Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

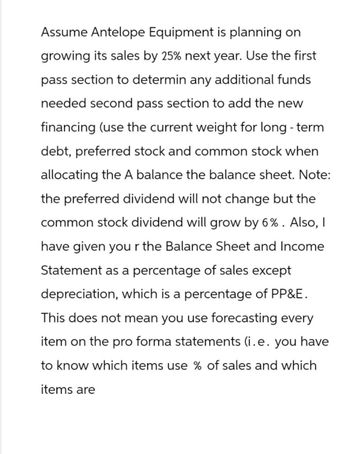

Transcribed Image Text:Assume Antelope Equipment is planning on

growing its sales by 25% next year. Use the first

pass section to determin any additional funds

needed second pass section to add the new

financing (use the current weight for long-term

debt, preferred stock and common stock when

allocating the A balance the balance sheet. Note:

the preferred dividend will not change but the

common stock dividend will grow by 6%. Also, I

have given your the Balance Sheet and Income

Statement as a percentage of sales except

depreciation, which is a percentage of PP&E.

This does not mean you use forecasting every

item on the pro forma statements (i.e. you have

to know which items use % of sales and which

items are

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A financial analyst wants to compute a company's weighted average cost of capital (WACC) using the dividend discount model. The company has a before-tax cost of new debt of 9%, tax rate of 37.5%, target debt-to-equity ratio of 0.76, current stock price of $74, estimated dividend growth rate of 7% and will pay a dividend of $3.2 next year. What is the company’s WACC A. 8 percent. B. 9 percent. C. 10 percent. D. 11 percent.arrow_forwardA3) see picturearrow_forwardThe FI’s initial balance sheet is assumed to be: "Picture 1" Duration of assets is 5 years and duration of liabilities is 3 years. If the manager learns from an economic forecasting unit that rates are expected to rise from 10 to 11% in the immediate future, what is the potential loss or gain to equity holders’ net worth?arrow_forward

- The investment banking firm of Stan Inc. will use a dividend valuation model to appraise the shares of the DB Corporation. Dividends (D) at the end of the current year will be P1.20. The growth rate (g) is 9% and the discount rate (K) is 13%?arrow_forwardThe investment banking firm of Einstein & Co. will use a dividend valuation model to appraise the shares of the Modern Physics Corporation. Dividends (D1) at the end of the current year will be $1.64. The growth rate (g) is 8 percent and the discount rate (Ke) is 13 percent. What should be the price of the stock to the public? If there is a 7 percent total underwriting spread on the stock, how much will the issuing corporation receive? If the issuing corporation requires a net price of $31.30 (proceeds to the corporation) and there is a 7 percent underwriting spread, what should be the price of the stock to the public? (Round to two places to the right of the decimal point.)arrow_forwardYou have the following initial information on Financeur Co. on which to base your calculationsand discussion for questions 1) and 2): (Answers in Excel if possible) • Current long-term and target debt-equity ratio (D:E) = 1:3• Corporate tax rate (TC) = 30%• Expected Inflation = 1.55%• Equity beta (E) = 1.6345• Debt beta (D) = 0.15• Expected market premium (rM – rF) = 6.00%• Risk-free rate (rF) =2%1) The CEO of Financeur Co., for which you are CFO, has requested that you evaluate apotential investment in a new project. The proposed project requires an initial outlay of$7.26 billion. Once completed (1 year from initial outlay) it will provide a real net cashflow of $555 million in perpetuity following its completion. It has the same business riskas Financeur Co.’s existing activities and will be funded using the firm’s current target D:Eratio.a) What is the nominal weighted-average cost of capital (WACC) for this project?b) As CFO, do you recommend investment in this project? Justify…arrow_forward

- I need help with these questions please. Thank you!arrow_forwardThis is a more difficult but informative problem. James Brodrick & Sons, Incorporated, is growing rapidly and, if at all possible, would like to finance its growth without selling new equity. Selected information from the company's five-year financial forecast follows. Year Earnings after tax ($ millions) Capital investment ($ millions) Target book value debt-to-equity ratio (%) Dividend payout ratio (%) Marketable securities ($ millions) (Year O marketable securities = $230 million) 1 100 180 120 ? 230 2 112 300 120 ? 230 3 152 300 120 ? 230 4 203 354 120 ? 230 5 300 460 120 ? 230 a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while maintaining a balance of $230 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times.) Note: Round dividends to the nearest million dollars and the payout ratio % to the nearest ones place.arrow_forwardThe stock of Alpha Tool sells for $70.20 per share. Its current dividend rate, D0, is $2 per share. Analysts and investors expect Alpha to increase its dividends at a 30 percent rate for each of the next 2 years. This annual dividend growth rate is expected to decline to 26 percent for years 3 and 4 and then to settle down to 24 percent per year forever. Calculate the cost of internal equity for Alpha Tool. Use Table II for your calculations. Round your answer to the nearest whole number. %arrow_forward

- Please show work in Excel.arrow_forwardAt this point, you may be confused why calling part of your in- vestment debt or equity makes a difference. Let’s walk through an example and compute your post-tax returns. Suppose $2 million of your investment is structured as debt and the remaining $8 million is equity. What happens each year after the company is set up? Well, using the $4 million EBIT, the company will first pay $2 million 50% = $1 million interest to you (as a debt investor). Then, on the remaining $4 $1 = $3 million of EBIT, the company pays corporate taxes of $3 20% = $0.6 million and is left with $2.4 million, which will be paid out to you (the equity holder) as dividend. Income Statement EBIT 4 -Interest expense 1 -Corporate taxes .6 = Net income of 2.4 million Therefore, the total returns to you (as an investor) is $1 million in interest and $2.4 million in dividends, which is a total of $3.4 million.4 Uncle Sam collected $0.6 million. The company will go bankrupt if its EBIT is strictly less than interest…arrow_forwardWhat is the Minimum return in pesosarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education