FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

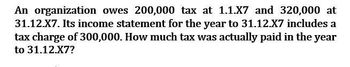

Transcribed Image Text:An organization owes 200,000 tax at 1.1.X7 and 320,000 at

31.12.X7. Its income statement for the year to 31.12.X7 includes a

tax charge of 300,000. How much tax was actually paid in the year

to 31.12.X7?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An organization has a $300,000 tax liability at 1/1/2018 and an ending balance of $450,000 on 12/31/2018. The income statement for the year ending 12/31/2018 includes a tax charge of 400,000. How much tax was actually paid in the year at 12/31/2018?arrow_forwardConsider gross earnings of $86,000. The standard deduction is $12,000 and itemized deduction is $8,000. Social security tax rate is 6.2%; Medicare tax rate is 1.45%. How much is the taxable income (for federal income tax)? Give typing answer with explanation and conclusionarrow_forwardhfgarrow_forward

- Delta has interest receivable which has a carrying amount of $75,000 in its statement of financial position at 31 December 2020. The related interest revenue will be taxed on a cash basis in 2021. Delta has trade receivables that have a carrying amount of $105,000 in its statement of financial position at 31 December 2020. The related revenue has been included in its statement of profit or loss for the year to 31 December 2020. Required: According to HKAS 12 ‘Income Taxes’, what is the total tax base of interest receivable and trade receivables for Delta at 31 December 2020? A. $105,000 B. $75,000 C. Nil D. $180,000arrow_forwardThe SGS Co. had $215,000 in taxable income. Use the rates from Table 2.3. (Enter your answer as directed, but do not round intermediate calculations.) Required: Calculate the company's income taxes. Income taxesarrow_forwardPumpkin Company recorded Income tax payable equal to $10M, increased the Deferred Tax Asset by $2M, and increased the Deferred Tax Liability by $3M. Accounting income before taxes is equal to $50M. What amount of Net Income will Maxie report on its income statement? O $45M. O $39M. O $49M. O $46M.arrow_forward

- Can you please help me with this question?arrow_forwardUse excel. Show your workarrow_forwardConsider gross earnings of $84,000. The standard deduction is $12,000 and itemized deduction is $5,000. Social security tax rate is 6.2%; Medicare tax rate is 1.45%. How much is the taxable income (for federal income tax)?arrow_forward

- 1. What is the tax due and payable amount in fiscal year 20x1? Fiscal year June 20, 20x1 (5th year) 20x2 Sales 80,000,000 75,000,000 Cost of Sales 50,000,000 46,875,000 Allowable Deductions excluding NOLCO 32,000,000 25,000,000 2. Using the information above, how much is tax due in fiscal year 20x2?arrow_forwardPrepare the income statement for 2023, beginning with the line "income before income taxes.arrow_forwardThornton, Inc., had taxable income of $129632 for the year. The company's marginal tax rate was 34 percent and its average tax rate was 24.7 percent. How much did the company have to pay in taxes for the year? a.30432 b.44075 c.30776 d.29074arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education