Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

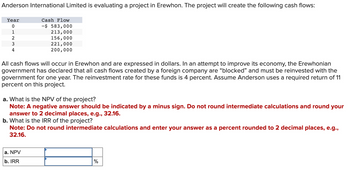

Transcribed Image Text:Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows:

Cash Flow

-$ 583,000

213,000

156,000

221,000

200,000

Year

0

1

2

3

4

All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian

government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the

government for one year. The reinvestment rate for these funds is 4 percent. Assume Anderson uses a required return of 11

percent on this project.

a. What is the NPV of the project?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your

answer to 2 decimal places, e.g., 32.16.

b. What is the IRR of the project?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.

a. NPV

b. IRR

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Anderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow -$590,000 0 1 2 √34 3 220,000 163,000 228,000 207,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 7 percent. Assume Anderson uses a required return of 13 percent on this project. a. What is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR of the project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. b. X Answer is complete but not entirely correct. NPV IRR $ 17,315.59 x 14.40 × %arrow_forwardCaribou River. Caribou River, Ltd., a Canadian manufacturer of raincoats, does not selectively hedge its transaction exposure. Instead, if the date of the transaction is known with certainty, all foreign currency-denominated cash flows must utilize the following mandatory forward cover formula: Caribou expects to receive multiple payments in Danish kroner over the next year. Kr3,000,000 is due in 90 days; Kr2,300,000 is due in 180 days; and Kr950,000 is due in one year. Using the following spot and forward exchange rates, what would be the amount of forward cover required by company policy for each period? What would be the Canadian dollar amount of forward cover required by company policy in 3 months? C$ (Round to the nearest cent.) Data table Data table (Click on the following icon in order to copy its contents into a spreadsheet.) (Click on the following icon in order to copy its contents into a spreadsheet.) Spot rate, Kr/C$ 4.61 Mandatory Forward Cover 0-90 days Paying the points…arrow_forwardAssume that interaffiliate cash flows are uncorrelated with one another. Calculate the standard deviation of the portfolio of cash held by the centralized depository for the following affiliate members: Affiliate ExpectedTransaction StandardDeviation U.S. $100,000 $40,000 Canada $150,000 $70,000 Mexico $175,000 $35,000 Chile $200,000 $75,000arrow_forward

- In this question they say that lenders would need a promised payment of 80 million. How is this solved for in question d. How can i derive this mathmaticallyarrow_forwardThe Bank of China is considering an application from the Government of the Republic of Zambia for a large dam project. Some costs and benefits of the project (in Kwacha values) are as follows: Construction costs: K500 million per year for three years Operating costs: K50 million per year Hydropower to be generated: 3 billion kilowatt hours per year Price of electricity: K0.05 per kilowatt hour Irrigation water available from dam: 5 billion liters per year Price of irrigation water: K0.02 per liter Agricultural product lost from flooded lands: K45 million per year Forest products lost from flooded lands: K20 million per year Assume that the project incurs no ecological and other costs besides the ones stated above. Do a formal cost-benefit analysis encompassing all of the quantifiable factors listed above. Assume that the lifespan of the dam is 10 years and that construction begins in Year 0. All other impacts start once the dam is completed and continue for 10 years. Use 5%…arrow_forwardSelect- (increases/reduces) please show with steps thanks!arrow_forward

- Vogl Co. is a U.S. firm conducting a financial plan for the next year. It has no foreign, subsidiaries, but more than half of it sale are form exports. Its foreign cash inflows to be received from exporting and cash outflow to be paid for imported supplies over the next year are shown n the following table: Currency total inflow total outflow Canadian dollar (C$) C $32,000,000 C $ 2,000,000 New Zealand dollar (NZ$) NZ $ 5,000,000 NZ $1,000,000 Mexican peso (MXP) MXP 11,000,000 MXP 10,000,000 Singapore dollar (s$) S$ 4, 000,000 8000,000 The spot rate and one-year forward rates as of today are shown below: Currency spot rate one-year forward rate C$ $.90 .93 NZ$ .60 .59 MXP .18 .15 S$ .65 .64 Questions 1. Based on the information provided, determine Vogl’s net exposure to each foreign currency in dollars. 2. Assume that today’s spot rate is used as a forecast of the future spot rate one year from now. The New Zealand dollar, Mexican peso, and Singapore dollars are expected to move in…arrow_forwardYou are working for an imports-exports company. In the current financial year, your company has a net income of $851,000 and plans to use a part of it as retained earnings for a new project which will cost $500,000 next year. The company’s stock is currently listed and actively traded on ASX. Required: Your company has an extra cash of A$216 000. The AUD/USA exchange rate in New York is 0.77923. The USD/AUD rate in Sydney is 1.29135. Is there any arbitrage profit possible? Set up an arbitrage scheme with the extra cash, disregarding bid-ask spread. What is the potential gain in AUD dollar?arrow_forwardAnderson International Limited is evaluating a project in Erewhon. The project will create the following cash flows: Year Cash Flow -$590,000 O 1 2 3 4 220,000 163,000 228,000 207,000 All cash flows will occur in Erewhon and are expressed in dollars. In an attempt to improve its economy, the Erewhonian government has declared that all cash flows created by a foreign company are "blocked" and must be reinvested with the government for one year. The reinvestment rate for these funds is 7 percent. Assume Anderson uses a required return of 13 percent on this project. a. What is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the IRR of the project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education