FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:SMART Prepaid

32% D 1:36

"Batang Pasaway

Assignment Details

GSRADFISMAN Course

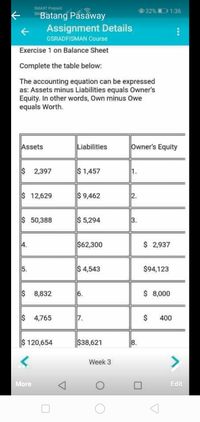

Exercise 1 on Balance Sheet

Complete the table below:

The accounting equation can be expressed

as: Assets minus Liabilities equals Owner's

Equity. In other words, Own minus Owe

equals Worth.

Assets

Liabilities

Owner's Equity

$ 2,397

$ 1,457

1.

$ 12,629

$ 9,462

2.

$ 50,388

$ 5,294

3.

$62,300

$ 2,937

5.

$ 4,543

$94,123

$ 8,832

6.

$ 8,000

$ 4,765

$

400

$ 120,654

$38,621

Week 3

More

Edit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A9 please help.....arrow_forwardGiven the following financial statement information: $ in millions Income Statement Net Income: $578 Depreciation Expense: $50 Balance Sheet Accounts Receivable Total Inventory Dec. 31, 2022 $38 $112 Accounts Payable $85 Calculate the cash from operating activities. Dec. 31, 2023 $63 $157 $108arrow_forwardCash $38,100; Short-term investments $4,100; Accounts receivable $48,500; Supplies $6,100; Long-term notes receivable $2,100; Equipment $96,500; Factory Building $181,000; Intangible assets $6,100; Accounts payable $29,900; Accrued liabilities payable $3,950; Short-term notes payable $14,200; Long-term notes payable $92,500; Common stock $181,000; Retained earnings $60,950. Prepare Total Assets Sectionarrow_forward

- Probability of financial Value of debt distress $0 0% $2,500,000 1% $5,000,000 2% $7,500,000 4% $10,000,000 8% $12,500,000 16% $15,000,000 32% $20,000,000 64%arrow_forwardBalance Sheet as of December 31, 2021 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2021 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends 552 Addition to retained earnings 2$ 828arrow_forwardGenatron Manufacturing Corporatio Balancs Sh出出t 2017 216 ASSETS Cach $41,752 $51,878 Accts. recelvable 260, 499 200,543 Inventory 450,460 Total current assets B02, 735 702,181 Fixed asset, nct 300, 100 $1,202, 735 $1,002, 381 LIABILITIES AND EQUITY Accts. paysble $172,648 $131,068 Bank loan 91,013 91,013 Accrusis 70,000 50, 000 Total current Isbllties 333,661 272.081 Long-term deot, 12% 398,220 290,301 Common stock, $10 par 300,000 Capital surplus 44,555 44,555 Retained crninga 126,299 95,444 Total liabiliiti &oulty 51.202,735 51,002,381 2017 2016 Net sales Cost of peocS So0 388,411 Gross profit E72.274 Experses: General ancasm nistrative 50.000 Market ng cod ost rer cs 44.5E5 Ceprec at cn v (a) Calculate Genatron's dollar amount of net working capital in each year. Interest E5.024 Earnings tetsre taxes 267.055 227.266 2017 2016 Incometaxes 75 145 Net working capital et ncome %24arrow_forward

- Assets Cash $ 15,050 Marketable securities Accounts receivable Inventory Property and equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Current notes payable Mortgage payable Bonds payable 8,260 13,400 11,100 165,500 (12,000) $201,310 $ 8,180 3,880 4,350 Common stock Retained earnings 21,480 113,900 49,520 $ 201,310 Total liabilities and stockholders' equity The average number of common stock shares outstanding during Year 3 was 880 shares. Net income for the year was $14,400. Required Compute each of the following: Note: Round your answer to 2 decimal places. For percentages, 0.2345 should be entered as 23.45. a. Current ratio per share b. Earnings per share c. Quick (acid-test) ratio d. Return on investment + % % e. Return on equity f. Debt to equity ratioarrow_forwardAssets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forward6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education