FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

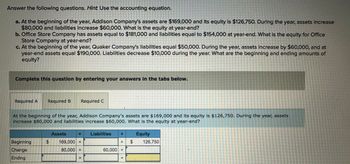

Transcribed Image Text:Answer the following questions. Hint Use the accounting equation.

a. At the beginning of the year, Addison Company's assets are $169,000 and its equity is $126,750. During the year, assets increase

$80,000 and liabilities increase $60,000. What is the equity at year-end?

b. Office Store Company has assets equal to $181,000 and liabilities equal to $154,000 at year-end. What is the equity for Office

Store Company at year-end?

c. At the beginning of the year, Quaker Company's liabilities equal $50,000. During the year, assets increase by $60,000, and at

year-end assets equal $190,000. Liabilities decrease $10,000 during the year. What are the beginning and ending amounts of

equity?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

At the beginning of the year, Addison Company's assets are $169,000 and its equity is $126,750. During the year, assets

Increase $80,000 and liabilities increase $60,000. What is the equity at year-end?

Beginning

Change

Ending

$

Assets

169,000 =

80,000 =

Liabilities

+

60,000 +

+

Equity

$ 126,750

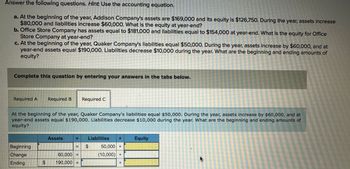

Transcribed Image Text:Answer the following questions. Hint. Use the accounting equation.

a. At the beginning of the year, Addison Company's assets are $169,000 and its equity is $126,750. During the year, assets increase

$80,000 and liabilities increase $60,000. What is the equity at year-end?

b. Office Store Company has assets equal to $181,000 and liabilities equal to $154,000 at year-end. What is the equity for Office

Store Company at year-end?

c. At the beginning of the year, Quaker Company's liabilities equal $50,000. During the year, assets increase by $60,000, and at

year-end assets equal $190,000. Liabilities decrease $10,000 during the year. What are the beginning and ending amounts of

equity?

Complete this question by entering your answers in the tabs below.

Required A Required B Required C

At the beginning of the year, Quaker Company's liabilities equal $50,000. During the year, assets increase by $60,000, and at

year-end assets equal $190,000. Liabilities decrease $10,000 during the year. What are the beginning and ending amounts of

equity?

Beginning

Change

Ending

Assets

60,000

$ 190,000 =

IN

Liabilities

$.

50,000 +

(10,000) +

Equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tibbs Inc. had the following data for the most recent year: Net income = $300; Net operating profit after taxes (NOPAT) = $380; Total assets = $2,500; Short-term investments = $200; Stockholders' equity = $1,800; Total debt = $700; and Total operating capital = $2,300. What was its return on invested capital (ROIC)? Select the correct answer. a. 16.92% b. 16.52% c. 17.12% d. 16.72% e. 16.32%arrow_forwardThe stockholders' equity of Diakovsky Company at the beginning and end of 2021 totaled $119,000 and $136,000, respectively. Assets at the beginning of 2021 were $143,000. If the liabilities of Diakovsky Company increased by $66,000 in 2021, how much were total assets at the end of 2021? Use the accounting equation. OA. $213,000 OB. $209,000 OC. $226,000 O D. $60,000arrow_forwardQUESTION: At the beginning of the year, Keller Company's liabilities equal $60,000. During the year, assets increase by $80,000, and at year-end assets equal $180,000. Liabilities decrease by $10,000 during the year. What are the beginning and ending amounts of equity?arrow_forward

- Using the accounting equation Thompson Handyman Services has total assets for the year of $18,400 and total liabilities of $9,050. Requirements Use the accounting equation to solve for equity. If next year's assets increased by $4,300 and equity decreased by $3,850, what would be the amount of total liabilities for Thompson Handyman Services?arrow_forwardAt the beginning of the current fiscal year, the balance sheet of Hughey Incorporated showed stockholders' equity of $519,000. During the year, liabilities increased by $23,000 to $224,000, paid-in capital increased by $38,000 to $176,000, and assets increased by $269,000. Dividends declared and paid during the year were $51,000. Required: Calculate net income or loss for the year. Note: Amounts to be deducted should be indicated with a minus sign. Beginning Changes Changes Ending Assets = 269,000 = Liabilities 23,000 + Stockholders' Equity RE PIC + 38,000 + $ 224,000+ $ 176,000 + $519,000 SEarrow_forwardWD Corporation reports the following year-end balance sheet data. The company's debt-to-equity ratio equals: Cash $ 42,000 Current liabilities $ 77,000 Accounts receivable 57,000 Long-term liabilities 28,000 Inventory 62,000 Common stock 102,000 Equipment 147,000 Retained earnings 101,000 Total assets $ 308,000 Total liabilities and equity $ 308,000arrow_forward

- At the beginning of the current fiscal year, the balance sheet of Hughey Inc. showed stockholders' equity of $520,000. During the year. liabilities increased by $26,000 to $222,000; paid-in capital increased by $34,000 to $178,000; and assets increased by $252,000. Dividends declared and paid during the year were $62,000. Required: Calculate net income or loss for the year. (Amounts to be deducted should be Indicated with a minus sign.) Beginning Changes Ending Assets 252,000 = Liabilities + + 26,000+ Stockholders' Equity RE PIC + 34,000 + $ 222,000+ $ 178,000+ $520,000 SEarrow_forwardHow do you calculate the first years net income under the cash basis of accounarrow_forward. a. At the beginning of the year, Addison Company's assets are $286,000 and its equity is $214,500. During the year, assets. increase $80,000 and liabilities increase $42,000. What is the equity at year-end? b. Office Store Company has assets equal to $207,000 and liabilities equal to $174,000 at year-end. What is the equity for Office Store Company at year-end? c. At the beginning of the year, Quaker Company's liabilities equal $52,000, During the year, assets increase by $60,000, and at year-end assets equal $190,000. Liabilities decrease $19,000 during the year. What are the beginning and ending amounts of equity? Complete this question by entering your answers in the tabs below. Required A Required Required C At the beginning of the year, Addison Company's assets are $286,000 and its equity is $214,500. During the year, assets increase $80,000 and liabilities increase $42,000. What is the equity at year-end? Asta Equity Liabilities + 71.500+ 5 42.000 Beginning $ 266,000S Change…arrow_forward

- Last year, McGinley Company had total equity of $600,000, a return on assets of 10%, and a return on equity of 15%. What was the amount of McGinley's total assets?arrow_forwardam.104.arrow_forwardThe financial statements for Castile Products, Incorporated, are given below: Castile Products, Incorporated Balance Sheet December 31 Assets Current assets: Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 10% Total liabilities. Stockholders equity Connon stock, $5 per value. Retained earnings Total stockholders equity Total liabilities and stockholders' equity Castile Products, Incorporated Income Statement For the Year Ended December 31 Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net incone before taxes Income taxes (30%) Net income $24,000 230,000 370,000 9,000 633,000 860,000 $1,493,000 $ 290,000 320,000 610,000 $150,000. 733,000 883,000 $1,493,000 $ 2,290,000 1,220,000 1,070,000 580,000 490,000 32,000 458,000 137,400 $ 320,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education