Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

How much is the material price variance ?

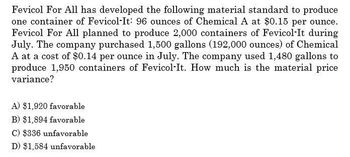

Transcribed Image Text:Fevicol For All has developed the following material standard to produce

one container of Fevicol-It: 96 ounces of Chemical A at $0.15 per ounce.

Fevicol For All planned to produce 2,000 containers of Fevicol-It during

July. The company purchased 1,500 gallons (192,000 ounces) of Chemical

A at a cost of $0.14 per ounce in July. The company used 1,480 gallons to

produce 1,950 containers of Fevicol-It. How much is the material price

variance?

A) $1,920 favorable

B) $1,894 favorable

C) $336 unfavorable

D) $1,584 unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Fevicol For All has developed the following material standard to produce one container of Fevicol-It: 96 ounces of Chemical A at $0.15 per ounce. Fevicol For All planned to produce 2,000 containers of Fevicol-It during July. The company purchased 1,500 gallons (192,000 ounces) of Chemical A at a cost of $0.14 per ounce in July. The company used 1,480 gallons to produce 1,950 containers of Fevicol-It. How much is the material price variance? Don't Use Aiarrow_forwardFevicol For All has developed the following material standard to produce one container of Fevicol-It: 96 ounces of Chemical A at $0.15 per ounce. Fevicol For All planned to produce 2,000 containers of Fevicol-It during July. The company purchased 1,500 gallons (192,000 ounces) of Chemical A at a cost of $0.14 per ounce in July. The company used 1,480 gallons to produce 1,950 containers of Fevicol-It. How much is the material price variance? Accurate Answerarrow_forwardFevicol For All has developed the following material standard to produce one container of Fevicol-It: 96 ounces of Chemical A at $0.15 per ounce. Fevicol For All planned to produce 2,000 containers of Fevicol-It during July. The company purchased 1,500 gallons (192,000 ounces) of Chemical A at a cost of $0.14 per ounce in July. The company used 1,480 gallons to produce 1,950 containers of Fevicol-It. How much is the material price variance? Accountingarrow_forward

- Fevicol For All has developed the following material standard to produce one container of Fevicol-It: 96 ounces of Chemical A at $0.15 per ounce. Fevicol For All planned to produce 2,000 containers of Fevicol-It during July. The company purchased 1,500 gallons (192,000 ounces) of Chemical A at a cost of $0.14 per ounce in July. The company used 1,480 gallons to produce 1,950 containers of Fevicol-It. How much is the material price variance?arrow_forwardHow much____?arrow_forwardMartin Company manufactures a powerful cleaning solvent. The main ingredient in the solvent is a rawmaterial called Echol. Information concerning the purchase and use of Echol follows:Purchase of Echol Echol is purchased in 15-gallon containers at a cost of $115 per container. A discount of2% is offered by the supplier for payment within 10 days, and Martin Company takes all discounts. Shipping costs, which Martin Company must pay, amount to $130 for an average shipment of 100 15-galloncontainers of Echol.Use of Echol The bill of materials calls for 7.6 quarts of Echol per bottle of cleaning solvent. (Each galloncontains four quarts.) About 5% of all Echol used is lost through spillage or evaporation (the 7.6 quartsabove is the actual content per bottle). In addition, statistical analysis has shown that every 41st bottle isrejected at final inspection because of contamination.Required:1. Compute the standard purchase price for one quart of Echol.2. Compute the standard quantity of…arrow_forward

- Carina Company produces sanitation products after processing specialized chemicals; Thefollowing relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 isprocessed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre.2. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent ispackaged at an additional cost of $300 and made into 200 packs of Softener that canbe sold for $2 per pack.Required:1. Allocate the joint cost to the Detergent and the Softener using the following:a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocationmethod have on this decision?arrow_forwardBandar Industries manufactures sporting equipment. One of the company's products is a football helmet that requires special plastic During the quarter ending June 30, the company manufactured 3,300 helmets, using 2,475 klograms of plastic. The plastic cost the company $18,810. According to the standard cost card, each helmet should require 0.68 kilograms of plastic, at a cost of $8.00 per kilogram. Required: 1. What is the standard quantity of kilograms of plastic (SQ) that is allowed to make 3,300 helmets? 2. What is the standard materials cost allowed (SQ - SP) to make 3,300 helmets? 3. What is the materials spending variance? 4. What is the materials price varlance and the materials quantity variance? (For requirements 3 and 4, indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Do not round intermediote calculations.) 1. Standard quantity of kilograms allowed…arrow_forwardSherwin Pogi produces a drink extract that passes through three processes: mixing, blending and bottling. During the 3rd quarter of the year, the blending department received 20,000 gallons of liquid from the Cooking Department with costs of Php 192,000. Upon receiving the liquid, the Blending Department adds sugar and stirs the mixture for twenty minutes. The product is then passed on to the Bottling Department. There were 4,000 gallons in process at the beginning of the quarter, 75% converted with the following costs: Prior Dept. costs, Php 38,000; Powder, Php 5,360; conversion costs, Php 12,000. Costs added by the Blending Department during the quarter were: Powder, Php 28,0003; Conversion costs, Php 60,788. There were 3,500 gallons in ending inventory, 20% converted. Using FIFO Method, the conversion cost per EUP is: O a Php 4.74 Php 234 Php 9,20 d. Php 14.34arrow_forward

- Cranbrook Chemical Ltd. manufactures two industrial compounds. In the month of May, 15,000 litres of direct material costing $160,000 were processed at a cost of $400,000. The joint process yielded 16,000 containers of a compound known as Jarlon and 4,000 containers of a compound known as Kharton. The respective selling prices of Jarlon and Kharton are $38 and $58. Both products may be processed further. Jarlon may be processed into Jaxton at an incremental cost of $8 per jar of the final product while Kharton may be processed into Kraxton at an additional cost of $32 per jar of the final product. The volume of jars of the final product are: 12,000 and 3,000 for Jaxton and Kraxton respectively. The selling price of Jaxton is $48 per jar. The selling price of Kraxton is $102 per jar. Using the NRV method, the amount of joint costs allocated to Jaxton is: $111,312. $389,592. $170,408. $121,720. $278,280.arrow_forwardCarina Company produces sanitation products after processing specialized chemicals; Thefollowing relates to its activities: 1 Kilogram of chemicals purchased for $2000 and with an additional $1000 isprocessed into 400 grams of Crystals and 80 litres of a Cleaning agent. At split-off, agram of Crystal can be sold for $1 and the Cleaning agent can be sold for $4 per litre. At an additional cost of $400, Carina can process the 400 grams of Crystal into 500 grams of Detergent that can be sold for $2 per gram. The 80 litres of Cleaning agent is packaged at an additional cost of $300 and made into 200 packs of Softener that can be sold for $2 per pack. Required: 1. Allocate the joint cost to the Detergent and the Softener using the following: a. Sales value at split-off method b. NRV method 2. Should Carina have processed each of the products further? What effect does the allocationmethod have on this decision? Make full references to Question 1 when possiblearrow_forwardPlease provide Solutions with explanationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,