FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

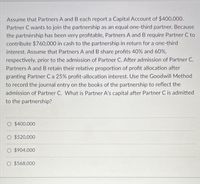

Transcribed Image Text:Assume that Partners A and B each report a Capital Account of $400,000.

Partner C wants to join the partnership as an equal one-third partner. Because

the partnership has been very profitable, Partners A and B require Partner C to

contribute $760,000 in cash to the partnership in return for a one-third

interest. Assume that Partners A and B share profits 40% and 60%,

respectively, prior to the admission of Partner C. After admission of Partner C,

Partners A and B retain their relative proportion of profit allocation after

granting Partner C a 25% profit-allocation interest. Use the Goodwill Method

to record the journal entry on the books of the partnership to reflect the

admission of Partner C. What is Partner A's capital after Partner C is admitted

to the partnership?

O $400,000

O $520,000

O $904,000

O $568,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Memanarrow_forwardShirley contributes property to a new partnership with a value of $1,000,000 and a basis of $400,000 that is secured by a $500,000 nonrecourse note. Under the terms of the partnership agreement, Shirley will be allocated 25% of all profits. The partnership agreement also states that "excess nonrecourse liabilities" will be allocated to partners according to profit ratios. How much of the nonrecourse liability will be allocated to Shirley? please dont provide answer in images thank youarrow_forwardDaggett, Lamppin, and Pendergast are partners who share profits and losses 50%, 30%, and 20%, respectively. Their capital balances are $140,000, $80,000, and $55,000, respectively. (a) Your answer is correct. Assume Sanford joins the partnership by investing $135,000 for a 25% interest with bonuses to the existing partners. Prepare the journal entry to record his investment. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Cash Sanford, Capital Daggett, Capital Lamppin, Capital Pendergast, Capital + + + Debit 135000 Credit 102500 16250 9750 6500arrow_forward

- After the tangible assets have been adjusted to current market prices, the capital accounts of Grayson Jackson and Harry Barge have balances of $64,900 and $86,500, respectively. Lewan Gorman is to be admitted to the partnership, contributing $43,300 cash to the partnership, for which he is to receive an ownership equity of $50,500. All partners share equally in income. a. Journalize the entry to record the admission of Gorman, who is to receive a bonus of $7,200. If an amount box does not require an entry, leave it blank. Cash Grayson Jackson, Capital Harry Barge, Capital Lewan Gorman, Capital b. What are the capital balances of each partner after the admission of the new partner? Partner Balance Grayson Jackson $ Harry Barge $ Lewan Gorman $arrow_forwardPlease help mearrow_forwardJerry and Sherry own and operate a partnership. Jerry’s capital balance is $50,000 and Sherry’s is $55,000. Jerry and Sherry decided to admit a new partner, Allison, to their partnership. By the terms of their partnership agreement, Jerry and Sherry share income/loss equally. Allison intends to contribute $40,000 cash to receive a twenty-five percent interest in the partnership Required: a. Revalue the partnership assets b. Determine the total equity of the partnership after the new partner is admitted c. Determine the new partner share of the total equity d. Determine the bonus resulting from Allison’s equity of her contribution e. Make journal entries to record Allison’s admission to the partnership. Please solve sub-part e. Show Your Work:arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education