FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

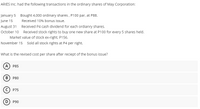

Transcribed Image Text:ARIES Inc. had the following transactions in the ordinary shares of May Corporation:

January 5 Bought 4,000 ordinary shares , P100 par, at P88.

June 15

Received 10% bonus issue.

August 31 Received P4 cash dividend for each ordianry shares.

October 10 Received stock rights to buy one new share at P100 for every 5 shares held.

Market value of stock ex-right, P156.

November 15 Sold all stock rights at P4 per right.

What is the revised cost per share after reciept of the bonus issue?

А) Р85

В) Р80

c) P75

D) P90

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information to answer the question below. 33 The following transactions involving Lupine Corporation occurred during the year: lot et cell Apr. 1 Purchased 2,000 shares of its own preferred stock for $20, the current market price. This is the first transaction involving its own stock engaged in by the company. May 3 Sold 400 of the shares purchased on April 1 for $25 per share. June 5 Retired 600 of the shares purchased on April 1. The original issue price was $10. The par value of the stock is $5. The entry to record the May 3 transaction is A) Preferred Stock $ 3,000 Additional Paid in Capital, Preferred $ 3,000 Treasury Stock, Preferred vode $ to a 6,000 $ to als 6,0000 yns srl 25 B) Treasury Stock, Preferred Cash $50 6,000 C) Cash 10,000 $ obo12 nomme Treasury Stock $ 8,000 Additional Paid in Capital, Treasury Stocks $ 2,000 D) Preferred Stock $ Treasury Stock, Preferred 12,000 2012 Additional Paid in Capital, Preferred Retained Earnings E) none of the above 3,000…arrow_forwardWhen March Green Products Ltd. started their business they issued 150,000 common shares and 10,000 noncumulative preferred shares. Their first declaration of dividends happened in Year 4 of operations, and was for $270,000. What was the per share dividend received by the common shareholders? O $142 O $1.6875 O $1.80 O cannot be determined with the information providedarrow_forwardOn January 1, 20x1, Raven Ltd. had 40,000 shares of common shares issued and outstanding. The book value of those shares was $600,000. Furthermore, they had 10,000 $3, cumulative, preferred shares issued and outstanding which had a book value of $200,000. Account Debit Credit The following transactions took place in 20xl: Feb 28 - Issued 20,000 common shares for $500,000 Jun 1 - Repurchased and cancelled 20,000 shares at $20.00 each. Jun 30 - A 2:1 stock split was announced Dec 15 - Declared a dividend of $2.00/share to shareholders of record on Dec 31. Required - Prepare all journal entries to record the above transactions. Round to two decimal points on any calculations.arrow_forward

- During 20x2, the following transactions related to the capital share of the ABC Corp occurred: Jan 7 Declared a P .75 cash dividends on 150,000 shares of preference shares. Feb 7 Paid dividends on preference shares March 4 Declared a P ,50 cash dividend on 200,000 ordinary shares with P 20 par value. March 18 Paid dividends on ordinary shares June 30 Split ordinary shares 4 for 1. July 9 Purchased 12,000 shares of ABC Corp’ own ordinary shares at P 32 per share; acquisition recorded at cost Sept 10 Declared a cash dividend of P .40 per share on ordinary shares outstanding Sept 18 Paid dividends on ordinary shares. Required: Provide the entries to record the above transactions.arrow_forwardWonder Ltd. has treasury stock transactions in 20X9 as follows: a. Feb. 27 Purchased 140,000 common shares as treasury stock at $6.50 per share. b. March 15 Purchased 64,000 common shares as treasury stock for $5.50 per share. c. April 30 Reissued 100,000 shares of treasury stock for $4.25 per share. d. May 16 Purchased 54,000 common shares as treasury stock for $6.05 per share. e. Nov. 26 Reissued 268,000 shares of treasury stock for $4 per share. At the end of 20X8, Wonder Limited had reported the following in shareholders’ equity: Common shares, no-par value; authorized, unlimited shares; issued, 5,800,000 shares, outstanding, 5,500,000 shares $ 21,117,000 Contributed capital on treasury stock transactions 133,600 Retained earnings 14,840,000 Treasury stock, 300,000 common shares (1,260,000) Required:1. Prepare…arrow_forwardWW Corp. resells 400 shares of its own common stock for $20 per share. WW had acquired these shares two months before for $14 per share. The resale of this stock would be recorded with a: Select one: a. Debit to Common Stock for $8,000 b. Credit to Additional Paid-In Capital for $800 c. Credit to Treasury Stock for $8,000 d. Credit to Additional Paid-In Capital for $2,400 e. Credit to Additional Paid-In Capital for $2,000arrow_forward

- Vaughn Corporation sold 390 shares of treasury stock for $55 per share. The cost for the shares was $45. The entry to record the sale will include a O credit to Treasury Stock for $21450. O credit to Paid-in Capital from Treasury Stock for $3900. O debit to Paid-in Capital in Excess of Par for $3900. O credit to Gain on Sale of Treasury Stock for $17550.arrow_forwardThe Snow Corporation issues 9,800 shares of $52 par value preferred stock for cash at $66 per share. The entry to record the transaction will consist of a debit to Cash for $646,800. What credit or credits will the entry consist of? Select the correct answer. -Preferred Stock for $509,600 and Retained Earnings for $137,200. -Paid-in Capital from Preferred Stock for $646,800. -Preferred Stock for $646,800. -Preferred stock for $509,600 and Paid-in Capital in Excess of Par Value - Preferred Stock for $137,200.arrow_forwardFancy Clothing Company is authorized to issue 110,000 shares of $2 par common stock. The company issued 5,100 shares at $6 per share, when the market price of the common stock was $10 per share. Later, Charter declared and paid a $0.50 per share cash dividend. The journal entry to declare the cash dividend would be: O Dividends Payable - Common 55,000 Cash Dividends O Cash Dividends OOO Dividends Payable - Common O Cash Dividends Dividends Payable - Common O Dividends Payable - Common Cash Dividends 2,550 55,000 2,550 55,000 2,550 55,000 2,550arrow_forward

- Sh8arrow_forwardBandit, Inc., issued for $19 per share 5,000 shares of $10 par value common stock. The entry to record this transaction includes: Select one: a. Increase Cash for 95,000; and increase Common Stock for 95,000 b. Increase Cash for 95,000; increase Common Stock for 50,000 and increase Paid-in Capital in Excess of Par Value for 45,000 c. Increase Cash for 95,000; increase Common Stock for 50,000 and increase Retained Earnings for 45,000 d. Increase Cash for 95,000; increase Common Stock for 50,000 and increase Gain on Sale of Stock for 45,000 e. None of the abovearrow_forwardD Company had the following transactions pertaining to stock investments. Feb. 1 Purchased 600 shares of G common stock (4%) for $6,000 cash, plus brokerage fees of $400. July 1 Received cash dividends of $2 per share on Goetz common stock. Sept. 1 Sold 300 shares of G common stock for $4,600, less brokerage fees of $100. Dec. 1 Received cash dividends of $1 per share on G common stock. Instructions: Journalize the transactions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education