ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

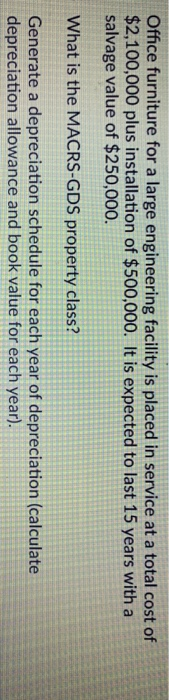

Transcribed Image Text:Office furniture for a large engineering facility is placed in service at a total cost of

$2,100,000 plus installation of $500,000. It is expected to last 15 years with a

salvage value of $250,000.

What is the MACRS-GDS property class?

Generate a depreciation schedule for each year of depreciation (calculate

depreciation allowance and book value for each year).

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A machine was bought 3 years ago for $20,000. SL depreciation has been used with B=$20,000, N=4years, S=$0. A replacement is been considered. A new machine can be bought for $16,000 to replace the old one. DDB depreciation will be used for the new machine with B=$16,000, N=4 years, S=$0. The new machine will be used for 2 years and then can be sold for $12,000. The new machine will save $5,000/yr in operation cost. The old machine can be sold for $4,000 right now, or kept in use for 2 more years and then will be sold for $1,000. Incremental combined tax rate is 50%, after-tax MARR is 10%. Calculate ∆PW of the replacement.arrow_forwardCalculate the value of depreciation of gross value is $120 million and the net value is $100 millionarrow_forwardThe cost of a certain machinery is $30,000. Its useful life is 6 years, and its resale value is $5,000. Estimate the book value of the machine after 2 years, using constant percentage depreciation method. Tabulate the annual depreciation amounts and the book value of the equipment at the end of each year.arrow_forward

- A digitally controlled plane for manufacturing furniture is purchased on April 1 by a calandar -year taxpayer for 66,000. It is expected to last 12 years and have a salvage value of 5,000. Calculate the deprexiation deduction during years 1,4 and 8. A) Use straight line depreciation B) Use declining balance depreciation, with a rate that encures the book value equals the salvage title c) Use double declining balance depreciatin D) Use declining balance depreciation, switching to straight line depreciation. please show all steps and use an excell sheet..arrow_forwardIdentify the depreciation method used for Double-declining-balance depreciation?arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- A new drilling mud pump was purchased and placed in service by a petroleum drilling company. Its initial cost is $250,000, and it has an estimated market value of $15,000 at the end of useful life of 15 years. Calculate the depreciation amount and the BV in the fifth year and at the end of the tenth year using the (1) straight line (SL) method, por workovcr at 8 year (2) 150% declining balance (DB) method.arrow_forwardA printing equipment costs P 74,506 has a life expectancy of 9 years and has a salvage value of P 4,479 at the end of its life. The book value at the end of x years is equal to P 30,389. Using straight line method of depreciation, solve for the value of x.arrow_forwardThe depreciation schedule for certain equipment has been arrived at by various methods. The estimated salvage value of the equipment at the end of its 7 years useful life is $366. Identify the resulting depreciation schedules. YEAR I || 1 2 3 4 5 6 7 IV $1335 2336.25 2775 3632 $1335 2002.5 1982 2273 $1335 1668.75 1416 1423 $1335 1335 1011 891 $1335 1001.25 722 558 $1335 667.5 515 349 $1335 333.75 368 219 Which scheme represents DDB depreciation and how much is the first year depreciation? a. III, $2775 O b. 1, $1335 O c. IV, $3632 O d. II, $2336arrow_forward

- An asset is purchased for 9,000. It estimated economic life is for 10 years after which it will be sold for P1000. Find the depreciation in the first three years using straight line method?arrow_forwardAn earth moving equipment that cost P90,000 will have an estimated salvage value of P18,000 at the end of 8 years. Using the double declining balance method calculate the total depreciation at the end of 5 years.arrow_forwardA miniature building company named Tiny Touches purchased a 3D printer which costs $250,000. It is expected to last for 15 years and at the end of its useful life, it will cost $25,005 Find the annual depreciation if it’s depreciation using sinking fund method at 7%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education