ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

The answer is not Development 4 and Support 1 either.

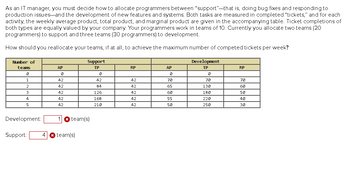

Transcribed Image Text:As an IT manager, you must decide how to allocate programmers between "support"-that is, doing bug fixes and responding to

production issues and the development of new features and systems. Both tasks are measured in completed "tickets," and for each

activity, the weekly average product, total product, and marginal product are given in the accompanying table. Ticket completions of

both types are equally valued by your company. Your programmers work in teams of 10. Currently you allocate two teams (20

programmers) to support and three teams (30 programmers) to development.

How should you reallocate your teams, if at all, to achieve the maximum number of competed tickets per week?

Number of

teams

0

1

2

3

4

5

Development:

Support:

AP

Ø

42

42

42

42

42

Support

TP

✪ team(s)

4 * team(s)

Ø

42

84

126

168

210

MP

42

42

42

42

42

AP

Ø

70

65

60

55

50

Development

TP

70

130

180

220

250

MP

70

60

50

40

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If LRTC is 100q-10(q)(q) +(q)(q)(q) then the LRAC is ......... , the LRMC=..............and the MC cuts the LRAC at q=............... and LRAC of ...........arrow_forwardFind the lower bound of the confidence interval, rounding the result to four decimal places. Р(1 — р) p - E = P – Z«j2\ %3D 0.57(1 – 0.57) = 0.57 1.960 1,007 Find the upper bound of the confidence interval, rounding the result to four decimal places. P(1 — р) p + E : p + z 0.57(1 – 0.57) = 0.57 + 1.960 1,007 Therefore, a 95% confidence interval for the population proportion of adults who lack confidence they will be able to afford health insurance in the future is from a lower bound of X to an upper bound ofarrow_forwardFethe's Funny Hats is considering selling trademarked, orange-haired curly wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows will be $27,000 per year for 2 years. If demand is bad (60% probability), then the net cash flows will be $9,000 per year for 2 years. Fethe's cost of capital is 14%. A. What is the expected NPV of the project? B. Use decision-tree analysis to calculate the expected NPV of this project, including the option to continue for an additional 2 years. B. Use decision-tree analysis to calculate the expected NPV of this project, including the option to continue for an additional 2 years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education