Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

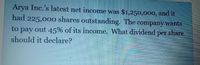

Transcribed Image Text:Arya Inc.'s latest net income was $1,250,000, and it

had 225,00o shares outstanding. The company wants

to pay out 45% of its income, What dividend per share

should it declare?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Helmuth Inc's latest net income was $1,210,000, and it had 225,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare?arrow_forwardCompany X's latest net income was $1,500,000, and it had 250,000 shares outstanding. The company wants to pay out 45.0% of its net income as dividends. What dividend per share should it declare? Do not round your intermediate calculations. 2.30 3.30 2.03 2.70 0.08arrow_forwardChikage Inc's latest net income was $1,400,000, and it had 210,000 shares outstanding. The company wants to pay out 40.0% of its net income as dividends. What dividend per share should it declare? Do not round your intermediate calculations.arrow_forward

- Helmuth Inc's latest net income was $1,500,000, and it had 225,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? Do not round your intermediate calculations. O a. $2.31 O b. $3.24 O c. $3.00 O d. $2.28 Oe. $3.21arrow_forwardHelmuth Inc's latest net income was $1,415,000, and it had 250,000 shares outstanding. The company wants to pay out 45% of its income. What dividend per share should it declare? Do not round your intermediate calculations. a. $3.11 Ob. $1.91 c. $5.66 Od. $8.21 O e. $2.55arrow_forwardIn December 2022, Samar Co. had a share price of AED 50. They had 12 million shares outstanding, a market-to-book ratio of 3. In addition, Samar had AED 200 million debt, AED 40 million in net income and AED 850 million in sales. Calculate P/E ratio and ROE according to Du Pont system.arrow_forward

- At year end, Sampson Company's balance sheet showed total assets of $80 million, total liabilities of $50 million, and 1,000,000 shares of common stock outstanding. Next year, Malta is projecting that it will have net income of $2.9 million. If the average P/E multiple in Malta's industry is 16, (and this is an average stock) what should be the price of Sampson's stock? O $50.43 O $46.40 O $44.57 O $41.60arrow_forwardAngel Company would like to undertake a policy of paying out 45% of its income. Its latest net income was P1,250,000, and it had 225,000 shares outstanding. What dividend per share should Angel declare? * P2.50 P2.14 P2.38 O P2.26 O P2.63arrow_forwardZero Corp's total common equity at the end of last year was $350,000 and its net income was $70,000. What was its ROE? a. 19.40% b.24.20% O c. 17.00% d. 17.40% e. 20.00%arrow_forward

- Zero Corp's total common equity at the end of last year was $430,000 and its net income was $70,000. What was its ROE?arrow_forwardBenkart Corporation has sales of \$5,000,000 , net Income of 800,000, total assets of \$2,000,000 , and 100, 000 shares of common stock Outstanding. If Benkart's stock price $96 per share, what is the company's P/E ratio?arrow_forwardA company has net income of $950,000; its weighted-average common shares outstanding are 190,000. Its dividend per share is $0.95, its market price per share is $98, and its book value per share is $91.00. Its price-earnings ratio equals: Multiple Choice 19.60. 7.00. 18.20. Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education