FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

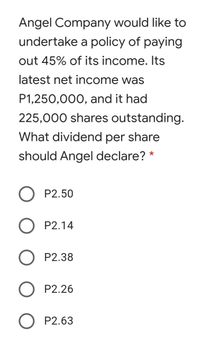

Transcribed Image Text:Angel Company would like to

undertake a policy of paying

out 45% of its income. Its

latest net income was

P1,250,000, and it had

225,000 shares outstanding.

What dividend per share

should Angel declare? *

P2.50

P2.14

P2.38

O P2.26

O P2.63

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- q6- You are using Bloomberg to look up financial information for Delta Ltd. You determine that the share price is currently $13.80 and that the value of dividends paid over the past year was $1.41. You paid $8.47 for the share exactly one year ago. What would you expect the dividend yield to be according to Bloomberg? a. 62.93% b. 10.22% c. 79.57% d. 16.65%arrow_forwardNeed answer the questionarrow_forwardIn a recent IPO, a social network company issued 4,000,000 new shares. The initial price to the public was £22.00 per share. The final first-day closing price was £52.37. If the investment bankers retained £1.45 per share as fees, what was the net proceeds to the social network firm and its market capitalisation? Select one: O a. Net proceeds: £93,800,000; Market capitalisation: £203,680,000 O b. Net proceeds: £88,000,000; Market capitalisation: £88,000,000 O c. Net proceeds: £82,200,000; Market capitalisation: £209,480,000 Od. Net proceeds: £83,200,000; Market capitalisation: £219,480,000arrow_forward

- Gnomes R Us just paid a dividend of $1.89 per share. The company has a dividend payout ratio of 65 percent. If the PE ratio is 16.8 times, what is the stock price? Multiple Choice $20.64 $31.75 $48.85 $90.72 $69.78arrow_forwardNeed help with this questionarrow_forward6. Matilda Industries pays a dividend of £2.10 per share and is expected to pay this amount indefinitely. If Matilda's cost of equity capital is 9%, which of the following would be closest to Matilda's share price? A. £14.00 B. £18.66 C. £23.33 D. £29.16arrow_forward

- Gamma Corporation just paid a dividend of $3.00 per share on its common stock. Dividends are expected to grow at an annual rate of 8% for next two years and then at 3% thereafter. If you want minimum return of 10%, what is the most that you would be willing to pay for a share of Gamma Corporation today? o earn a O A. $51.29 O B. $49.99 O C. $48.39 O D. $53.24arrow_forward10. Consider the following price and dividend data for Quicksilver Inc.: Year Price (£) Dividend (£) 0 10 1 0.14 2 0.14 3 14 0.14 Assume that you purchased Quicksilver's share in year 0 and sold it at the end of year 3. Your annual rate of return for holding this share is closest to ________. A. 8% B. 14% C. 20% D. 19%arrow_forwardPlease helparrow_forward

- A firm has 7,000 outstanding shares with current value of 10£ per share. Planned dividend is £5 per share. What is the ex-dividend share price? How much is the share price if the company decides to use the cash it had originally earmarked for dividend for a share repurchase instead? A. £5, £10 B. £10, £5 C. £8, £10 D. £2, £12 ( explain well with step by step answer ).arrow_forwardI want to answer this questionarrow_forward7. Determine the P/E ratio of the company ZYX if you know that the number of company's outstanding shares is 18,000,000. The current market price of the company corresponds to 588.5 per share. The company's intrinsic value is 654 per share. The expected return for investors is 8.7 %. The dividend amounts to 62.4. The EBIT in the given year corresponded to the amount of 481,530,000. a. 24.4 b. 26.6 c. 22 d. 19.7 e. 25 8. Consider the spot rate of 24.36 CZC/EUR. If we assume a payment for goods of 5.000 EUR in two months and the spot rate at that time will be 24.95 CZC/EUR. For hedging purposes, it is possible to arrange a forward on the exchange rate with a fixation of 24.7 CZC/EUR. If the company were to import goods. closing a forward would mean a profit/loss in the amount of: a. 1.250 EUR gain b. 1,700 CZC loss c. 2,950 EUR gain d. 1,250 CZC gain e. 1,250 CZC lossarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education