FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

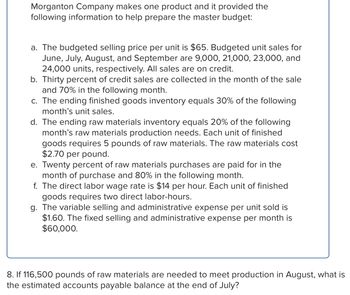

Transcribed Image Text:**Morganton Company Master Budget Information**

Morganton Company manufactures a single product and provides the following data for budget preparation:

a. **Selling Price and Sales Forecast:**

- Budgeted selling price per unit: $65.

- Budgeted unit sales for:

- June: 9,000 units.

- July: 21,000 units.

- August: 23,000 units.

- September: 24,000 units.

- All sales are on credit.

b. **Credit Sales Collection:**

- 30% of credit sales are collected in the same month.

- 70% are collected in the following month.

c. **Finished Goods Inventory:**

- Ending inventory equals 30% of the next month’s unit sales.

d. **Raw Materials Inventory:**

- Ending inventory equals 20% of the next month’s production needs.

- Each unit requires 5 pounds of raw materials.

- Cost per pound of raw materials: $2.70.

e. **Raw Material Purchases Payment:**

- 20% of purchases paid in the purchase month.

- 80% paid in the following month.

f. **Labor Costs:**

- Direct labor rate: $14 per hour.

- Each unit requires two labor hours.

g. **Selling and Administrative Expenses:**

- Variable expense per unit: $1.60.

- Fixed monthly expense: $60,000.

**Budget Calculation Example:**

- If 116,500 pounds of raw materials are needed for August, estimate the accounts payable at the end of July, considering the purchase and payment terms outlined above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Corning Incorporated sells its product for $24 per unit. Its actual and projected sales follow: Units Dollars January (actual) 18,500 $444,000 February (actual) 23,000 552,000 March (budgeted) 19,800 475,200 April (budgeted) 18,950 454,800 May (budgeted) 22,000 528,000 Here is added information about Corning’s operations: All sales are on credit. Recent experience show that 35% of sales are collected in the month of the sale, 45% in the month following the sale, 17% in the second month after the sale, and 3% prove to be uncollectible. The product’s purchase price is $15 per unit. All payments are payable within 21 days. Thus 30% of purchases in any given month are paid for in that month, with the remaining 70% paid for in the following month. The company has a policy to maintain an ending inventory of 20% of the next month’s projected sales plus a safety stock of 100 units. The January 31 and February 28…arrow_forwardZily Co. predicts sales of $185,000 for June. Zily pays a sales manager a monthly salary of $6.600 and a commission of 8% of that month's sales dollars. Prepere a selling expense budget for the month of June. ZILLY CO. Selling Expense Budget For Month Ended June 30 Budgeled salesarrow_forwardPreparing an operating budget-cost of goods sold budget Butler Company expects to sell, 1,650 units in January and 1,550 units in February. The company expects to incur the following product costs: The beginning balance in Finished Goods Inventory is 250 units at $200 each for a total of $50,000. Butler uses FIFO inventory costing method. Prepare the cost of goods sold budget for Butler for January and February.arrow_forward

- Please do not give solution in image format thankuarrow_forwardAztec Company sells its product for $150 per unit. Its actual and budgeted sales follow. May (Actual) June (Budget) July (Budget) August (Budget) 4,000 $ 600,000 2,200 5,000 4,100 $ 330,000 $ 750,000 $ 615,000 Sales units Sales dollars All sales are on credit. Collections are as follows: 22% is collected in the month of the sale, and the remaining 78% is collected in the month following the sale. Merchandise purchases cost $110 per unit. For those purchases, 60% is paid in the month of purchase and the other 40% is paid in the month following purchase. The company has a policy to maintain an ending monthly inventory of 24% of the next month's unit sales. The May 31 actual inventory level of 1,200 units is consistent with this policy. Selling and administrative expenses of $155,000 per month are paid in cash. The company's minimum cash balance at month-end is $110,000. Loans are obtained at the end of any month when the preliminary cash balance is below $110,000. Any preliminary cash…arrow_forwardCorning Incorporated sells its product for $24 per unit. Its actual and projected sales follow: Units Dollars January (actual) 18,500 $444,000 February (actual) 23,000 552,000 March (budgeted) 19,800 475,200 April (budgeted) 18,950 454,800 May (budgeted) 22,000 528,000 Here is added information about Corning’s operations: All sales are on credit. Recent experience show that 35% of sales are collected in the month of the sale, 45% in the month following the sale, 17% in the second month after the sale, and 3% prove to be uncollectible. The product’s purchase price is $15 per unit. All payments are payable within 21 days. Thus 30% of purchases in any given month are paid for in that month, with the remaining 70% paid for in the following month. The company has a policy to maintain an ending inventory of 20% of the next month’s projected sales plus a safety stock of 100 units. The January 31 and February 28…arrow_forward

- For each unit of finished goods Surf Inc. needs 3 pounds of material. The production budget is shown below for the next 4 months: Description Month 1 Month 2 Month 3 Month 4 Production Budget in Units 14,000.00 15,000.00 16,000.00 12,000.00 Prepare the material purchases budget and show the total cost of material to purchase based on the following for Months 1-3 Beg Inv Month 1 8,800.00 pounds of material Cost per pound $4.75 Required Ending Inventory 12% of next months requirement Description Month 1 Month 2 Month 3arrow_forwardHow do I prepare the selling and administrative expense budget for the quarter ended March 31, 20X1?arrow_forwardAztec Company sells its product for $180 per unit. Its actual and budgeted sales follow. Units Dollars April (actual) . 4,000 $ 720,000 May (actual) 2,000 360,000 June (budgeted) . 6,000 1,080,000 July (budgeted) 5,000 900,000 August (budgeted) . 3,800 684,000 All sales are on credit. Recent experience shows that 20% of credit sales is collected in the month of the sale, 50% in the month after the sale, 28% in the second month after the sale, and 2% proves to be uncollectible. The product’s purchase price is $110 per unit. 60% of purchases made in a month is paid in that month and the other 40% is paid in the next month. The company has a policy to maintain an ending monthly inventory of 20% of the next month’s unit sales plus a safety stock of 100 units. The April 30 and May 31 actual inventory levels are consistent with this policy. Selling and administrative expenses for the year are $1,320,000 and are paid evenly throughout the year in cash. The company’s minimum cash balance at…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education