FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

infoPractice Pack

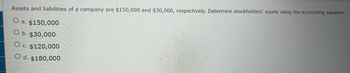

Transcribed Image Text:Assets and liabilities of a company are $150,000 and $30,000, respectively. Determine stockholders' equity using the accounting equation.

O

a. $150,000

O b. $30,000

O c. $120,000

O d. $180,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Subject :- Accountingarrow_forwardEarnings per Share and Price-Earnings Ratio A company reports the following: Net income $1,340,000 Preferred dividends $76,000 Shares of common stock outstanding 80,000 Market price per share of common stock $132.72 a. Determine the company's earnings per share on common stock. Round your answer to the nearest cent. Use the rounded answer of requirement a for subsequent requirement, if required.$fill in the blank 1 b. Determine the company's price-earnings ratio. Round to one decimal place.fill in the blank 2arrow_forwardWhat is the total stockholders' equity based on the following data? Common Stock $900,000 Excess of Issue Price Over Par—Common Stock 375,000 Retained Earnings (deficit) (50,000) a.$900,000 b.$1,225,000 c.$1,275,000 d.$1,325,000arrow_forward

- What is the total stockholders' equity based on the following account balances? Common Stock $450,000 Paid-in Capital in Excess of Par $90,000 Retained Earnings Treasury Stock a. $740,000 b. $730,000 c. $720,000 d. $640,000 $190,000 $10,000arrow_forwardCash Accounts Receivable, Net Inventory Property, Plant and Equipment, net Total Assets Accounts Payable Mortgage Payable Common Stock, par $5 Retained Earnings Total Liabilities and Owners' Equity Sales for the year Cost of Goods Sold Net Income for the year 2021 25 65 50 140 280 50 100 90 40 280 4. Calculate the earnings per share. Show work. A. $3.00 B. $4.00 $100 C. $2.00 D. $2.50 50 36 2. Using horizontal analysis, what is the change in inventory? A. 35% increase B. 35% decrease C. 25% increase D. 25% decrease Using the information above, answer the following questions. 1. Using vertical analysis, what percentage is Mortgage Payable for year 2021? Show work. A. 34.23% B. 35.71% C. 40% D. 36.71% 3. Calculate the Accounts Receivable Turnover. Show work A. 1.6 times B. 1.6% C. 1.8 times D. 1.8% 2020 30 60 40 155 285 60 110 90 25 285arrow_forwardA company reports the following: Net income $133,720 Preferred dividends 12,060 Average stockholders' equity 1,064,390 Average common stockholders' equity 887,500 Round percentages to one decimal place. a. Determine the return on stockholders' equity.fill in the blank 1% b. Determine the return on common stockholders' equity.fill in the blank 2%arrow_forward

- A firm has common stock of $100, paid-in surplus of $300, total liabilities of $500, current assets of $400, and net fixed assets of $600. What is the amount of the shareholders’ equityarrow_forwardneed helparrow_forwardEarnings per share and price-earnings ratio A company reports the following: Line Item Description Amount Net income $650,000 Preferred dividends $45,000 Shares of common stock outstanding 110,000 Market price per share of common stock $44 a. Determine the company's earnings per share on common stock. Round your answer to two decimal places.fill in the blank 1 of 2$ b. Determine the company's price-earnings ratio.arrow_forward

- Mcq helparrow_forwardEarnings per Share and Price-Earnings Ratio A company reports the following: Net income $1,340,000 Preferred dividends $76,000 Shares of common stock outstanding 80,000 Market price per share of common stock $132.72 a. Determine the company's earnings per share on common stock. Round your answer to the nearest cent. Use the rounded answer of requirement a for subsequent requirement, if required.$fill in the blank 1 b. Determine the company's price-earnings ratio. Round to one decimal place.fill in the blank 2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education