EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with accounting questions

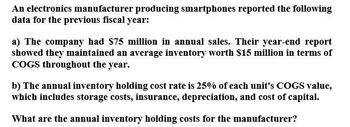

Transcribed Image Text:An electronics manufacturer producing smartphones reported the following

data for the previous fiscal year:

a) The company had $75 million in annual sales. Their year-end report

showed they maintained an average inventory worth $15 million in terms of

COGS throughout the year.

b) The annual inventory holding cost rate is 25% of each unit's COGS value,

which includes storage costs, insurance, depreciation, and cost of capital.

What are the annual inventory holding costs for the manufacturer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- TOKYO ended the year with an inventory of $935,000. During the year, the firm purchased $6,378,000 of new inventory and the cost of goods sold reported on the income statement was $6,109,000. What was TOKYO's inventory at the beginning of the year?arrow_forwardSpree Company sold $769,300 of goods during the year at a cost of goods sold of $548,600. Inventory was $31,283 at the beginning of the year and $35,538 at the end of the year. What was the inventory turnover ratio for the year?arrow_forwardVaughn Manufacturing had January 1 inventory of $300000 when it adopted dollar-value LIFO. During the year, purchases were $1850000 and sales were $2930000. December 31 inventory at year-end prices was $435480, and the price index was 114.What is Vaughn Manufacturing’s gross profit?arrow_forward

- In a recent annual report, Bonita Inc. reported beginning inventory of $1,400 million and ending inventory of $1,300 million, cost of goods sold of $9,450 million, and net sales of $11,200 million. Compute Bonita's inventory turnover.arrow_forwarde. The average sale period. (The inventory at the beginning of last year totaled$1,920,000.) f. The operating cycle. g. The total asset turnover. (The total assets at the beginning of last year totaled$12,960,000.)arrow_forwardBobaflex Corporation has endinginventory of $527,156 and cost of goods sold for the year just ended was$8,543,132. What is the inventory turnover? The days’ sales in inventory?How long on average did a unit of inventory sit on the shelf before it wassold?arrow_forward

- Milton Company reported inventory of $60,000 at the beginning of 2014. During the year, it purchased inventory of $625,000 and sold inventory for $950,000. A count of inventory at the end of the year determined that the cost of inventory on hand was $50,000. Required: 1. What was Milton's cost of goods sold for 2014? 2. What is Milton's gross margin for the year?arrow_forwardCharlie’s Cycles Inc. has $110 million in sales. The companyexpects that its sales will increase 5% this year. Charlie’s CFO uses a simple linearregression to forecast the company’s inventory level for a given level of projected sales. On the basis of recent history, the estimated relationship between inventories and sales (inmillions of dollars) is as follows:Inventories = $9 + 0.0875(Sales)Given the estimated sales forecast and the estimated relationship between inventories andsales, what are your forecasts of the company’s year-end inventory level and its inventoryturnover ratio?arrow_forwardAt the beginning of the year, ABC's Inventory balance was $91,000. During the year ABC bought $7,076,000 inventory. At the end of the year the firm's reported inventory was $115,000. What was the firm's cost of goods sold over the course of the year?arrow_forward

- During 2021, Rogue Corporation reported net sales of $600,000. Inventory at both the beginning and end of the year totaled $75,000. The inventory turnover ratio for the year was 6.0. What amount of gross profit did the company report in its 2021 income statement?arrow_forwardSpritzer Company made sales of $29,750 million in 2018. The cost of goods sold for the year totaled $11,900 million. At the end of 2017, Malt's inventory stood at $1,200 million, and Spritzer ended 2018 with an inventory of $1,600 million. Compute Malt's gross profit percentage and rate of inventory turnover for 2018.arrow_forwardA concrete corporation had cost of goods sold of $1,350,000 for the third quarter. The beginning inventory at cost was $145,000, and the ending inventory at cost amounted to $170,900. The inventory turnover rate published as the industry standard for a business of this size is 9.5 times. Round inventories to the nearest cent and inventory turnovers to the nearest tenth. (A): Calculate the average inventory (in $) and actual inventory turnover rate for the company. Average Inventory = $ Inventory Turnnover = times (B): If the turnover rate is less than 9.5 times, calculate the target average inventory (in $) needed to theoretically come up to industry standards. If the turnover rate is greater than 9.5 times, enter "above". $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT