FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

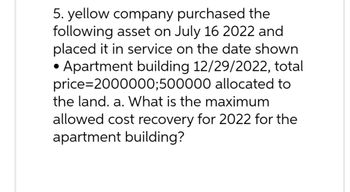

Transcribed Image Text:5. yellow company purchased the

following asset on July 16 2022 and

placed it in service on the date shown

• Apartment building 12/29/2022, total

price=2000000;500000 allocated to

the land. a. What is the maximum

allowed cost recovery for 2022 for the

apartment building?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Typed plzzz and Asap Thanksarrow_forwardThe following information is for five mutually exclusive alternatives that have 20-year useful lives. The decision maker may choose any one of the options or reject them all. Prepare a choice table.arrow_forwardMyUSF My Home 4 CengageNOWv2 | Online teachin X + ngagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inpro.. to Determine the average rate of return for a project that is estimated to yield total income of $270,400 over 4 years, costs $615,000, and has a $61,000 residual value.arrow_forward

- 6) Year Project A Project B Difference 0 -75000 -75000 0 1 26300 24000 2300 2 29500 26900 2600 3 45300 51300 -6000 Crossover rate 14.60% Hi I need help with the following question! Thank you! Are you going to accept project A or project B? Why?arrow_forwardDon't provide answers in image formatarrow_forward****Only answer this question if you are sure about the correct answer **** ***Return on investment Question*** 27. If you want to remodel your house: a. The house was bought with a cost of $175,000. b. The house remodel will cost $38,000. с. After the remodel, the expected house value could increase by 4% 1. What is the ROI % (...............) 2. Yes or no, based on ROI is this a good investment (...........)arrow_forward

- x E My Home CengageNOWv2 |Online teachir x+ now.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inpro. ta o 伯 Determine the average rate of return for a project that is estimated to yield total income of $250,000 over 4 years, costs $480,000, and has a $20,000 residual value. Next Previous Submit Test for Gradingarrow_forward1. (I need the answer as soon as possible)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education