FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

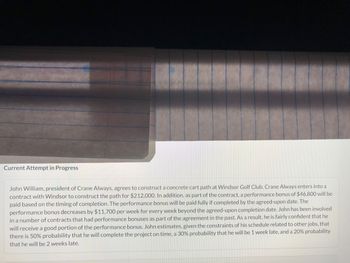

Transcribed Image Text:Current Attempt in Progress

John William, president of Crane Always, agrees to construct a concrete cart path at Windsor Golf Club. Crane Always enters into a

contract with Windsor to construct the path for $212,000. In addition, as part of the contract, a performance bonus of $46,800 will be

paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date. The

performance bonus decreases by $11,700 per week for every week beyond the agreed-upon completion date. John has been involved

in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he

will receive a good portion of the performance bonus. John estimates, given the constraints of his schedule related to other jobs, that

there is 50% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 20% probability

that he will be 2 weeks late.

Transcribed Image Text:(b)

List of Accounts

Assume that John William has reviewed his work schedule and decided that it makes sense to complete this project on time.

Assuming that he now believes that the probability for completing the project on time is 93% and otherwise it will be finished 1

week late, determine the transaction price.

Transaction price

Attempts: 2 of 3 used

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are a real estate agent thinking of placing a sign advertising your services at a local bus stop. The sign will cost $4,200 and will be posted for one year. You expect that it will generate additional revenue of $714 a month. What is the payback period? The payback period is ___ months (Round to one decimal place)arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardProblem 4. Which project would you select on the basis of rate of return, assuming MARR =15%. Please use excel spreadsheet to answer.arrow_forward

- Find the IRR for an investment that costs £96,000 today and pays £1028.61 at the end of the month for the next 60 months and then pays an additional £97,662.97 at the end of the 60th month if the investor discounts expected future cash flows monthly. You will once again have to do this iteratively.arrow_forward(4) Evaluate the ROI.arrow_forwardplease answer all parts of the question within 30 minutes with detailed explanation. Make sure the answers are in detailed manner for better understanding. Else i will give negative ratings.arrow_forward

- ou are preparing to produce some goods for sale. You will sell them in one year and you will incur costs of $ 76,000 immediately. If your cost of capital is 7%. What is the minimum dollar amount you need to sell the goods for in order for this to be a non-negative NPV? Question content area bottom Part 1 The minimum dollar amount is $XXX enter your response here .arrow_forwardYou invest $100,000 in a project and received $40,000 at n = 1, $40,000 at n = 2, and $30,000 at n = 3 years. You need to terminate the project at the end of year 3. Your interest rate is 10%. What is the project balance at the time of termination?arrow_forwardAnswer according to the question pleasearrow_forward

- Answer the questions ASAP.arrow_forward5. QuizCo would like to use the IRR method to choose between projects A and B below. QuizCo's MARR is 10%. Each project lasts 5 years. (a) Calculate the IRR for each project. Check with Excel using the IRR function, the rate function, and Goal Seek. Include the Excel output in your Assignment. (b) Calculate the incremental IRR. (c) Which project should be selected based on incremental IRR? Project First Cost Annual Savings 12,000 13,000 A 3450 3700arrow_forwardCalculate the actual value of work done and the total actual profit contribution from all the projects as of the 31st of March.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education