FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

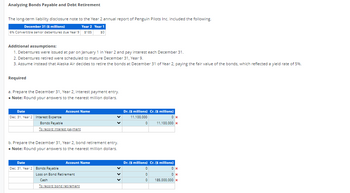

Transcribed Image Text:Analyzing Bonds Payable and Debt Retirement

The long-term liability disclosure note to the Year 2 annual report of Penguin Pilots Inc. included the following.

December 31 ($ millions)

Year 2 Year 1

6% Convertible senior debentures due Year 9 $185 $0

Additional assumptions:

1. Debentures were issued at par on January 1 in Year 2 and pay interest each December 31.

2. Debentures retired were scheduled to mature December 31, Year 9.

3. Assume instead that Alaska Air decides to retire the bonds at December 31 of Year 2, paying the fair value of the bonds, which reflected a yield rate of 5%.

Required

a. Prepare the December 31, Year 2, interest payment entry.

• Note: Round your answers to the nearest million dollars.

Date

Dec. 31, Year 2 Interest Expense

Bonds Payable

To record interest payment

Account Name

b. Prepare the December 31, Year 2, bond retirement entry.

• Note: Round your answers to the nearest million dollars.

Date

Dec. 31, Year 2 Bonds Payable

Account Name

Loss on Bond Retirement

Cash

To record bond retirement

Dr. ($ millions) Cr. ($ millions)

11,100,000

0

0x

11,100,000 x

Dr. ($ millions) Cr. ($ millions)

0

0

0

0x

0x

185,000,000 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for Issuing Bonds and Amortizing Premium by Straight-Line Method Daan Corporation wholesales repair products to equipment manufacturers. On April 1, 2016, Daan Corporation issued $1,700,000 of 4-year, 11% bonds at a market (effective) interest rate of 9%, receiving cash of $1,812,130. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 2016. For a compound transaction, if an amount box does not require an entry, leave it blank. Interest Expense- b. Journalize the entry to record the first interest payment on October 1, 2016, and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. (Round to the nearest dollar.) For a compound transaction, if an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $1,812,130 rather than for the face amount of…arrow_forwardZillow Corp. issued question attached inss thnaks gankodgnro wgwornarrow_forwardPremium Amortization On the first day of the fiscal year, a company issues a $8,700,000, 10%, 6-year bond that pays semiannual interest of $435,000 ($8,700,000 x 10 % x V), receiving cas of $9,516,500. Journalize the first interest payment and the amortization of the related bond premium. Round to the nearest dollar. If an amount box does not require an entry, leave it blank €88arrow_forward

- Bonds Payable Journal Entries; Issued at Par Plus Accrued Interest Richard, Inc., which closes its books on December 31, is authorized to issue $600,000 of six percent, 20‑year bonds dated March 1, with interest payments on September 1 and March 1.RequiredPrepare journal entries to record the following events, assuming that the bonds were sold at 100 plus accrued interest on July 1.a. The bond issuance.b. Payment of the semiannual interest on September 1.c. Accrual of bond interest expense at December 31.d. Payment of the semiannual interest on March 1 of the following year.e. Retirement of $200,000 of the bonds at 104 on March 1, Year 3 (immediately after the interest payment on that date). General Journal Date Description Debit Credit a. Jul.1 Bonds Payable Issuance of bonds plus accrued interest. b. Sept.1 Bond Interest Payable To record semiannual interest payment. c.…arrow_forwardCornerstone Exercise 9-27 (Algorithmic)Debt Issued at a Discount (Straight Line) On January 1, 2020, Drew Company issued $1,250,000, 5-year bonds for $1,112,500. The stated rate of interest was 4% and interest is paid annually on December 31. Required: Prepare the amortization table for Drew Company's bonds. If an amount box does not require an entry, leave it blank and if the answer is zero, enter "0". Drew Company Amortization Table Period Cash Payment (Credit) Interest Expense (Debit) Discount on Bonds Payable (Credit) Discount on Bonds Payable Balance Carrying Value At issue $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 $fill in the blank 4 $fill in the blank 5 12/31/20 fill in the blank 6 fill in the blank 7 fill in the blank 8 fill in the blank 9 fill in the blank 10 12/31/21 fill in the blank 11 fill in the blank 12 fill in the blank 13 fill in the blank 14 fill in the blank 15 12/31/22 fill in the blank 16 fill in the blank 17 fill in the…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- vnt.1arrow_forwardPremium Amortization On the first day of the fiscal year, a company issues a $5,100,000, 8%, 5-year bond that pays semiannual interest of $204,000 ($5,100,000 × 8% × ½), receiving cash of $5,312,072. Journalize the first interest payment and the amortization of the related bond premium Round to the nearest dollar If an amount box does not require an entry, leave it blank.arrow_forwardNonearrow_forward

- Discount Amortization On the first day of the fiscal year, a company issues a $4,600,000, 7%, 6-year bond that pays semiannual interest of $161,000 ($4,600,000 x 7% x ), receiving cash $3,988,436. Journalize the first interest payment and the amortization of the related bond discount. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense Discount on Bonds Payable Cash 161,000arrow_forwardPremium Amortization On the first day of the fiscal year, a company issues a $3,500,000, 6%, 9-year bond that pays semiannual interest of $105,000 ($3,500,000 × 6% × ½), receiving cash of $4,322,808. Journalize the first interest payment and the amortization of the related bond premium. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense Premium on Bonds Payable Casharrow_forwardEntries for Issuing Bonds and Amortizing Premium by Straight-Line Method Daan Corporation wholesales repair products to equipment manufacturers. On April 1, 2016, Daan Corporation issued $2,100,000 of 6-year, 6% bonds at a market (effective) interest rate of 3%, receiving cash of $2,443,587. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 2016. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Journalize the entry to record the first interest payment on October 1, 2016, and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. (Round to the nearest dollar.) For a compound transaction, if an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $2,443,587 rather than for the face amount of $2,100,000? The market rate…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education