Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

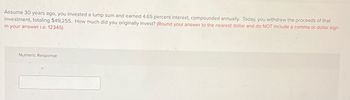

Transcribed Image Text:Assume 30 years ago, you invested a lump sum and earned 4.65 percent interest, compounded annually. Today, you withdrew the proceeds of that

investment, totaling $49,255. How much did you originally invest? (Round your answer to the nearest dollar and do NOT include a comma or dollar sign

in your answer i.e. 12345)

Numeric Response

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mark Harris borrowed some money from his friend and promised to repay him $1,250, $1,340, $1,490, $1,560, and $1,560 over the next five years. If the friend normally discounts investment cash flows at 8.0 percent annually, how much did Mark borrow? (Round answer to 2 decimal places)arrow_forward100. Subject :- Financearrow_forwardIf Mike deposited and withdrew as shown below, how much can he withdraw at the end of 5th year? Assume i=4%. If it is a deposit, then enter the value as a negative number and if it is a withdrawal, then enter the value as a positive number. n 0 1 2 3 4 5 CF 0 -500 -400 500 -500 -500 If the answer is a dollar value then enter the number without any comma, without $sign, without any gap, and with 2 decimal digits, for example, -5896547.12 4 If the answer is a % then enter the number with 3 decimal digits followed by a % sign without any gap, for example 3.123% or 4.210%arrow_forward

- Subject : Accounting Thirteen years ago, Mr. Lawton rolled a $18,000 retiring allowance into an RRSP that subsequently earned 10.1% compounded semiannually. Four years ago he transferred the funds to an RRIF. Since then, he has been withdrawing $1100 at the end of each quarter. If the RRIF earns 8.1% compounded quarterly, how much longer can the withdrawals continue? (Do not round intermediate calculations and round up the number of payments, n, to the next whole number.)arrow_forwardOn 2003-06-17 Keiko invests $2,800.00 in an account paying i(¹) = 10.000%. The account uses the compound interest method for computing interest for partial periods. How much money does she receive when she withdraws it on 2008-10-03? a. $2,912.21 b. $2,909.63 c. $4,638.41 d. $2,916.08 e. $2,939.30arrow_forwardPlease do not answer this question in excel thank you in advance. Find the future value of a single deposit of $54,000 earning 1.60% interest compounded quarterly after 60 years.arrow_forward

- Determine what the interest rate would have been if a financial asset valued at $156,500 amounted to a total value of $199,800 after 2 years.arrow_forwardH3. Hannah invested $2,000 at the beginning of every 6 months in an RRSP for 11 years. For the first 5 years it earned interest at a rate of 4.70% compounded semi-annually and for the next 6 years it earned interest at a rate of 5.50% compounded semi-annually. Que 1. Calculate the accumulated value of his investment at the end of the first 5 years. Que 2. Calculate the accumulated value of her investment at the end of 11 years. Que 3. Calculate the amount of interest earned from the investment. Show proper step by step calculationarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education