FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

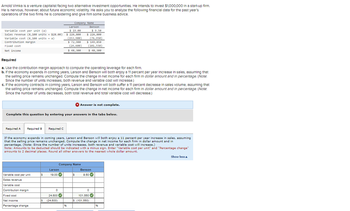

Transcribed Image Text:Arnold Vimka is a venture capitalist facing two alternative Investment opportunities. He intends to invest $1,000,000 in a start-up firm.

He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year's

operations of the two firms he is considering and give him some business advice.

Variable cost per unit (a)

Sales revenue (8,100 units × $28.00)

Variable cost (8,100 units x a)

Contribution margin.

Fixed cost

Net income

Required A

Variable cost per unit

Sales revenue

Variable cost

Contribution margin

Required

a. Use the contribution margin approach to compute the operating leverage for each firm.

b. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year Increase in sales, assuming that

the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in percentage. (Note:

Since the number of units Increases, both revenue and variable cost will increase.)

Fixed cost

Net income

Percentage change

Company Name

c. If the economy contracts in coming years, Larson and Benson will both suffer a 11 percent decrease in sales volume, assuming that

the selling price remains unchanged. Compute the change in net Income for each firm in dollar amount and in percentage. (Note:

Since the number of units decreases, both total revenue and total variable cost will decrease.)

$

Larson

$ 19.00

$ 226,800

(153,900)

$ 72,900

(24,600)

$ 48,300

Complete this question by entering your answers in the tabs below.

Larson

19.00✔

0

24,600

S (24,600)

Required B Required C

If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming

that the selling price remains unchanged. Compute the change in net income for each firm in dollar amount and in

percentage. (Note: Since the number of units increases, both revenue and variable cost will increase.)

Note: Amounts to be deducted should be indicated with a minus sign. Enter "Variable cost per unit" and "Percentage change"

amounts to 2 decimal places. Round all other answers to the nearest whole dollar amount.

96

Company Name

Benson

$ 226,800

(76,950)

$ 149,850

(101,550)

$48,300

$

$ 9.50

X Answer is not complete.

Benson

0

9.50✔

101,550

$ (101,550)

96

Show less

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: what is operating leverage

VIEW Step 2: calculating Operating Leverage of Companies

VIEW Step 3: Change in net income for each firm in dollar amount and in percentage if sales are increased by 11%

VIEW Step 4: Change in net income for each firm in dollar amount and in percentage if sales are decreased by 11%.

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Similar questions

- Halfdome is considering a major expansion program that has been proposed by the company’s information technology group. Before proceeding with the expansion, the company must estimate its cost of capital. Suppose you are an assistant to Jerry Lehman, the financial vice president. Your first task is to estimate Halfdome’s cost of capital. Lehman has provided you with the following data, which he believes may be relevant to your task. *The firm’s tax rate is 25%. *The current price of Coleman’s 12% coupon, semiannual payment, noncallable bonds with 15 years remaining to maturity is $1,153.72. Coleman does not use short-term, interest-bearing debt on a permanent basis. New bonds would be privately placed with no flotation cost. *The current price of the firm’s 10%, $100.00 par value, quarterly dividend, perpetual preferred stock is $111.10. *Halfdome’s common stock is currently selling for $50.00 per share. Its last dividend (D0) was…arrow_forwardSuppose that you have been given a summer job as an intern at Issac Aircams, a company that manufactures sophisticated spy cameras for remote-controlled military reconnaissance aircraft. The company, which is privately owned, has approached a bank for a loan to help finance its growth. The bank requires financial statements before approving the loan. Required: Classify each cost listed below as either a product cost or a period cost for the purpose of preparing financial statements for the bank. × Answer is complete but not entirely correct. Costs Product Cost / Period Cost Period Cost Product Cost 1. Depreciation on salespersons' cars. 2. Rent on equipment used in the factory. 3. Lubricants used for machine maintenance. 4. Salaries of personnel who work in the finished goods warehouse. 5. Soap and paper towels used by factory workers at the end of a shift. 6. Factory supervisors' salaries. 7. Heat, water, and power consumed in the factory. 8. Materials used for boxing products for…arrow_forwardMr. Martínez is the owner of a company dedicated to the production of renewable energy. Nowadays, his business has good cash flows due to the increase in demand in this area. However, to be more competitive he needs cost efficiency with his suppliers. The average financing need ranges between $600,000 and $1,200,000 pesos per year. The following is requested: 1. Introduction, that is, what is expected with the resolution of this exercise. 2. Define first what is the need to solve. 3. Investigate the options offered by financial institutions.arrow_forward

- Sally is thinking about starting a new business. The company would require $700,000 of assets, financed with 40% debt and 60% equity. She will go forward only if she thinks the firm can provide an ROE of at least 15.9%. Operating at a profit margin of 12%, what is the minimum amount of sales that must be expected to support starting the business? Your answer should be between 472000 and 595000, rounded to even dollars (although decimal) places are okay), with no special characters.arrow_forwardThis is an individual assignment. Everyone needs to work on the firm that your team chooses [prefer simple business] for your industry analysis. Follow my class video, do the following: 1. compute your company's free cash flow for the past 3 years. This requires you to compute each of the components in the FCF. Compare your FCF for the most recent year to that reported from the barchart website. Are you close? Explain why you cannot get close to it. Note for MSFT that I did in class, deferred tax is a big deal, it may not be a problem for you. NOPAT = EBIT - tax. Either find the line for tax, or do tax = EBT-NI. Also check their cash flow statement and that should give you a clue of what to include. 2. do a free cash flow model to value your stock for next year. Is your price close to the current stock price? If not, what could be the reason? 3. do a sensitivity table by varying terminal growth g and the WACC. Upload your excel file with a sheet explaining your results. Always…arrow_forwardAssume that you are thinking about starting your own small business. You have made the following estimates regarding this opportunity: • You can rent a location for your business at a cost of $36,000 per year. The equipment costs incurred to start the business would total $250,000. The equipment would have a 5-year useful life and a salvage value of $25,000 Your company's estimated sales per year would equal $350,000 and its variable cost of goods sold would be 30% of sales. • Other operating costs would include $58,000 per year in salaries, $4,000 per year for insurance, $25,000 per year for utilities, and a 3% sales commission The simple rate of return for this investment opportunity is closest to: Multiple Choice 22.0% 19.0% 26.6% 15.7%arrow_forward

- 2.) Discount Rates for Oil Exploration You are a senior manager at an automobile company. In an effort to offer a full menu of auto and gas products, your firm is considering an oil exploration project. The CEO has selected the manager of the company's truck division to oversee the project, and has asked you to evaluate whether the company should proceed with the exploration or not. To help you evaluate the project, your associate gives you the following information: Company Equity Beta General American Oil 1.81 1.29 Louisiana Land & Exploration Mesa Petroleum 2.36 1.60 Murphy Oil Natomas Oil 1.84 1.53 1.35 Oceanic Exploration Superior Oil D/(D+E) 0.03 0.12 0.37 0.27 0.41 0.23 0.16 a.) Should you also ask the associate for similar information on car manufacturers? On truck manufacturers? On automobile companies? On your firm in particular? Why or why not? b.) Based on the information you have available, calculate an appropriate discount rate assuming that risk free rate is 4% and…arrow_forwardthe VC is checking your business acumen and says, "If I give you $500,000, and you purchase your additional stores, your total assets will be around a million dollars. What is your current ratio?" Please calculate the current ratio?arrow_forwardYou are looking for security for your business. Your firm does highly confidential work so you absolutely must have security. You have found two options. The first option is a high tech solution with door sensors, motion detectors, cameras and card readers for door access. The second option is rather low tech. You would upgrade your door locks and hire a guard to be on duty overnight. The costs for each of these options is shown below. If your cost of capital is 8% which option should you select? Support your answer with the appropriate discounted cash flow analysis. Upfront CostAnnual CostLength of ContractHi Tech$200000$ 8,0007Low Tech$ 10,000$ 50,0003arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education