Question

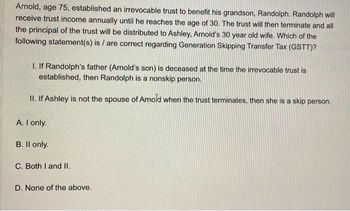

Transcribed Image Text:Arnold, age 75, established an irrevocable trust to benefit his grandson, Randolph. Randolph will

receive trust income annually until he reaches the age of 30. The trust will then terminate and all

the principal of the trust will be distributed to Ashley, Arnold's 30 year old wife. Which of the

following statement(s) is/are correct regarding Generation Skipping Transfer Tax (GSTT)?

1. If Randolph's father (Arnold's son) is deceased at the time the irrevocable trust is

established, then Randolph is a nonskip person.

II. If Ashley is not the spouse of Arnold when the trust terminates, then she is a skip person.

A. I only.

B. Il only.

C. Both I and II.

D. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Dennis is the oldest among the four shareholders and is in the poorest health. He is concerned that upon his death his wife will be stuck with the shares, because there will be no market for them. However, he would like her to be able to use the proceeds from selling the shares for living expenses. For their part, Able, Baker, and Carter like Mrs. Dennis, but are not interested in being co-owners of the business with her. And they certainly do not want her to sell Dennis's shares to an unknown third party. So, they four have agreed that upon Dennis's death, Mrs. Dennis will be obligated to sell one third of the shares to Able, one third to Baker, and one third to Carter. Able, Baker, and Carter agree to buy the shares at a price figured according to a predetermined formula. What kind of transfer restriction is this? Multiple Choice Option agreement Right of first refusal Provision disqualifying purchasers Buy-and-sell agreement Consent constraintarrow_forwardAble does not ever want Baker's shares to be transferred to Baker's brother, who has been convicted of criminal fraud and embezzlement on several occasions and who is currently serving time in a federal prison for one of those convictions. Which of the following types of restrictions on the transfer of Baker's shares might Able insist to accomplish this, even if Carter and Dennis don't share Able's concerns? Multiple Choice A put agreement Option agreement Provision disqualifying purchasers Buy-and-sell agreement Right of first refusalarrow_forwardA mutual will cannot be unilaterally revoked after one of the parties has died. true or falsearrow_forward

- Jack, a stockbroker, was an inexperienced in tax. He has sought the advice of an independent designated tax professional to advise him on tax planning and tax shelter that he needs. Simon, who is a designated accountant who specialized in those areas, advised Jack to invest in a number of multiple unit residential building (MURBs), a real estate investment project as tax shelter, by the conventional wisdom, were safe and conservative. When the value of MURBs fell during a decline in the real estate market, Jack lost heavily in his investment. Though the advice was perfectly sound at the time it was given, but unknown to Jack, Simon was also acting as adviser for developers in restructuring the MURBs and did not disclose that fact to Jack. In the context of breach of contract, is Jack liable for the loss of investment? In the context of breach of fiduciary duty, is Jack liable as well? Does ethics issue involve? Please state your reasons. Mr. Hunt, who has just retired, set up an…arrow_forward9arrow_forward22arrow_forward

- Pls help ASAParrow_forwardSubject: acountingarrow_forwardSkip and Jack are the shareholders of the Blue Fish Event Corporation. Skip and Jack regularly put on classy events on or near the beach, so they have a special insurance policy to protect their assets. Business has been slow as fewer large beach weddings are taking place, so Skip and Jack use a large fan to blow down and damage most of their décor assets, some of which were personal assets of Skip and Jack, to collect the insurance benefits. (a) Assuming their acts are proven, will a court allow Skip and Jack to recover the insurance money? (b) Is this a situation where the corporate veil may be pierced? Why or why not? (c) What would it mean for Skip and Jack if the corporate veil is pierced in this situation?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios