FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

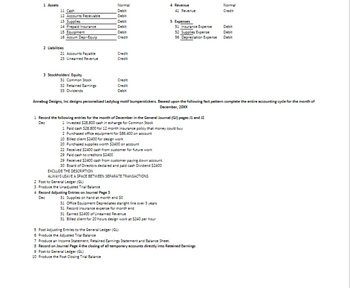

Transcribed Image Text:1 Assets

11 Cash

12 Accounts Receivable

13 Supplies

14 Prepaid Insurance

15 Equipment

16 Accum Depr-Equip

2 Liabilities

21 Accounts Payable

23 Unearned Revenue

3 Stockholders' Equity

31 Common Stock

32 Retained Earnings

33 Dividends

Normal

Debit

Debit

Debit

Debit

2 Post to General Ledger (GL)

3 Produce the Unadjusted Trial Balance

Debit

Credit

4 Record Adjusting Entries on Journal Page 3

Dec

Credit

Credit

Credit

Credit

Debit

20 Purchased supplies worth $2400 on account

22 Received $2400 cash from customer for future work

29 Paid cash to creditors $2400

29 Received $2400 cash from customer paying down account.

30 Board of Directors declared and paid cash Dividend $2400

EXCLUDE THE DESCRIPTION

ALWAYS LEAVE A SPACE BETWEEN SEPARATE TRANSACTIONS

Annabug Designs, Inc designs personalized Ladybug motif bumperstickers. Beseed upon the following fact pattern complete the entire accounting cycle for the month of

December, 20XX

1 Record the following entries for the month of December in the General Journal (GJ) pages 11 and 12

Dec

1 Invested $28,800 cash in exhange for Common Stock

1 Paid cash $28,800 for 12 month insurance policy that money could buy

2 Purchased office equipment for $86,400 on account

10 Billed client $2400 for design work

31 Supplies on hand at month end 50

4 Revenue

31 Office Equipment Depreciates staright line over 3 years

31 Record insurance expense for month and

31 Earned $2400 of Unearned Revenue

31 Billed dient for 20 hours design work at $240 per hour

41 Revenue

5 Post Adjusting Entries to the General Ledger (GL)

6 Produce the Adjusted Trial Balance

5 Expenses

51 Insurance Expense

Debit

52 Supplies Expense

Debit

56 Depreciation Expense Debit

Normal

Credit

7 Produce an Income Statement, Retained Earnings Statement and Balance Sheet

8 Record on Journal Page 4 the closing of all temporary accounts directly into Retained Earnings

9 Post to General Ledger (GL)

10 Produce the Post Closing Trial Balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In problems 3 through 8, complete the table one entry at a time by filling in the amount that goes where the red star is. Use the unpaid balance method to calculate interest. Assume an 18% annual interest rate. Unpaid Balance at Beginning of Month Unpaid Balance Purchases Purchases Payments at End of Month Finance Month Charge June $350.10 $ 25.00 $36.75 $ 75.00 July $150.40 $ 0 $200.00 August $208.75 $55.40 $150.00arrow_forwardA Pre-Closing Trial Balance for Shady Lane Senior Living Center is listed below. From the list of accounts provided, prepare an activity statement. In this instance, there are no assets released from restrictions. Download the excel file provided. Prepare the activity statement, save it on your computer, and upload your response in the drop box below. Cash $121,000 Pledges Receivable 50,240 Interest Income Receivable 500 Inventory 1,000 Investments – long term 492,600 Land 42,000 Building 162,800 Vintage Car Collection 60,000 Allowance for Uncollectible Pledges 1,000 Accumulated Depreciation 22,600 Accounts Payable 600 Notes Payable 1,000 Deferred Revenue 400 Long Term Loans Payable 100,000 Mortgage Payable 14,000 Net Assets: UR Undesignated 100,000 Net Assets: UR Designated 60,000 Net Assets: TR 100,000 Net Assets: PR 200,000 Program Expenses 42,300 SS: Mgt & Genl Exp 9,600 SS: Fundraising Exp 3,600 Reclassifications OUT-TR 44,200 Loss on Disposal of equipment 600 Revenue:…arrow_forwardcreate a t account for this montharrow_forward

- I need the answer as soon as possiblearrow_forwardIdentify the 3 issues with this General Journalarrow_forwardEXERCISE (All exercise would be saved in one record) Journalize the following transactions for the month of February 1: Sold merchandise on account for $10,000 (other income, other receivable,); Cost of Goods Sold $3,000 (Inventory, Cost of Sale) Received the utilities bill for $250.00 (accrued expense, utilities expense) Salaries for the week are $3,300 (salaries expense, wages payable) Received an invoice of $100 for advertising. Create a new customer (use your own information), Term 3%, n/15, credit limit $1,000. Prepare the Customer List Report only for your account, include a column for term conditions and credit limits. (February 5) Prepare a sales order (15 units of any product). In the Sales Order Register include a column with the name of the vendor. (February 7) The invoice from the sales order above was delivered completely (February 9) (Prepare an Invoice Register) Prepare an Income Statement (February 28) Prepare a Balance Sheet (February 28)…arrow_forward

- please dont give solutions in an image thnxarrow_forwardCurrent Attempt in Progress Presented below is information related to Sheridan Company for its first month of operations. Jan. 06 Jan. 10 Jan. 23 Balance of Credit Purchases Gorst Company Tian Company Accounts Payable $9,000 11,800 Maddox Company 12,300 $ Gorst Company Jan. 11 Determine the balances that appear in the accounts payable subsidiary ledger. What Accounts Payable balance appears in the general ledger at the end of January? $ Jan. 16 Jan. 29 Cash Paid Gorst Company Tian Company Maddox Company Subsidary Ledger Tian Company 69 $6,800 11,800 7,400 $ Maddox Company $ General Ledgearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education