FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

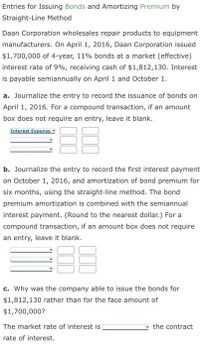

Transcribed Image Text:Entries for Issuing Bonds and Amortizing Premium by

Straight-Line Method

Daan Corporation wholesales repair products to equipment

manufacturers. On April 1, 2016, Daan Corporation issued

$1,700,000 of 4-year, 11% bonds at a market (effective)

interest rate of 9%, receiving cash of $1,812,130. Interest

is payable semiannually on April 1 and October 1.

a. Journalize the entry to record the issuance of bonds on

April 1, 2016. For a compound transaction, if an amount

box does not require an entry, leave it blank.

Interest Expense-

b. Journalize the entry to record the first interest payment

on October 1, 2016, and amortization of bond premium for

six months, using the straight-line method. The bond

premium amortization is combined with the semiannual

interest payment. (Round to the nearest dollar.) For a

compound transaction, if an amount box does not require

an entry, leave it blank.

c. Why was the company able to issue the bonds for

$1,812,130 rather than for the face amount of

$1,700,000?

The market rate of interest is

the contract

rate of interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- for issuing bonds and amortizing premium by straight-line method Entries Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $3,500,000 of 8-year, 10% bonds at a market (effective) interest rate of 8%, receiving cash of $3,907,830. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. Debit Cash Account Premium on Bonds Payable Bonds Payable Feedback ►Check My Work 3,907,830 Interest Expense Premium on Bonds Payable Cash Debit b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for 6 months, using the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Account Credit 154,609 X Credit 20,391 X 407,830 3,500,000 175,000arrow_forwardBond Premium, Entries for Bonds Payable Transactions Instructions Present Value Tables Chart of Accounts Journal Final Questions Instructions O'Halloran Inc. produces and sells outdoor equipment. On July 1, Year 1, O'Halloran Inc. issued $32,000,000 of six-year, 8% bonds at a market (effective) interest rate of 7%, receiving cash of $33,546,022. Interest on the bonds is payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, Year 1.* 2. Journalize the entries to record the following:* a. The first semiannual interest payment on December 31, Year 1, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. b. The interest payment on June 30, Year 2, and the amortization of the bond premium, using the straight-line method. Round to the nearest dollar. 3. Determine the total interest…arrow_forwardHow do I journalize using the straight line methodarrow_forward

- Aggies Inc. issued bonds with a $450,000 face value, 8% interest rate, and a 4-year term on July 1, 2018, and received $510,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premium Prepare journal entries for the above transactions. If an amount box does not require an entry, leave it blank. A. fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 B. fill in the blank 11 fill in the blank 12 fill in the blank 14 fill in the blank 15 C.arrow_forwardOn January 1, Year 1, Price Company issued $291,000 of five-year, 5 percent bonds at 98. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Required Prepare the journal entries to record the bond transactions for Year 1 and Year 2. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the entry for issuance of bonds. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general journalarrow_forwardEntries for Issuing Bonds and Amortizing Premium by Straight-Line Method Favreau Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Favreau Corporation issued $3,600,000 of 9-year, 10% bonds at a market (effective) interest rate of 9%, receiving cash of $3,818,878. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the first interest payment on October 1 and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $3,818,878 rather than for the face amount of $3,600,000? The market rate of interest is the contract rate of interest.arrow_forward

- On the first day of the fiscal year, a company issues a $621,000, 11%, 10-year bond that pays semiannual interest of $34,155 ($621,000 × 11% × 1/2), receiving cash of $652,050. Required: Journalize the entry to record the first interest payment and amortization of premium using the straight-line method. Refer to the Chart of Accounts for exact wording of account titles. Chart Of Accounts CHART OF ACCOUNTS General Ledger ASSETS 110 Cash 111 Petty Cash 112 Accounts Receivable 113 Allowance for Doubtful Accounts 114 Notes Receivable 115 Interest Receivable 121 Merchandise Inventory 122 Supplies 131 Prepaid Insurance 140 Land 151 Building 152 Accumulated Depreciation-Building 153 Equipment 154 Accumulated Depreciation-Equipment LIABILITIES 210 Accounts Payable 221 Salaries Payable 231 Sales Tax Payable 241 Notes Payable 242 Interest Payable 251 Bonds Payable 252 Discount on Bonds…arrow_forwardEntries for issuing bonds and amortizing premium by straight-line method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $20,000,000 of 5-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of $20,811,010. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for 6 months, using the straight-line method. If an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $20,811,010 rather than for the face amount of $20,000,000? The market rate of interest is the contract rate of interest.arrow_forwardEntries for Issuing Bonds and Amortizing Premium by Straight-Line Method Daan Corporation wholesales repair products to equipment manufacturers. On April 1, 2016, Daan Corporation issued $3,600,000 of 9-year, 9% bonds at a market (effective) interest rate of 8%, receiving cash of $3,827,866. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 2016. For a compound transaction, if an amount box does not require an entry, leave it blank. Cash 3,827,866 Premium on Bonds Payable 3,600,000 X Bonds Payable 227,866 X Feedback V Check My Work Bonds Payable is always recorded at face value. Any difference in issue price is reflected in a premium or discount account. The straight-line method of amortization provides equal amounts of amortization over the life of the bond. b. Journalize the entry to record the first interest payment on October 1, 2016, and amortization of bond premium for six months, using the straight-line…arrow_forward

- Entries for Issuing Bonds and Amortizing Premium by Straight-Line Method Daan Corporation wholesales repair products to equipment manufacturers. On April 1, 2016, Daan Corporation issued $2,100,000 of 6-year, 6% bonds at a market (effective) interest rate of 3%, receiving cash of $2,443,587. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 2016. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Journalize the entry to record the first interest payment on October 1, 2016, and amortization of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual interest payment. (Round to the nearest dollar.) For a compound transaction, if an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $2,443,587 rather than for the face amount of $2,100,000? The market rate…arrow_forwardEntries for Issuing Bonds and Amortizing Discount by Straight-Line Method On the first day of its fiscal year, Jacinto Company issued $21,200,000 of five-year, 12% bonds to finance its operations of producing and selling home improvement products. Interest is payable semiannually. The bonds were issued at a market (effective) interest rate of 14%, resulting in Jacinto Company receiving cash of $19,711,014. a. Journalize the entries to record the following: 1. Issuance of the bonds. 2. First semiannual interest payment. The bond discount amortization is combined with the semiannual interest payment. 3. Second semiannual interest payment. The bond discount amortization is combined with the semiannual interest payment. If an amount box does not require an entry, leave it blank. Round your answers to the nearest dollar. 1. 2. 3. b. Determine the amount of the bond interest expense for the first year. Round your answer to the nearest dollar. c. Why was the company able to issue the bonds…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education