ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

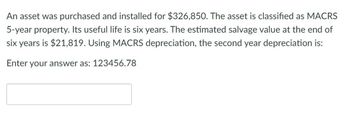

Transcribed Image Text:An asset was purchased and installed for $326,850. The asset is classified as MACRS

5-year property. Its useful life is six years. The estimated salvage value at the end of

six years is $21,819. Using MACRS depreciation, the second year depreciation is:

Enter your answer as: 123456.78

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Bison Gear and Engineering of St Charles, IL, makes sensorless and brushless dc gear motors suited for foodservice equipment, factory automation,alternative energy systems, and other specialty machinery applications. The company purchased an asset 2 years ago that has a 5-year recovery period. If the depreciation charge by the MACRS method for year 3 is $14,592, what was (a) the first cost of the asset, and (b) the depreciation charge in year 1?arrow_forwardA new barcode reading device has an installed cost basis of $24,160 and an estimated service life of eight years. It will have a zero salvage value at that time. The 200% declining balance method is used to depreciate this asset. a. What will the depreciation charge be in year eight? b. What is the book value at the end of year seven? c. What is the gain (or loss) on the disposal of the device if it is sold for $3,400 after seven years?arrow_forwardFreeman Engineering paid $40,000 for specialized equipment for use with their new global positioning system/geographic information system (GPS/GIS). The equipment was depreciated over a 3-year recovery period using Modified Accelerated Cost Recovery System (MACRS) depreciation. The company sold the equipment after 2 years for $8,000 when it purchased an upgraded system. Determine the amount of the depreciation recapture or capital loss involved in selling the asset. The amount of capital loss is determined to be $____arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education