FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

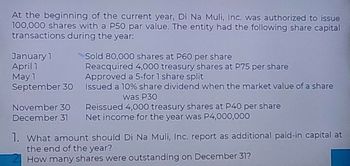

Transcribed Image Text:At the beginning of the current year, Di Na Muli, Inc. was authorized to issue

100,000 shares with a P50 par value. The entity had the following share capital

transactions during the year:

January 1

April 1

Sold 80,000 shares at P60 per share

May 1

Reacquired 4,000 treasury shares at P75 per share

Approved a 5-for 1 share split

September 30 Issued a 10% share dividend when the market value of a share

November 30

was P30

Reissued 4,000 treasury shares at P40 per share

December 31 Net income for the year was P4,000,000

1. What amount should Di Na Muli, Inc. report as additional paid-in capital at

the end of the year?

How many shares were outstanding on December 31?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Visnoarrow_forwardBridgeport SA uses a calendar year for financial reporting. The company is authorized to issue 8,210,000 R$12 par ordinary shares. At no time has Bridgeport issued any potentially dilutive securities. Listed below is a summary of Bridgeport’s ordinary share activities. 1. Number of ordinary shares issued and outstanding at December 31, 2021 2,040,000 2. Shares issued as a result of a 12% share dividend on September 30, 2022 244,800 3. Shares issued for cash on March 31, 2023 1,870,000 Number of ordinary shares issued and outstanding at December 31, 2023 4,154,800 4. A 2-for-1 share split of Bridgeport’s ordinary shares took place on March 31, 2024 (a) Compute the weighted-average ordinary shares used in computing earnings per ordinary share for 2022 on the 2023 comparative income statement. enter a number of shares sharesarrow_forward

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education