Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

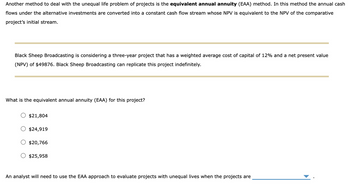

Transcribed Image Text:Another method to deal with the unequal life problem of projects is the equivalent annual annuity (EAA) method. In this method the annual cash

flows under the alternative investments are converted into a constant cash flow stream whose NPV is equivalent to the NPV of the comparative

project's initial stream.

Black Sheep Broadcasting is considering a three-year project that has a weighted average cost of capital of 12% and a net present value

(NPV) of $49876. Black Sheep Broadcasting can replicate this project indefinitely.

What is the equivalent annual annuity (EAA) for this project?

$21,804

$24,919

$20,766

$25,958

An analyst will need to use the EAA approach to evaluate projects with unequal lives when the projects are

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Duo Corporation is evaluating a project with the following cash flows. The company uses a discount rate of 10 percent and a reinvestment rate of 7 percent on all of its projects. Year 0 1 Cash Flow -$ 15,400 6,500 7,700 7,300 6,100 -3,500 Calculate the MIRR of the project using all three methods with these interest rates. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach Combination approach % % %arrow_forwardCompany A is considering two investment projects, Project X and Project Y. The initial investments and projected annual cash flows for each project are as follows: Project X: Initial Investment: $10,000 Annual Cash Flows: $2,500 for 5 years Project Y: Initial Investment: $15,000 Annual Cash Flows: $5,750 for 3 years Using the roll-over method, determine which project should be selected. Assume a 6% discount rate. The NPV of the preferred project is??arrow_forwardA company is considering three alternative investment projects with different net cash flows. The present value of net cash flows is calculated using Excel and the results follow. Potential Projects Present value of net cash flows (excluding initial investment) Initial investment Project A $ 11,226 (10,000) Project B $ 10,568 (10,000) a. Compute the net present value of each project. b. If the company accepts all positive net present value projects, which of these will it accept? c. If the company can choose only one project, which will it choose on the basis of net present value? Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the net present value of each project. Potential Projects Project A Project B Project C Present value of net cash flows Initial investment Net present value $ $ $arrow_forward

- Galaxy Corp. has to choose between two mutually exclusive projects. If it chooses project A, Galaxy Corp. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment. The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of 11%? Project A Year 0: Year 1: Year 2: Year 3: O $15,077 O $21,538 $12,923 O $14,000 O $19,384 Cash Flow -$12,500 8,000 14,000 13,000 Project B Year 0: Year 1: Year 2: Year 3: Year 4: Year 5: Year 6: -$40,000 9,000 13,000 12,000 11,000 10,000 9,000arrow_forwardPlease see attached:arrow_forwardTwo projects, Alpha and Beta, are being considered using the payback method. Each has an initial cost of $100,000. The annual cash flows for each project are listed below. a) What is the pay back period in years for Alpha? (round to two decimal places) b) What is the pay back period in years for Beta? (round to two decimal places) Year Project Alpha Project Beta 1 25,000 15,000 2 25,000 25,000 3 25,000 45,000 4 25,000 30,000 5 25,000 20,000 25,000 15,000arrow_forward

- Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow 0 −$ 29,800 1 12,000 2 14,700 3 16,600 4 13,700 5 −10,200 The company uses an interest rate of 9 percent on all of its projects. Calculate the MIRR of the project using the reinvestment approach Calculate the MIRR of the project using the combination approach.arrow_forwardProject A, currently requires an investment of IDR 250 billion, and will generate revenue of IDR 275 billion next year. Meanwhile, to build project B, a fund of IDR 2.5 trillion is needed, with a potential revenue of IDR 2.7 trillion in the following year. Using the concepts of internal rate of return and net present value, which project should be built? Explain your reasons. (assuming the prevailing interest rate is 6 percent).arrow_forwardFor your ongoing business, the required investments are $420,000 for X1, $550,000 for X2, $720,000 for X3, and $800,000 for X4. X0 denotes the do-nothing alternative. Moreover, you had information about the internal rates of return for the incremental projects: IRR for X1-XO is 18%, IRR for X2-XO is 20%, IRR for X3-XO is 25%, IRR for X4-XO is 30%, IRR for X2-X1 is 10%, IRR for X3-X1 is 21%, IRR for X4-X1 is 19%, IRR for X3- X2 is 18%, IRR for X4-X3 is 14%, IRR for X4-X2 is 23%. Using the information above, if the MARR is 15%, what system should be selected? а) ХО O b) X2 с) XЗ d) None of the answers are correct e) X1 O f) X4arrow_forward

- The Butler-Perkins Company (BPC) must decide between two mutually exclusive projects. Each costs $7,000 and has an expected life of 3 years. Annual project cash flows begin 1 year after the initial investment and are subject to the following probability distributions: Project A Project B Probability Cash Flows Probability Cash Flows 0.2 $6,250 0.2 $0 0.6 $7,000 0.6 $7,000 0.2 $7,750 0.2 $19,000 BPC has decided to evaluate the riskier project at 12% and the less-risky project at 10%. a. What is each project's expected annual cash flow? Round your answers to two decimal places. Project A: $ Project B: $ Project B's standard deviation (σB) is $6,131.88 and its coefficient of variation (CVB) is 0.77. What are the values of (σA) and (CVA)? Round your answers to two decimal places. σA = $ CVA = b. Based on the risk-adjusted NPVs, which project should BPC choose? c. If you knew that Project B's cash flows were negatively correlated with the firm's other cash flow, but Project A's cash flows…arrow_forward(Related to Checkpoint 11.1 and Checkpoint 11.4) (IRR and NPV calculation) The cash flows for three independent projects are found below: a. Calculate the IRR for each of the projects. b. If the discount rate for all three projects is 13 percent, which project or projects would you want to undertake? c. What is the net present value of each of the projects where the appropriate discount rate is 13 percent? a. The IRR of Project A is%. (Round to two decimal places.) Data table Year 0 (Initial investment) Year 1 Year 2 Year 3 Year 4 Year 5 Project A $(70,000) $12,000 18,000 19,000 28,000 33,000 Project B $(110,000) $28,000 28,000 28,000 28,000 28,000 Project C $(420,000) $240,000 240,000 240,000arrow_forwardA project has an initial cost of $52,125, expected net cash inflows of $12,00 per year for 8 years, and a cost of capital of 12%. P11-1. What is the project's NPV? P11-2. What is the project's IRR? P11-3. What is the project's MIRR? P11-4. What is the project's PI? P11-5. What is the project's payback periodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education