FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

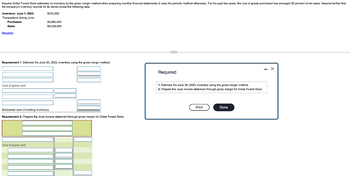

Question

Transcribed Image Text:Assume Dollar Forest Store estimates its inventory by the gross margin method when preparing monthly financial statements (it uses the periodic method otherwise). For the past two years, the cost of goods purchased has averaged 62 percent of net sales. Assume further that

the company's inventory records for its stores reveal the following data:

$510,000

Inventory: June 1, 2023

Transactions during June:

Purchases

Sales

Required

Requirement 1. Estimate the June 30, 2023, inventory using the gross margin method.

Cost of goods sold

$4,880,000

$8,435,000

Estimated cost of ending inventory

Requirement 2. Prepare the June Income statement through gross margin for Dollar Forest Store.

Cost of goods sold

Required

1. Estimate the June 30, 2023, inventory using the gross margin method.

2. Prepare the June income statement through gross margin for Dollar Forest Store.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Estimating sales returns On December 31, Jack Photography Supplies estimated that approximately 2% of merchandise sold will be returned. Sales Revenue for the year was $80,000 with a cost of $48,000. Journalize the adjusting entries needed to account for the estimated returns.arrow_forwardRequired information Use the following information for the Exercises 8-10 below. (Algo) [The following information applies to the questions displayed below.] Hemming Company reported the following current-year purchases and sales for its only product. Date January 1 January 10 March 14 March 15 July 30 October 5 October 26 Total Beginning inventory Purchases: March 14 July 30 October 26 b) Periodic LIFO Total Beginning inventory Purchases: March 14 July 30 October 26 Activities Beginning inventory Sales Purchase Sales c) Gross profit Purchase Sales Purchase Totals Exercise 6-10A (Algo) Periodic: Inventory costing LO P3 # of units Cost of Goods Available for Sale FIFO # of units 0 Hemming uses a periodic inventory system. (a) Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. (b) Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. (c) Compute the gross profit for each method. a) Periodic FIFO Cost per unit 0 Cost of…arrow_forwardThe following information is taken from the books of All in the Family Center for the first quarter of its fiscal year ending on April 30, 20--: Cost Retail Inventory, start of period (January 1, 20--) $37,000 $66,000 Net purchases during the period 174,000 330,000 Net sales for the period 310,500 Required: 1. Estimate the ending inventory as of April 30, 20--, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar. Estimate the ending inventory 46,435 X Feedback 2. Estimate the cost of goods sold for the time period, January 1, through April 30, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar. Estimated cost of goods sold 164,565 Feedhackarrow_forward

- Question: Langley Inc. inventory records for a particular development program show the following at October 31, 2020: At October 31, ten of these programs are on hand. Langley uses the perpetual inventory system. 1. Journalize for Langley: a. Total October purchases in one summary entry. All purchases were on credit. b. Total October sales and cost of goods sold in two summary entries. The selling price was $500 per unit, and all sales were on credit. Langley uses the FIFO inventory method. (Please show the calculations/where the number is from) Ex: I didn't understand the part of the answer for the entry Cost of Goods Sold & Inventory 1,710. 2. Under FIFO, how much gross profit would Langley earn on these transactions? What is the FIFO cost of Langley’s ending inventory?arrow_forwardThe following data was obtained from the records of ABC Inc., for the current year. Sales during the year were 201 units. (SHOW YOUR WORK) Jan 1, 2021 Jan 11, 2021 Jan 23, 2021 January 31 Beginning Inventory Purchases Purchases 80 units at $8 65 units at $10 55 units at $12 53 units at $14 Purchases Required: Calculate the cost of the ENDING INVENTORY and the COST OF GOODS SOLD using: a) FIFO b) LIFO c) Prepare an income statement using the FIFO method for inventory valuation. Sales were $5000 and operating expenses were $2,000. The income tax rate is 25%.arrow_forwardThe following information is taken from the books of All in the Family Center for the first quarter of its fiscal year ending on April 30, 20--: Cost Retail Inventory, start of period (January 1, 20--) $37,000 $66,000 Net purchases during the period 174,000 330,000 Net sales for the period 310,500 Required: 1. Estimate the ending inventory as of April 30, 20--, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar. Estimate the ending inventory 46,435 x Feedback Check My Work Incorrect 2. Estimate the cost of goods sold for the time period, January 1, through April 30, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar. Estimated cost of goods sold 164,565 X Feedback Check My Work Incorrectarrow_forward

- Using the selected year-end account balances at December 31, 2014, for Lifeline General Store that follow, prepare a multistep 2014 income statement. Show detail of net sales. The company uses the periodic inventory system. Beginning merchandise inventory was $28,000; ending merchandise inventory is $21,000. Account Name Debit CreditSales $309,000Sales Returns and Allowances $ 15,200Purchases 114,800Purchases Returns and Allowances 7,000Freight-In 5,600Selling Expenses…arrow_forwardPlease read and asnwer question using table provided.arrow_forwardYou have the following information for Bramble Inc. for the month ended June 30, 2022. Bramble uses a periodic inventory system. Date Description Quantity Unit Cost orSelling Price June 1 Beginning inventory 40 $31 June 4 Purchase 135 34 June 10 Sale 110 61 June 11 Sale return 15 61 June 18 Purchase 55 37 June 18 Purchase return 10 37 June 25 Sale 65 67 June 28 Purchase 35 41arrow_forward

- A company reports the following: Cost of merchandise sold $1,460,000 Average merchandise inventory 182,500 Determine (a) the inventory turnover and (b) the number of days sales in inventory. Assume a 365-day year. Round your answers to one decimal place. a. Inventory turnover b. Number of days' sales in inventory days Previous Next 1:00 PM 18 se g 12/11/2020 aarrow_forwardDuring the year, TRC Corporation has the following inventory transactions. Date Jan. 1 Beginning inventory Apr. 7 Purchase Jul.16 Purchase Oct. 6 Purchase Weighted Average Cost Total Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Transaction Sales revenue Gross profit For the entire year, the company sells 450 units of inventory for $70 each. 3. Using weighted-average cost, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. (Round "Average Cost per unit" to 2 decimal places and all other answers to the nearest whole number.) Number of Units 60 140 210 120 530 Cost of Goods Available for Sale # of units 60 140 210 120 530 Average Cost per unit Cost of Goods Available for Sale $ $ Unit Cost 3,120 $ 52 54 57 58 7,560 11,970 6.960 29,610 Total Cost $ 3,120 7,560 11,970 6,960 $29,610 Cost of Goods Sold - Weighted Average Cost of units Sold Average Cost of Cost per Unit Goods Sold Ending Inventory - Weighted Average Cost # of units in Ending Inventory…arrow_forwardTariq Fisher Company uses a perpetual inventory system. On January 1, its inventory account had a beginning balance of Rs 450,000. Tariq engaged in the following transactions during the year:Prepare all necessary transaction as General Entries and answer given below option. Purchased merchandise inventory for Rs 500,000. Generated net sales of Rs 600,000. Recorded inventory shrinkage of Rs 10,000 after taking a physical inventory at year-end. Reported gross profit for the year of Rs 180,000 in its income statement. At what amount was Cost of Goods Sold reported in the company’s year-end income statement? At what amount was Merchandise Inventory reported in the company’s year-end balance sheet? Immediately prior to recording inventory shrinkage at the end of the year, what was the balance of the Cost of Goods Sold account? What was the balance of the Merchandise Inventory account? d- Calculate the Gross profit margin ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education