FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

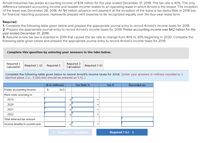

Transcribed Image Text:**Arnold Industries Tax Accounting for 2018 and 2019**

Arnold Industries reported a pretax accounting income of $34 million for the year ending December 31, 2018, with a tax rate applicable of 40%. The only variance between accounting income and taxable income pertains to an operating lease under which Arnold is the lessee. At the inception of the lease on December 28, 2018, the company made a $4 million advance payment, deductible for tax purposes in 2018, but recognized as prepaid rent for financial reporting over a four-year lease term.

**Tasks:**

1. **2018 Income Tax Recording:**

- Complete the table to determine Arnold's income taxes for 2018.

- Prepare the journal entry to record this tax adjustment.

2. **2019 Income Tax Recording:**

- Arnold's pretax accounting income for 2019 is $42 million.

- Record the income taxes for 2019.

3. **2020 Tax Rate Adjustment:**

- Assume a new tax regulation effective in 2020 reduces the tax rate from 40% to 30%.

- Determine and record the journal entry for Arnold’s 2019 income taxes with this new information.

**Table Completion for 2018:**

The table is designed to compute income taxes for 2018 by accounting for variations in rent costs that reverse over the subsequent four years and the effect on deferred tax amounts. The process involves:

- Listing pretax accounting income at $34 million.

- Adjusting for rent cost recognition across 2019-2022.

- Calculating tax impacts using respective rates for each adjustment and reversing year.

- Determining total deferred tax amounts.

Once data is entered, it will reflect the taxable income for the current year and the associated tax recorded. The adjustment accommodates future tax implications of reversing lease payment treatments.

**Educational Goals:**

- Understand differences between accounting and taxable income.

- Record tax entries reflecting deferred payments and future rate changes.

- Analyze the impact of tax law changes on corporate financial statements.

This exercise reinforces comprehension of lease accounting, deferred taxation, and the strategic impact of changing fiscal policies.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2021, Ryan Management collected rent revenue for 2022 tenant occupancy. For financial reporting, the rent is recorded as deferred revenue and then recognized as revenue in the period tenants occupy rental property. For tax reporting, the rent is taxed when collected in 2021. The deferred portion of the rent collected in 2021 was $194.0 million. No temporary differences existed at the beginning of the year, and the tax rate is 25%. Suppose the deferred portion of the rent collected was $76 million at the end of 2022. Taxable income is $760 million. Prepare the appropriate journal entry to record income taxes in 2022. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).)arrow_forwardAt the beginning of 2020, Wertz Construction Company changed from the completed-contract method to recognizing revenue over time (percentage-of-completion) for financial reporting purposes. The company will continue to use the completed- contract method for tax purposes. For years prior to 2020, pretax income under the two methods was as follows: percentage-of- completion $120,000, and completed-contract $80,000. The tax rate is 20%. Prepare Wertz's 2020 journal entry to record the change in accounting principle.arrow_forwardSherrod, Inc., reported pretax accounting income of $70 million for 2021. The following information relates to differences between pretax accounting income and taxable income: Income from installment sales of properties included in pretax accounting income in 2021 exceeded that reported for tax purposes by $4 million. The installment receivable account at year-end 2021 had a balance of $6 million (representing portions of 2020 and 2021 installment sales), expected to be collected equally in 2022 and 2023. Sherrod was assessed a penalty of $1 million by the Environmental Protection Agency for violation of a federal law in 2021. The fine is to be paid in equal amounts in 2021 and 2022. Sherrod rents its operating facilities but owns one asset acquired in 2020 at a cost of $60 million. Depreciation is reported by the straight-line method, assuming a four-year useful life. On the tax return, deductions for depreciation will be more than straight-line depreciation the first two years but…arrow_forward

- How much should be shown in FIVE's 2021 income statement as gross rental income? * On December 31, 2021, FIVE Corporation signed an operating lease for a warehouse with Aye Company for ten years at P30,000 per year. Upon execution of the lease, Aye paid FIVE P60,000, covering rent for the first two years. FIVE closed its books on December 31 and correctly reported P60,000 as gross rental income in its 2021 income tax return.arrow_forwardOn December 31, 2022, Dodd, Inc. appropriately changed the company's method of accounting for long-term construction contracts from the percentage-of-completion method to the cost recovery method for financial statement and income tax purposes. The change will result in a €2,300,000 decrease in the beginning Construction in Process at January 1, 2022. Assume a 30% income tax rate. The cumulative effect of this accounting change on the Deferred Tax Liability account is Group of answer choices 1) a decrease of €690,000. 2) an increase of €690,000. 3) a decrease of €1,610,000. 4)an increase of €2,300,000.arrow_forwardAt the end of 2020, Payne Industries had a deferred tax asset account with a balance of $90 million attributable to a temporary book-tax difference of $360 million in a liability for estimated expenses. At the end of 2021, the temporary difference is $272 million. Payne has no other temporary differences. Taxable income for 2021 is $648 million and the tax rate is 25%. Payne has a valuation allowance of $36 million for the deferred tax asset at the beginning of 2021. Required: Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that the deferred tax asset will be realized in full. Prepare the journal entry(s) to record Payne’s income taxes for 2021, assuming it is more likely than not that only one-fourth of the deferred tax asset ultimately will be realized.arrow_forward

- XYZ Company manufactures equipment that are sold through installment. XYZ recognizes revenue on the year of sale for financial reporting and when installment payments are received for income tax purposes. In 2020, the company earned a gross profit of P6,000,000 for accounting and P1,500,000 for income tax purposes. In relation to its sales, XYZ also provides warranties for its equipment. Warranty costs are accrued as expense for financial reporting and recognized as deductible expense in the income tax return when paid. Accrued warranty expense for 2020 is P2,500,000, but only P500,000 of warranty costs are actually paid during the year.In addition, XYZ also earned P500,000 of interest, net of final withholding taxes, from its bank deposits. Interest income subject to final withholding taxes is non-taxable income for income tax purposes. The entity also paid P100,000 insurance premium on the life of its president in relation to an insurance policy where XYZ Company is the beneficiary.…arrow_forwardJ-Matt, Inc., had pretax accounting income of $331,000 and taxable income of $376,000 in 2021. The only difference between accounting and taxable income is estimated product warranty costs of $45,000 for sales in 2021. Warranty payments are expected to be in equal amounts over the next three years (2022–2024) and will be tax deductible at that time. Recent tax legislation will change the tax rate from the current 25% to 20% in 2023. Determine the amounts necessary to record J-Matt’s income taxes for 2021 and prepare the appropriate journal entry.arrow_forwardAt the end of 2019, its first year of operations, Beattie Company reported taxable income of $39,000 and pretax financial income of $35,000. The difference is due to the way the company handles its warranty costs. For tax purposes, Beattie deducts the warranty costs as they are paid. For financial reporting purposes, Beattie provides for a year-end estimated warranty liability based on future expected costs. Beattie is subject to a 30% tax rate for 2019, and no change in the tax rate has been enacted for future years. Based on verifiable evidence, the company decides it should establish a valuation allowance of 60% of its ending deferred tax asset. Required: 1. Prepare Beattie’s income tax journal entry at the end of 2019. 2. Prepare the lower portion of Beattie’s 2019 income statement.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education