FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1200 sombong jina logo

Tripistata mobni ns omge19

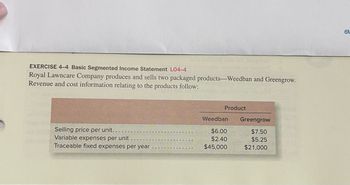

EXERCISE 4-4 Basic Segmented Income Statement L04-4

Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow.

Revenue and cost information relating to the products follow:

Selling price per unit..

Variable expenses per unit

Traceable fixed expenses per year

Product

Weedban

$6.00

$2.40

$45,000

Greengrow

$7.50

$5.25

$21,000

61

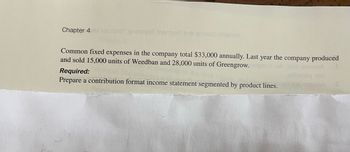

Transcribed Image Text:Chapter 4

oof anthogen Jnemge2 bris gnited eldsnsV

Common fixed expenses in the company total $33,000 annually. Last year the company produced

and sold 15,000 units of Weedban and 28,000 units of Greengrow.qsadi

Required:

Prepare a contribution format income statement segmented by product lines.

eno

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Requirements Dialog content starts 1. Allocate revenue from the sale of each unit of Dynamic Duo to Smarty and Sublime using the following: a. The stand-alone revenue-allocation method based on selling price of each product b. The incremental revenue-allocation method, with Smarty ranked as the primary product c. The incremental revenue-allocation method, with Sublime ranked as the primary product d. The Shapley value method 2. Of the four methods in requirement 1, which one would you recommend for allocating Paris's revenues to Smarty and Sublime? Explain.arrow_forwardceive full credit you must show your as a template. Practice Problems 1)Corp sells several products. Information on average revenue and costs is as follows: Selling price per unit $28.50 Variable costs per unit: Direct material $5.50 Direct manufacturing labor $1.15 Manufacturing overhead $0.85 Selling costs $2.50 $125,000 ulations Annual fixed costs How much is operating income if the company sells 15,000 units? 2) If the company decides to lower its selling price by 10%, the operating income is reduced by how r hour: firm (this is conceptually similar to the O/H allocation year 2015, O/H cost estimates total $840,000 for an 2015, it decided to evaluate the use of additional ined that number of design changes, setups, and llowing information was gathered during the analysis: S 0 ! Activity level 300 design changes 5,000 setups 8,000 inspections pital Systems, are expected to use the following lospital Systems 76,000 0 10 38 e O/H cost estimate for Money Managers for a deluxe model.…arrow_forwardSales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement 138 25 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses 1 Required 3 Net operating income $ 1,470,000 $ 420 49 $16 $ 135,000 $ 110,000 HON 1.470 000 $ 65,000 $ 115,000 $ 320,000 0arrow_forward

- Please provide answer in text (Without image)arrow_forwardA buyer for home furnishings orders merchandise from a North Carolina vendor totaling 2,800. The vendor offers two options a) 3/10 net 30 FOB Destination (to buyers' warehouse or (b) 6/10 FOB Factory. If transportation costs are @250, which would be the better option for the buyer?arrow_forwardRevise your worksheet to reflect these updated assumptions and then answer the questions that follow. Sales Sale Price 9,400 units 27 Date Number of Units Unit Cost Total Cost Beginning 1,500 10.30 $15,450 March 12 2,700 10.20 27,540 June 5 1,400 10.10 14,140 October 22 5,300 9.90 52,470 Totals 10,900 $109,600 Required: 1. Use your spreadsheet to recalculate the Cost of Goods Sold, Inventory balances, and Gross Profit under each method and enter your results below: (Round your answers to the nearest whole dollar amount.). FIFO LIFO Weighted Average Cost of Goods Sold Ending Inventory Gross Profit < Prev ♡ 14 of 14 Nextarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education