FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

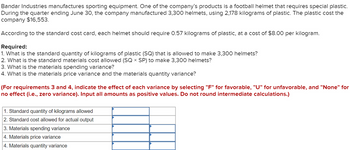

Transcribed Image Text:**Bandar Industries Manufacturing Cost Analysis**

Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,300 helmets, using 2,178 kilograms of plastic. The plastic cost the company $16,553.

According to the standard cost card, each helmet should require 0.57 kilograms of plastic, at a cost of $8.00 per kilogram.

**Required:**

1. **Standard Quantity of Kilograms of Plastic (SQ):**

- Determine the allowed kilograms of plastic to make 3,300 helmets.

2. **Standard Materials Cost Allowed (SQ × SP):**

- Calculate this cost for 3,300 helmets.

3. **Materials Spending Variance:**

- Compute the variance in spending on materials.

4. **Materials Price Variance and Materials Quantity Variance:**

- Analyze both variances.

**Instructions for Analysis:**

- For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).

- Input all amounts as positive values.

- Do not round intermediate calculations.

**Required Calculations and Analysis Table:**

1. **Standard Quantity of Kilograms Allowed**

2. **Standard Cost Allowed for Actual Output**

3. **Materials Spending Variance**

4. **Materials Price Variance**

5. **Materials Quantity Variance**

This guide assists in analyzing the material variances encountered during the manufacturing process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Bandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic. During the quarter ending June 30, the company manufactured 3,200 helmets, using 2,048 kilograms of plastic. The plastic cost the company $13,517. According to the standard cost card, each helmet should require 0.58 kilograms of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,200 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,200 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? Note: For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate calculations. 1. Standard quantity of kilograms…arrow_forwardBandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's products, a football helmet for the North American market, requires a special plastic. During the quarter ending June 30, the company manufactured 3,700 helmets, using 2,516 kilograms of plastic. The plastic cost the company $19,122. According to the standard cost card, each helmet should require 0.59 kilograms of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,700 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,700 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate…arrow_forwardHandMI Corp. manufactures organic cotton totes in Michigan. The company estimates its production for the next four months as follows: July 5,200 units, August 7,800 units, September 7,900 units, October 8,800 units. Each tote requires 0.7 square meters of cotton. The company's cotton inventory policy is 40% of next month’s production needs. On July 1 cotton inventory was expected to be 1,456 square meters. What will cotton purchases be in July? Multiple Choice 5,393 square meters 4,118 square meters 4,518 square meters 4,368 square metersarrow_forward

- Chadwick Shoe Co. produces and sells an e xcellent-quality walking shoe. After production, the shoes are distributed to 20 warehouses around the country. Each warehouse services approximately 100 stores in its region. Chadwick uses an EOQ model to determine the number of pairs of shoes to order for each warehouse from the factory. Annual demand for Warehouse OR2 is approximately 120,000 pairs of shoes. The ordering cost is $250 per order. The annual carrying cost of a pair of shoes is $2.40 per pair. Q. Assume each month consists of approximately 4 weeks. If it takes 1 week to receive an order, at what point should warehouse OR2 reorder shoes?arrow_forwardBig Sur Water Sports, Inc., manufactures fiberglass boards used for riding the waves at the beach. The products are sold under the brand name Crazy Board. The standard cost for material and labor is $89.20 per board. This includes 8 kilograms of direct material at a standard cost of $5.00 per kilogram and 6 hours of direct labor at $8.20 per hour. The following data pertain to November: Purchases of material: 46,500 kilograms for $248,000 Total actual direct labor costs: $301,490 Actual hours of direct labor: 36,500 hours Production: 5,600 units 1. Calculate the total direct materials variance 2. Calculate the total direct labor variance Check Figures: Total Direct Materials Variance $23,845 Unfavorable Total Direct Labor Variance $25,970 Unfavorablearrow_forwardPlease help if you understand really appreciatearrow_forward

- BIKE Company starts with $3,000 cash to finance its business plan of producing bike helmets using a simple assembly process. During the first month of business, the company signs sales con- tracts for 1,300 units (sales price of $9 per unit), produces 1,200 units (production cost of $7 per unit), ships 1,100 units, and collects in full for 900 units. Production costs are paid at the time of production. The company has only two other costs: (1) sales commissions of 10% of selling price when the company collects from the customer, and (2) shipping costs of $0.20 per unit paid at time of shipment. Selling price and all costs per unit have been constant and are likely to remain the same. Required: a. Prepare comparative (side-by-side) balance sheets and income statements for the first month of BIKE Company for each of the following three alternatives: (1) Revenue is recognized at the time of shipment. (2) Revenue is recognized at the time of collection. (3) Revenue is recognized at the…arrow_forwardAshvinbhaiarrow_forwardBandar Industries Berhad of Malaysia manufactures sporting equipment. One of the company's products, a football helmet for the North American market, requires a special plastic. During the quarter ending June 30, the company manufactured 3,400 helmets, using 2,652 kilograms of plastic. The plastic cost the company $17,503. According to the standard cost card, each helmet should require 0.70 kilograms of plastic, at a cost of $7.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,400 helmets? 2. What is the standard materials cost allowed (SQ x SP) to make 3,400 helmets? 3. What is the materials spending variance? 4. What is the materials price variance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediate…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education