Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

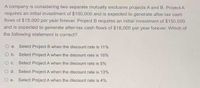

Transcribed Image Text:A company is considering two separate mutually exclusive projects A and B. Project A

requires an initial investment of $100,000 and is expected to generate after-tax cash

flows of $15,000 per year forever. Project B requires an initial investment of $150,000

and is expected to generate after-tax cash flows of $18,000 per year forever. Which of

the following statement is correct?

O a. Select Project B when the discount rate is 11%

Ob. Select Project A when the discount rate is 16%

Oc Select Project A when the discount rate is 5%

O d. Select Project A when the discount rate is 13%

O e. Select Project A when the discount rate is 4%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A project has estimated annual net cash flows of $63,800. It is estimated to cost $740,080. Determine the cash payback period. Round the answer to one decimal place.____________ yearsarrow_forwardFor each of the following problems, (a) draw the cash flow diagram; (b) present clean and clear manual solutions to the problem; (c) highlight the final answer (only the final answer as required by the problem) by enclosing it within a box. The future amount of $100,000 for a period of 8 years is equal to $341,655.49, considering money is worth 10% per year. What is the inflation rate?arrow_forward11) What is the rate of return (IRR) of a project that will generate revenues of $40,000 at the end of every year for 8 years, given the project will require an initial cash outlay today of $90,000 and another cash outlay of $80,000 in 6 years from today?arrow_forward

- How should the $70,000 be allocated to each alternative to maximize annual return? What is the annual return?arrow_forwardPerez Company is considering an investment of $20,957 that provides net cash flows of $6,900 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals. (b) The hurdle rate is 9%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return % Required A Required Barrow_forwardA project is expected to cost $4 million today and generate a net after-tax cash flow of $600,000 at the end of year 1 and $500,000 at the end of year 2. The net cash flows from year 2 onwards are expected to grow at 6% per annum forever. If the project’s discount rate is 12%, calculate the net present value of the project. Show all calculations.arrow_forward

- Find the net present value (NPV) for the following series of future cash flows, assuming the company’s cost of capital is 10.19 percent. The initial outlay is $471,448. Year 1: 191,637 Year 2: 128,236 Year 3: 161,255 Year 4: 138,369 Year 5: 190,517 Round the answer to two decimal places in percentage form.arrow_forwardUse the relevant information contained in the Cash Flow and Income Statement Tabs. Compute the Net Free Cash Flow to Invested Capital for the year 2022. State as a whole number and round to the second decimal place. (i.e. $12,987.654 would be written as 12,987.65). Assume the appropriate tax rate to compute NOPAT is 27%.arrow_forwardAn investment of $158397 is expected to generate an after-tax cash flow of $94000 in one year and another $129000 in two years. The cost of capital is 10 percent. What is the internal rate of return? O 24.27 percent O 24.47 percent O 24.07 percent O 24.67 percentarrow_forward

- You have bought property today for $600,000. You have estimated that it will provide monthly net cash flows of $10,000 and you think you could sell it for $800,000 in 5 years. What is the implied rate of return on this property?arrow_forwardam. 116.arrow_forwardWhen an investment’s annual net cash inflows are equal every year, the investment’s payback period can be calculated as: (See your Chapter 25 notes, page 2) When an investment’s annual net cash inflows are equal every year, the investment’s payback period can be calculated as: (See your Chapter 25 notes, page 2) Initial cost of the investment minus the annual net cash inflow Average amount of the investment divided by the average annual net income Initial cost of the investment divided by the annual net cash inflow Present value of net cash inflow divided by the initial cost of the investment Future value of net cash inflow divided by the initial cost of the investment Present value of the net cash inflow minus the initial cost of the investment Annual net cash inflow minus the initial cost of the investment Average annual net income divided by the average amount of the investmentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education