FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

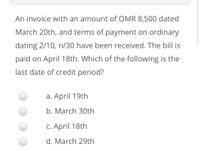

Transcribed Image Text:An invoice with an amount of OMR 8,500 dated

March 20th, and terms of payment on ordinary

dating 2/10, n/30 have been received. The bill is

paid on April 18th. Which of the following is the

last date of credit period?

a. April 19th

b. March 30th

C. April 18th

d. March 29th

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An invoice for furniture for $1, 210.88 with terms of 2/10, n/60 is dated October 3. A. What is the last day on which cash discount may be taken? B. If paid within discount period, how much is the cash discount? C. If the discount is missed, on what day does the credit period end?arrow_forwardOn July 8, Jones Inc. issued an $79,100, 6%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends on July 31. Using the 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? Round your answer to the nearest whole dollar. a.$303 b.$659 c.$791 d.$396arrow_forwardThe company determines that the interest expense on a note payable for the period ending December 31 is $560. This amount is payable on January 1. Journalize these transactions for December 31 and January 1. If an amount box does not require an entry, leave it blank. Dec. 31 - Select - - Select - - Select - - Select - Jan. 1 - Select - - Select - - Select - - Select -arrow_forward

- Year 1 Dec. 16 Accepted a $10,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note.arrow_forwardOn July 8, Jones Inc. issued an $84,700, 11%, 120-day note payable to Miller Company. Assume that the fiscal year of Jones ends July 31. Using a 360-day year, what is the amount of interest expense recognized by Jones in the current fiscal year? When required, round your answer to the nearest dollar. a.$595 b.$1,785 c.$9,317 d.$1,190arrow_forwardPlease help me figure out the notes and general journal for this problem.arrow_forward

- The terms of an invoice are 3/10, n/30 E.O.M. The invoice date is April 10. The last date on which the discount can be taken is: Select one: O a. April 30 O b. April 20 O c. May 30 O d. May 10arrow_forwardYear 1 December 16 Accepted a(n) $11,800, 60-day, 98 note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $7,600, 99, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,000, 30-day, 78 note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight Company dishonored its note. August 7 Accepted a(n) $8,950, 90-day, 118 note in granting a time extension on the past-due account receivable of Mulan Company. September 3 Accepted a $2,250, 60-day, 12% note in granting Noah Carson a time extension on his past-due account receivable. November 2 Received payment of principal plus interest from Carson for the September 3…arrow_forwardThe company determines that the interest expense on a note payable for the period ending December 31 is $490. This amount is payable on January 1. Journalize these transactions for December 31 and January 1. If an amount box does not require an entry, leave it blank.arrow_forward

- A 90-day note is signed on October 21. The due date of the note is: ◇ January 19 O January 21 ◇ January 20 ◇ January 18arrow_forwardGLO701 - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Garcia Company. Year 1 Dec. 16 Accepted a $20, 400, 60-day, 12% note in granting Rita Griffin a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Griffin note. Year 2 Feb. 14 Received Griffin's payment of principal and interest on the note dated December 16. 2 Accepted a $9,00e, 6%, 90-day note in granting a time extension on the past-due account receivable from Wright Co. 17 Accepted a $7, 200, 30-day, 10% note in granting Wang Lee a time extension on her past-due account receivable. Apr. 16 Lee dishonored her note. 31 Wright Co. dishonored its note. Mar. May Aug. 7 Accepted a $22, eee, 98-day, 1e% note in granting a time extension on the past-due account receivable of Collins Co. Sep. Nov. 2 Received payment of principal plus interest from Gonzalez for the September 3 note. Nov. 5 Received payment of principal plus interest from…arrow_forwardneed help with 1D, Feb 14.! Received Todd’s payment of principal and interest on the note dated December 16. The following transactions are from Ohlm Company. (Use 360 days a year.) Year 1 Dec. 16 Accepted a $10,700, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 Feb. 14 Received Todd’s payment of principal and interest on the note dated December 16. Mar. 2 Accepted a(n) $6,600, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Co. 17 Accepted a(n) $3,300, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. Apr. 16 Privet dishonored her note. May 31 Midnight Co. dishonored its note. Aug. 7 Accepted a(n) $7,900, 90-day, 10% note in granting a time extension on the past-due account receivable of Mulan Co. Sep. 3…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education