FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please i Want Answer of this Account Question

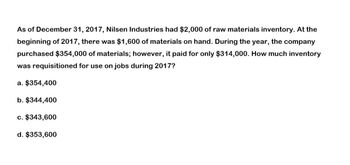

Transcribed Image Text:As of December 31, 2017, Nilsen Industries had $2,000 of raw materials inventory. At the

beginning of 2017, there was $1,600 of materials on hand. During the year, the company

purchased $354,000 of materials; however, it paid for only $314,000. How much inventory

was requisitioned for use on jobs during 2017?

a. $354,400

b. $344,400

c. $343,600

d. $353,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Benson Inc.'s accounting records reflect the following inventories: Dec. 31, 2016 $ 80,000 Dec. 31, 2017 $ 64,000 Raw materials inventory Work in process 104,000 116,000 inventory Finished goods inventory 100,000 92,000 During 2017, Benson purchased $1,450,000 of raw materials, incurred direct labor costs of $250,000, and incurred manufacturing overhead totaling $160,000. Assume Benson's cost of goods manufactured for 2017 amounted to $1,660,000. How much would it report as cost of goods sold for the year? O a) $1,760,000 b) $1,668,000 c) $1,568,000 d) $1,652,000arrow_forwardBenson Inc.'s accounting records reflect the following inventories: Dec. 31, 2016 Dec. 31, 2017 Raw materials inventory $ 80,000 $ 64,000 Work in process inventory 104,000 116,000 Finished goods inventory 100,000 92,000 During 2017, Benson purchased $1,450,000 of raw materials, incurred direct labor costs of $250,000, and incurred manufacturing overhead totaling $160,000.How much raw materials were transferred to production during 2017 for Benson? Select one: A. $1,386,000 B. $1,450,000 C. $1,466,000 D. $1,434,000arrow_forwardAs of December 31, 2022, Concord Industries had $1,010 of raw materials inventory. At the beginning of 2022, there was $750 of materials on hand. During the year, the company purchased $121,800 of materials, however paid for only $117,600. How much inventory was requisitioned for use on jobs during 2022?arrow_forward

- . Pan Company's accounting records reflect the following inventories: Dec. 31, 2016 $260,000 160,000 150,000 Raw materials inventory Work in process inventory Finished goods inventory Dec. 31, 2017 $310,000 300,000 190,000 During 2017, $800,000 of raw materials were purchased, direct labor costs amounted to $670,000, and manufacturing overhead incurred was $640,000. The total raw materials available for use during 2017 for Pan Company isarrow_forwardOgleby Inc's accounting records reflect the following inventories: Dec. 31. 2016 T Dec 31, 2017 Raw materials inventory $120,000 $96.000 Work in process inventory 156,000 174,000 Finished goods inventory 138.000 150,000 During 2017, Ogleby purchased $890,000 of raw materials, incurred direct labor costs of $175,000, and incurred manufacturing overhead totaling $224,000. How much is total manufacturing costs incurred during 2017 for Ogleby? $1,403,000 $1,313,000 $1,385,000 $1,379,000arrow_forwardAs of December 31, 2020, Dayton Industries had $2,000 of raw materials inventory. At the beginning of 2020, there was $1,600 of materials on hand. During the year, the company purchased $354,000 of materials; however it paid for only $314,000. How much inventory was requisitioned for use on jobs during 2020? 01) $354,400 02) $343,600 03) $353,600 04) $344,400 CLOSEarrow_forward

- What was the cost of goods sold for the year?arrow_forwardAt the beginning of 2012, Conway Manufacturing Company had the following account balances: WIP Inventory - DR 2,000 FG Inventory - DR 8,000 ( All T accounts) During the year the following transactions took place: Direct materials placed in production $80,000Direct labor incurred $190,00Manufacturing OH incurred $300,000Manufacturing OH allocated to production $295,000Costs of jobs completed $500,000Selling price of jobs sold $750,000Cost of jobs sold $440,000 After recording all these transaction the adjusted cost of goods sold account is: A) Debit of $445,000B) Debit of $440,000C) Credit of $445,000D) Debit of $435,000arrow_forwardThe accounting records for 2017 of DB Co. Showed the following: Decrease in raw materials inventory 45,000 Decrease in finished goods inventory 150,000 Raw materials purhased 1,290,000 Direct labor payroll 600,000 Factory overhead 900,000 Freight-out 135,000 The cost of raw materials used for the period amounted to:arrow_forward

- As of December 31, 2022, Bonita Industries had $3000 of raw materials inventory. At the beginning of 2022, there was $1700 of materials on hand. During the year, the company purchased $365000 of materials; however, it paid for only $313000. How much inventory was requisitioned for use on jobs during 2022? O $355900 O $363700 O $366300 O $353300arrow_forwardCandid, Inc. is a manufacturer of digital cameras. It has two departments: assembly and testing. In January 2017, the company incurred $800,000 on direct materials and $805,000 on conversion costs, for a total manufacturing cost of $1,605,000. Q. Assume there was no beginning inventory of any kind on January 1, 2017. During January, 5,000 cameras were placed into production and all 5,000 were fully completed at the end of the month. What is the unit cost of an assembled camera in January?arrow_forwardSnapshot, Inc. is a manufacturer of digital cameras. It has two departments: assembly and testing. In January 2017, the company incurred $800,000 on direct materials and $800,000 on conversion costs, for a total manufacturing cost of $1,600,000. Read the requirements1. Requirement 1. Assume there was no beginning inventory of any kind on January 1, 2017. During January, 20,000 cameras were placed into production and all 20,000 were fully completed at the end of the month. What is the unit cost of an assembled camera in January? (Round your answers to the nearest cent.) Direct materials cost per unit Conversion cost per unit Assembly department cost per unit Requirement 2. Assume that during February 20,000 cameras are placed into production. Further assume the same total assembly costs for January are also incurred in February, but only 19,000 cameras are fully completed at the end of the month. All direct materials have been…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education