FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

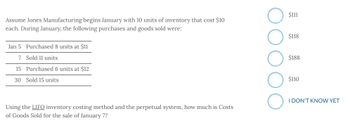

Transcribed Image Text:Assume Jones Manufacturing begins January with 10 units of inventory that cost $10

each. During January, the following purchases and goods sold were:

Jan 5 Purchased 8 units at $11

7 Sold 11 units

15

30 Sold 15 units

Purchased 6 units at $12

Using the LIFO inventory costing method and the perpetual system, how much is Costs

of Goods Sold for the sale of January 7?

OO

O

$111

$118

$188

$110

I DON'T KNOW YET

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I→ 3 Tremblay Company began June with 45 units of inventory that cost a total of $900. During June, Tremblay purchased and sold goods as follows: (Click the icon to view the transactions.) Calculate the gross margin amount using the weighted-average method. assuming Tremblay uses a periodic inventory system. Jave Before we can calculate gross margin, we must first determine the cost of goods sold, using the periodic method of costing inventory. Start by determining the formula, and then enter the amounts. (Round your answers to the nearest whole dollar.) Cost of goods available for sale Less: Cost of goods sold More info June 8 Purchase: 65 units at $14.00 June 14 June 22 Sale: 55 units at $32 Purchase: 48 units at $16.00 June 27 Sale: 65 units at $37.00 - Xarrow_forwardWan Tan Corp. made the following four inventory purchases in June: June 1 150 units $5.20 June 10 200 units $5.85 June 15 200 units $6.30 June 28 150 units $6.60 On June 22, 450 units were sold. The company uses the perpetual inventory system and the weighted average to value the inventory. Calculate the cost of goods sold for the sale. Round to the nearest whole dollar. Select one: a. $2,580 b. $2,628 c. $2,700 d. $1,572arrow_forwardSkysong, Inc. has the following inventory data: July 1 Beginning inventory 33 units at $16 $528 7 Purchases 115 units at $17 1955 22 Purchases 16 units at $18 288 $2771 A physical count of merchandise inventory on July 30 reveals that there are 41 units on hand. Using the LIFO inventory method, the amount allocated to cost of goods sold for July isarrow_forward

- Concord has the following inventory information. July 1 Beginning Inventory 30 units at $15 90 units at $23 7 Purchases 22 Purchases 10 units at $20 O $2060. O $2090. O $2270. O $2173. $450 2070 200 $2720 A physical count of merchandise inventory on July 31 reveals that there are 30 units on hand. Using the FIFO inventory method, the amount allocated to cost of goods sold for July isarrow_forwardThe units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 20 units @ $32 $640 June 16 Purchase 30 units @ $34 1,020 Nov. 28 Purchase 41 units @ $35 1,435 91 units $3,095 There are 11 units of the product in the physical inventory at November 30. The periodic inventory system is used. Determine the difference in gross profit between the LIFO and FIFO inventory cost systems. Enter the answer as a positive number. FIFO Cost of Goods Sold $fill in the blank 1 LIFO Cost of Goods Sold $fill in the blank 2 Difference fill in the blank 3arrow_forwardA company had the following purchases and sales during its first year of operations: Purchases Sales January: 10 units at $120 6 units February: 20 units at $125 5 units May: 15 units at $130 9 units September: 12 units at $135 8 units November: 10 units at $14013 units On December 31, there were 26 units remaining in ending inventory. Using the perpetual LIFO inventory costing method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.) $3,405.arrow_forward

- Kiwi Ltd. started April with 90 units in inventory costing $16 each. Kiwi Ltd., which uses a perpetual inventory system, had the following inventory transactions in April: Purchases Sales Units Unit Cost Units Selling Price/Unit 4 Purchase 300 18 12 Sale 240 $32 21 Purchase 100 24 29 Sale 165 $35 Instructions Using the FIFO cost formula, calculate the cost of goods sold for the month ended April Show calculations in the table below. Using the average cost formula, calculate the ending inventory at April 30. Show calculations in the table on the next page. Round to two decimals for all calculations. Use the ROUNDED values in your calculations. (a) Perpetual Inventory Record––FIFO PURCHASES COST OF GOODS SOLD INVENTORY ON HAND DA TE…arrow_forwardThe units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 24 units @ $32 $768 June 16 Purchase 30 units @ $35 1,050 Nov. 28 Purchase 38 units @ $39 1,482 92 units $3,300 There are 15 units of the product in the physical inventory at November 30. The periodic inventory system is used. a. Determine the inventory cost by the FIFO method. b. Determine the inventory cost by the LIFO method. c. Determine the inventory cost by the average cost methods. Round answer to two decimal places. %24 %24 %24arrow_forward1. Westor Aldor had a beginning inventory balance on July 1 of 440 units at a cost of $3.50 each. During the month, the following inventory transactions took place: Purchases Sales Date Units Cost per Unit Date Units Price Per Unit July 10 1,300 $3.10 July 2 250 $6 13 700 $3.40 11 1,000 $6 27 550 $3.75 28 400 $6.50 a) Calculate the cost of goods available for sale and the number of units of ending inventory. Please explain how to find ending inventory when not given.arrow_forward

- The units of Manganese Plus available for sale during the year were as follows: Mar. 1 Inventory 25 units @ $29 $725 June 16 Purchase 27 units @ $34 918 Nov. 28 Purchase 44 units @ $36 1,584 96 units $3,227 There are 10 units of the product in the physical inventory at November 30. The periodic inventory system is used. a. Determine the inventory cost by the FIFO method.$fill in the blank 1 b. Determine the inventory cost by the LIFO method.$fill in the blank 2 c. Determine the inventory cost by the average cost methods. Round answer to two decimal places.$fill in the blank 3arrow_forwardThe inventory records of TC show the following purchases:Month Units CostJanuary 15,000 190,500February 20,000 240,000March 12,500 165,00A physical count on March 31 shows 22,500 units on hand. What amount of inventory should be reported as of March 31, using FIFO method of costing?a. 120,000 b. 225,000 c. 280,500 d. 285,000arrow_forwardJesters company uses a periodic inventory system and reports the following for the month of June DATE EXPLAINATION UNITS UNIT COST TOTAL COST June 1 Inventory 120 $5 $600 12 Purchase 370 $6 $2220 23 Purchase 200 $7 $1400 30. Inventory. 230 How do the average-cost values for ending inventory and cost of goods sold relate to ending inventory and cost of goods sold for FIFO and LIFO? Explain why the average cost is not $6arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education