Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

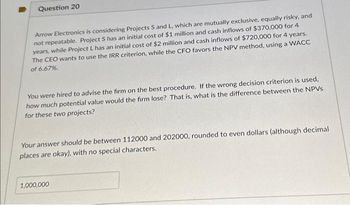

Transcribed Image Text:Question 20

Arrow Electronics is considering Projects S and L, which are mutually exclusive, equally risky, and

not repeatable. Project S has an initial cost of $1 million and cash inflows of $370,000 for 4

years, while Project L has an initial cost of $2 million and cash inflows of $720,000 for 4 years.

The CEO wants to use the IRR criterion, while the CFO favors the NPV method, using a WACC

of 6.67%.

You were hired to advise the firm on the best procedure. If the wrong decision criterion is used,

how much potential value would the firm lose? That is, what is the difference between the NPVs

for these two projects?

Your answer should be between 112000 and 202000, rounded to even dollars (although decimal

places are okay), with no special characters.

1,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- During the last few years, Harry Davis Industries has been too constrained by the high cost of capital to make many capital investments. Recently, though, capital costs have been declining, and the company has decided to look seriously at a major expansion program proposed by the marketing department. Assume that you are an assistant to Leigh Jones, the financial vice president. Your first task is to estimate Harry Davis’ cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task: •The firm’s tax rate is 35%. •The current price of Harry Davis’ 12.5% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1105.67. Harry Davis does not use short-term interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. •The current price of the firm’s 10%, $100 par value, quarterly dividend, perpetual preferred stock is $114.27. Harry Davis would incur flotation costs…arrow_forwardAn officer for a large construction company is feeling nervous. The anxiety is caused by a new excavator just released onto the market. The new excavator makes the one purchased by the company a year ago obsolete. As a result, the market value for the company’s excavator has dropped significantly, from $600,000 a year ago to $50,000 now. In ten years, it would be worth only $3,000. The new excavator costs only $950,000 and would increase operating revenues by $90,000 annually. The new equipment has a ten-year life and expected salvage value of $175,000. The tax rate is 35%, the CCA rate, 25% for both excavators, and the required rate of return for the company is 14%. What is the NPV of the new excavator?arrow_forwardChaquille's K-House, Inc. made an investment in a project with an initial cost of $11,064,450. This investment was for 8 years and had no residual value. The company expects to receive yearly net cash inflows of $2,603,400. Management is requiring a return of 12% on the investment. (Round your answers to two decimal places when needed and use rounded answers for all future calculations).arrow_forward

- In this assignment, you have been brought in to assess whether Nucor should be the first adopter of a new technology. This requires a $340 million investment in a commercially unproven technology. If successful, Nucor can expand into the flat sheet segment that was previously a segment where only the large integrated steelmakers competed. This assignment requires that you combine qualitative information (e.g., industry and firm insights) with quantitative analysis in Excel (discounted cash flow analysis). After you read the case, answer both questions: background analysis and cash flow analysis. For cash flow analysis, you need to do calculations using Excel file attached in the assignment on Blackboard. Once you finished your calculations using Excel file, you can answer your second part of the assignment. Background Analysis (20 points) Industry: Of the three groups of steelmakers, what are some of the differences between integrated steelmakers and minimill steelmakers? Nucor: What…arrow_forwardMiles Ltd., a manufacturer of various car products wants to estimate its funding requirements for the coming financial year. In the recent past, the company had spare production capacity, but increased sales has raised suspicions amongst management that investment in new capacity may be required soon. In the current financial year the company achieved sales of R200 million on assets worth R2000 million and liabilities of R500 m. It's resulting net profit margin was 10% with no dividend being paid I as the company ts in a high growth phase. All assets and liabilities are considered spontaneous and increase in line with sales. It is expected tha sales will grow by 20% in the coming year. Assets are however only utilized up to 90% of total capacity and the spare capacity can be used first before new capacity is installed. a. R36 million b. R76 million C. R120 million d. R240 million Iarrow_forwardBrandt Enterprises is considering a new project that has a cost of $1,000,000, and the CFO set up the following simple decision tree to show its three most likely scenarios. The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so, but to obtain this abandonment option, it would have to make a payment to those parties. How much is the option to abandon worth to the firm? WACC-11.5% Prob. -20% Prob. -60% Prob. -20% 1-0 -$1,000 A $55.08 B) $57.98 C) $61.03 D) $64.08 E $67.29 Dollars in Thousands 1-2 $800.0 $800.0 $520.0 $520.0 -$200.0 -$200.0 -$200,0 $800.0 $520.0 NPV This State $938.10 $259.76 -$1,484.52 Prob. x NPV $187.62 $155.86 -$296.90 Exp. NPV-$46.57arrow_forward

- J&R Construction Company is an international conglomerate with a real estate division that owns the right to erect an office building on a parcel of land in downtown Sacramento over the next year. This building would cost $40 million to construct. Due to low demand for office space in the downtown area, such a building is worth approximately $38 million today. If demand increases, the building would be worth $42.3 million a year from today. If demand decreases, the same office building would be worth only $35 million in a year. The company can borrow and lend at the risk-free annual effective rate of 5.5 percent. A local competitor in the real estate business has recently offered $821,000 for the right to build an office building on the land. What is the value of the office building today? Use the two-state model to value the real option. (Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.)…arrow_forwardAn officer for a large construction company is feeling nervous. The anxietyis caused by a new excavator just released onto the market. The newexcavator makes the one purchased by the company a year ago obsolete.As a result, the market value for the company’s excavator has droppedsignificantly, from $600,000 a year ago to $50,000 now. In ten years, itwould be worth only $3,000. The new excavator costs only $950,000 andwould increase operating revenues by $90,000 annually. The newequipment has a ten-year life and expected salvage value of $175,000. Thetax rate is 35%, the CCA rate, 25% for both excavators, and the requiredrate of return for the company is 14%. What is the NPV of the newexcavator? (Negative answer should be indicated by a minus sign. Do notround your intermediate calculations. Round the final answer to 2decimal places. Omit $ sign in your response.)NPV $arrow_forwardReq C was not answered.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education