Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

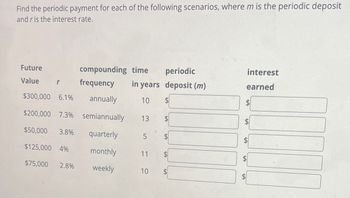

Transcribed Image Text:Find the periodic payment for each of the following scenarios, where m is the periodic deposit

and r is the interest rate.

Future

compounding time

periodic

interest

Value

frequency

in years deposit (m)

earned

$300,000 6.1%

annually

10

$

$200,000 7.3% semiannually

13

$

tA

$50,000 3.8%

quarterly

5

$125,000 4%

monthly

11

tA

SA

$75,000 2.8%

weekly

10

SA

A

A

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Coice 52,26,39 ,78arrow_forwardSuppose your credit card issuer states that it charges a 19.25% nominal annual rate, but you must make monthly payments, which amounts to monthly compounding. What is the effective annual rate? a. 21.04% b. 19.25% c. 20.18% d. 20.68% e. 20.51%arrow_forwardFind the present value of the ordinary annuity. (Round your answer to the nearest cent.) Amount of Deposit m Frequency n Rate r Time t $400 quarterly 10% 20 yrarrow_forward

- Find the future value for each of the following scenarios, where m is the periodic deposit and r is the interest rate. Future Value $50,000 7.8% $225,000 6.9% $200,000 6.5% $275,000 3.9% $125,000 5.2% r compounding frequency annually semiannually quarterly monthly weekly time in years 6 15 10 $ 11 $ 13 $ periodic deposit (m) $ interest earnedarrow_forwardA. Calculate the effective annual rate (EAR) in each of the following scenarios: b. APR = 10%, monthly compounding c. 4% semi-annual interest rate, monthly compounding d. 1.5% monthly interest rate, daily compounding e. 3% quarterly interest rate, annual compoundingarrow_forwardJatpara Subject;arrow_forward

- Expected Return, Variance, Std. Deviation and Cofficient of Variation:Magee Inc.'s manager believes that economic conditions during the next year will be strong, normal, or weak, and she thinks that the firm's returns will have the probability distribution shown below. What's the standard deviation of the estimated returns?Round your answer to two decimal places. For example, if your answer is $345.6671 round as 345.67 and if your answer is .05718 or 5.7182% round as 5.72. State of the Economy Probability of State Occurring Stock's Expected Return Boom 30% 22.50% Normal 50% 14.10% Recession 20% –11.15% 11.93% 10.14% 8.95% 14.91% 13.12%arrow_forwardFind the present value of the ordinary annuity. (Round your answer to the nearest cent.) Amount of Deposit m Frequency n Rate r Time t $100 quarterly 6% 25 yrarrow_forwardFind the present value of the ordinary annuity. (Round your answer to the nearest cent.) Amount of Deposit m Frequency n Rate r Time t $400 quarterly 14% 25 yr $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education