materials: 6 microns per toy at $0.33 per micron Direct labor: 1.1 hours per toy at $7.40 per hour During July, the company produced 5,400 Maze toys. The toy's production data for the month are as follows: Direct materials: 73,000 microns were purchased at a cost of $0.30 per micron. 32,500 of these microns were still in inventory at the end of the month. Direct labor. 6,540 direct labor-hours were worked at a cost of $50,358. Required: 1. Compute the following variances for July: (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. Round final answer to the nearest whole dollar amount.) a. The materials price and quantity…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education