Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

What is the total cost of job AW320 on these general accounting question?

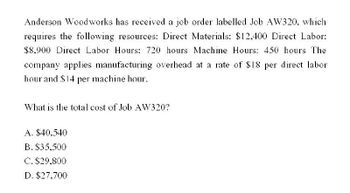

Transcribed Image Text:Anderson Woodworks has received a job order labelled Job AW320, which

requires the following resources: Direct Materials: $12,400 Direct Labor:

$8,900 Direct Labor Hours: 720 hours Machine Hours: 450 hours The

company applies manufacturing overhead at a rate of $18 per direct labor

hour and $14 per machine hour.

What is the total cost of Job AW320?

A. $40.540

B. $35,500

C. $29,800

D. $27,700

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- York Company Is a machine shop that estimated overhead will be $50,000, consisting of 5,000 hours of direct labor. The cost to make job 0325 is $70 in aluminum and two hours of labor at $20 per hour. During the month. York incurs $50 in indirect material cost. $150 in administrative labor, $300 in utilities, and $250 in depreciation expense. What is the predetermined overhead rate if direct labor hours are considered the cost driver? What is the cost of Job 0325? What is the overhead incurred during the month?arrow_forwardCompute the total job cost for each of the following scenarios: a. If the direct labor cost method is used in applying factory overhead and the predetermined rate is 100%, what amount should be charged to Job 2010 for factory overhead? Assume that direct materials used totaled 5,000 and that the direct labor cost totaled 3,200. b. If the direct labor hour method is used in applying factory overhead and the predetermined rate is 10 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, and the number of direct labor hours totaled 250. c. If the machine hour method is used in applying factory overhead and the predetermined rate is 12.50 an hour, what amount should be charged to Job 2010 for factory overhead? Assume that the direct materials used totaled 5,000, the direct labor cost totaled 3,200, the direct labor hours were 250 hours, and the machine hours were 295 hours.arrow_forwardSteeler Towel Company estimates its overhead to be $250,000. It expects to have 100,000 direct labor hours costing $2,500,000 in labor and utilizing 12,500 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forward

- Exotic Engine Shop uses a job order cost system to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: The average shop direct labor rate is 37.50 per hour. Determine the predetermined shop overhead rate per direct labor hour.arrow_forwardJob 19AB required 10,000 for direct materials, 4,000 for direct labor, 300 direct labor hours, 150 machine hours, three material moves, and five component parts. The cost pools and overhead rates for each pool follow: Determine the cost of Job 19AB using the ABC method.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Inez has the following information relating to Job AA5. Direct material cost was $200,000, direct labor was $36,550, and overhead applied on the basis of direct labor hours was $73,100. What was the predetermined overhead rate using the labor rate of $17 per hour?arrow_forwardGreen Bay Cheese Company estimates its overhead to be $375,000. It expects to have 125,000 direct labor hours costing $1,500,000 in labor and utilizing 15,000 machine hours. Calculate the predetermined overhead rate using: A. Direct labor hours B. Direct labor dollars C. Machine hoursarrow_forwardLucy Sportswear manufactures a specialty line of T-shirts using a job order cost system. During March, the following costs were incurred in completing Job ICU2: direct materials, 13,700; direct labor, 4,800; administrative, 1,400; and selling, 5,600. Factory overhead was applied at the rate of 25 per machine hour, and Job ICU2 required 800 machine hours. If Job ICU2 resulted in 7,000 good shirts, the cost of goods sold per unit would be: a. 5.70. b. 6.50. c. 5.50. d. 6.30.arrow_forward

- A company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forwardJob 25AX required 5,000 for direct materials, 2,000 for direct labor, 200 direct labor hours, 100 machine hours, two setups, and three design changes. The cost pools and overhead rates for each pool follow: Determine the cost of Job 25AX using the ABC method.arrow_forwardWhen direct labor hours for Job 101 are 30 and the predetermined factory overhead rate is 5/direct labor hour, what is the applied factory overhead amount? (a) 250 (b) 500 (c) 150 (d) It cannot be determined.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,