FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

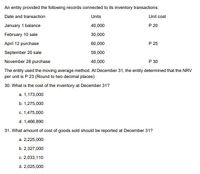

Transcribed Image Text:An entity provided the following records connected to its inventory transactions:

Date and transaction

Units

Unit cost

January 1 balance

40,000

P 20

February 10 sale

30,000

April 12 purchase

60,000

P 25

September 20 sale

59,000

November 28 purchase

40,000

P 30

The entity used the moving average method. At December 31, the entity determined that the NRV

per unit is P 23 (Round to two decimal places)

30. What is the cost of the inventory at December 31?

a. 1,173,000

b. 1,275,000

c. 1,475,000

d. 1,466,890

31. What amount of cost of goods sold should be reported at December 31?

a. 2,225,000

b. 2,327,000

c. 2,033,110

d. 2,025,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brock Co. adopted the dollar-value LIFO inventory method as of January 1, year 1. A single inventory pool and an internally computed price index are used to compute Brock’s LIFO inventory layers. Information about Brock’s dollar-value inventory follows: What was Brock’s dollar-value LIFO inventory at December 31, year 2? a. $80,000 b. $74,000 c. $66,000 d. $60,000arrow_forwardWhich capital budgeting technique measures all expected future cash inflows and outflows as if they occurred at a single point in time? Group of answer choices a. sensitivity analysis b. accrual accounting rate-of-return method c. net present value method d. payback methodarrow_forwardPeriodic Inventory Using FIFO, LIFO, and Weighted Average Cost Methods The units of an item available for sale during the year were as follows: $36,000 62,400 48,000 $146,400 There are 20 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using (a) the first-in, first-out (Firo) method; (b) the last-in, first-out (LIFO) method; and (c) the weighted average cost method (Round per unit cost to two decimal places and your final answer to the neares whole dollar). Jan. 1 Aug. 7 Dec, 11 Inventory 10 units at $3,600 Purchase 16 units at $3,900 Purchase 12 units at $4,000 38 units A. First-in, first out (riro)) b. Last-in, first-out (LIFO) Weighted average cost Garrow_forward

- The following data represent the beginning inventory and, in order of occurrence, the purchases and sales of Petroni, Inc. for an operating period. Units Unit Cost Total Cost Units Sold Beginning Inventory 50 $124 $6,200 Sale No. 1 40 Purchase No. 1 Sale No. 2 30 100 3,000 32 Purchase No. 2 40 88 3,520 - Totals 120 $12,720 72 Assuming Petroni, Inc. uses weighted-average (perpetual) inventory procedures, the ending inventory cost is: Select one: O A. $4,992 о B. $5,088 O C. $4,512 D. $4,368arrow_forwardFranco Company's inventory records showed the following transactions for the fiscal period ended June 30: Date Description Units Cost per Unit / Sales June 1 Inventory 700 $5.50 June 3 Purchase 400 $6.40 June 15 Sale 450 $12.00 June 22 Purchase 650 $6.70 June 30 Sale 500 $12.50 Required: Compute the ending inventory and the cost of goods sold under the FIFO cost flow assumption assuming a perpetual inventory system.arrow_forwardLIFO, Perpetual and Periodic Riedel Company's inventory records showed the following transactions for the fiscal period ended June 30: Units Cost/Unit June 1 Inventory 700 $6.20 June 3 Purchase 400 6.40 June 15 Sales @ $12.00 300 June 22 Sales @ $12.50 600 June 30 Purchase 600 6.70 Required: 1. Compute the ending inventory and the cost of goods sold under the LIFO cost flow assumption assuming both a perpetual and a periodic inventory system. If required, round your answers to the nearest dollar. LIFO - periodic:Ending inventory $fill in the blank 1Cost of goods sold $fill in the blank 2 LIFO - perpetual:Ending inventory $fill in the blank 3Cost of goods sold $fill in the blank 4 2. Under which of the following assumptions may the cost of goods sold include the costs of the most latest purchases of the period, even though those purchases were made after the sales took place? Under which of the following…arrow_forward

- The following units of an inventory item were available for sale during the year: Beginning inventory 8 units at $50 First purchase 16 units at $51 Second purchase 21 units at $52 Third purchase 15 units at $54 The firm uses the periodic inventory system. During the year, 22 units of the item were sold. The value of ending inventory rounded to the nearest dollar using average cost is (Round average cost per unit to three decimal places.) Oa. $1,174 Ob. $1,975 Oc. $1,100 Od. $1,114arrow_forwardBeginning inventory, purchases, and sales for Item 88-HX are as follows: July 1 86 units @ $21 8 69 units 15 95 units @ $23 27 80 units Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of goods sold on July 27 and (b) the inventory on July 31. a. Cost of goods sold on July 27 b. Inventory on July 31 Inventory Sale Purchase Salearrow_forwardMontoure Company uses a periodic inventory system. It entered into the following calendar-year purchases and sales transactions. Units Sold at Retail Units Acquired at Cost @$45 per unit $42 per unit @ $27 per unit Date January 1 February 10 March 13 March 15 August 21 Septeber 5 September 10 Activities Beginning inventory Purchase Purchase Sales Purchase Purchase Sales Totals Cost of goods available for sale Number of units available for sale Ending inventory Required: 1. Compute cost of goods available for sale and the number of units available for sale. (a) FIFO (b) LIFO (c) Weighted average (d) Specific identification 2. Compute the number of units in ending inventory. $ Sales Less: Cost of goods sold Gross profit 1,400 units Ending Inventory $ $ S O Weighted Average O Specific Identification O LIFO O FIFO 600 units 400 units 200 units 100 units 500 units 9,800 7,600 1,800 units 3. Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d)…arrow_forward

- Hemming Company reported the following current-year purchases and sales for its only product. Date January 1 January 10 Activities Beginning inventory Sales Units Acquired at Cost @ $12.00 = March 14 @ $17.00 = Purchase Sales March 15 July 30 October 5 October 26 @ $22.00 @ $27.00 a) Cost of Goods Sold using Specific Identification Available for Sale Date January 1 March 14 Purchase Sales Purchase Totals July 30 October 26 Less: Equals: Activity Beginning Inventory Purchase Purchase Purchase b) Gross Margin using Specific Identification # of units 250 units 250 400 450 150 1,250 400 units 450 units 150 units 1,250 units Ending inventory consists of 45 units from the March 14 purchase, 75 units from the July 30 purchase, and all 150 units from the October 26 purchase. Using the specific identification method, calculate the following. = Cost Per # of units Unit sold $ 3,000 6,800 9,900 4,050 $ 23,750 Cost of Goods Sold Cost Per Unit Units Sold at Retail COGS 200 units 360 units 420 units…arrow_forwardBased on the following data for the current year, what is the inventory turnover (rounded to one decimal place)? Sales on account during year $469,274 Cost of merchandise sold during year 179,305 Accounts receivable, beginning of year 42,159 Accounts receivable, end of year 52,598 Merchandise inventory, beginning of year 32,886 Merchandise inventory, end of year 40,548 Oa. 17.7 Ob. 12.8 Oc. 3.9 Od. 4.9arrow_forwardThe following data has been provided by Lee Company regarding its inventory purchases and sales throughout the year. Transaction Units Cost per Unit January 1 Balance 185 $86 March 14 Sale 54 May 23 Purchase 136 90 August 21 Sale 100 November 5 Purchase 171 91 November 18 Sale 100 November 30 Sale 100 December 5 Sale 100 December 10 Purchase 25 95 Required: Compute the cost of goods sold and ending inventory using the perpetual inventory system for the LIFO cost flow assumption. Ending inventory Cost of goods soldarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education