Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

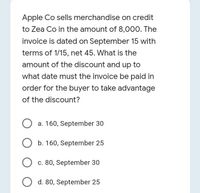

Transcribed Image Text:Apple Co sells merchandise on credit

to Zea Co in the amount of 8,000. The

invoice is dated on September 15 with

terms of 1/15, net 45. What is the

amount of the discount and up to

what date must the invoice be paid in

order for the buyer to take advantage

of the discount?

a. 160, September 30

b. 160, September 25

O c. 80, September 30

d. 80, September 25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If a customer purchased merchandise in the amount of $340, terms 3/10, n/30, returned $70 of the inventory for a full refund, and received an allowance for $65, how much discount would be applied if the customer remitted payment within the discount window?arrow_forward25. Jacob Co. sells merchandise on credit to Isaiah Co. for $11,000. The invoice is dated on May 1 with terms of 2/15, net 45. What is the amount of the discount and up to what date must the invoice be paid in order for the buyer to take advantage of the discount? a.$440, May 15 b.$440, May 16 c.$220, May 16 d.$220, May 15arrow_forwardApple Co sells merchandise on credit to Zea Co in the amount of P8,000. The invoice is dated on September 15 with terms of 1/15, net 45. If Zea Co. chooses not to take the discount, by when should the payment be made? September 25September 30October 30October 15arrow_forward

- Multiple choicearrow_forwardKaden Co. sells merchandise on credit to Jase Co. for $9,600. The invoice is dated July 15 with terms of 1/15, net 45. If Jase Co. chooses not to take the discount, by when should the payment be made? a.August 29 b.August 15 c.July 30 d.July 25arrow_forwardKaden Co. sells merchandise on credit to Jase Co. for $9,600. The invoice is dated July 15 with terms of 1/15, net 45. If Jase Co. chooses not to take the discount, by when should the payment be made? Oa. July 25 Ob. August 15 Oc. July 30 Od. August 29arrow_forward

- Trade Discount and Cash Discounts Merchandise was purchased on account from Jacob's Distributors on May 17. The purchase price was $1,400, less a 10% trade discount and credit terms of 2/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calculate the amount to be paid on this invoice within the discount period. 3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period).arrow_forwardThe journal entry to record the receipt of a payment from customer within the discount period on a sale of $2325 with terms of 3/10, n/30 will include a credit to O a. Sales discounts for $70 O b. Accounts receivable for $2325 O c. Sales Revenue for $2325 O d. Cash for $2255arrow_forwardTrade Discount and Cash Discounts Merchandise was purchased on account from Jacob's Distributors on May 17. The purchase price was $2,000, less a 10% trade discount and credit terms of 2/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calculate the amount to be paid on this invoice within the discount period. 3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period). Page: DOC. POST. DEBIT CREDIT NO. REF. DATE ACCOUNT TITLE 20-- 1 Мay 17 2 3 Purchased merchandise 3 4 27 5 6 6 7 Paid invoice within discount periodarrow_forward

- Trade Discount and Cash Discounts Merchandise was purchased on account from Jacob's Distributors on May 17. The purchase price was $2,000, less a 10% trade discount and credit terms of 2/10, n/30. 1. Calculate the net amount to record the invoice, less the 10% trade discount. 2. Calculate the amount to be paid on this invoice within thé discount period. $4 3. Journalize the purchase of the merchandise on May 17 in a general journal. Journalize the payment on May 27 (within the discount period). Page: DATE ACCOUNT TITLE DOC. POST. DEBIT CREDIT NO. REF. 20-- 1 May 17 1 2 Purchased merchandise 4 27 4 5 6. 6. Paid invoice within discount period 7 00000 00 000 3.arrow_forward6arrow_forwardplease qucikly thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub